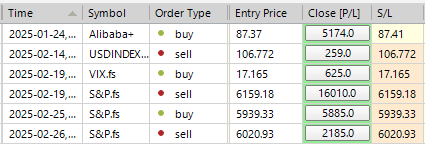

SP500 LDN TRADING UPDATE 27/02/25

SP500 LDN TRADING UPDATE 27/02/25

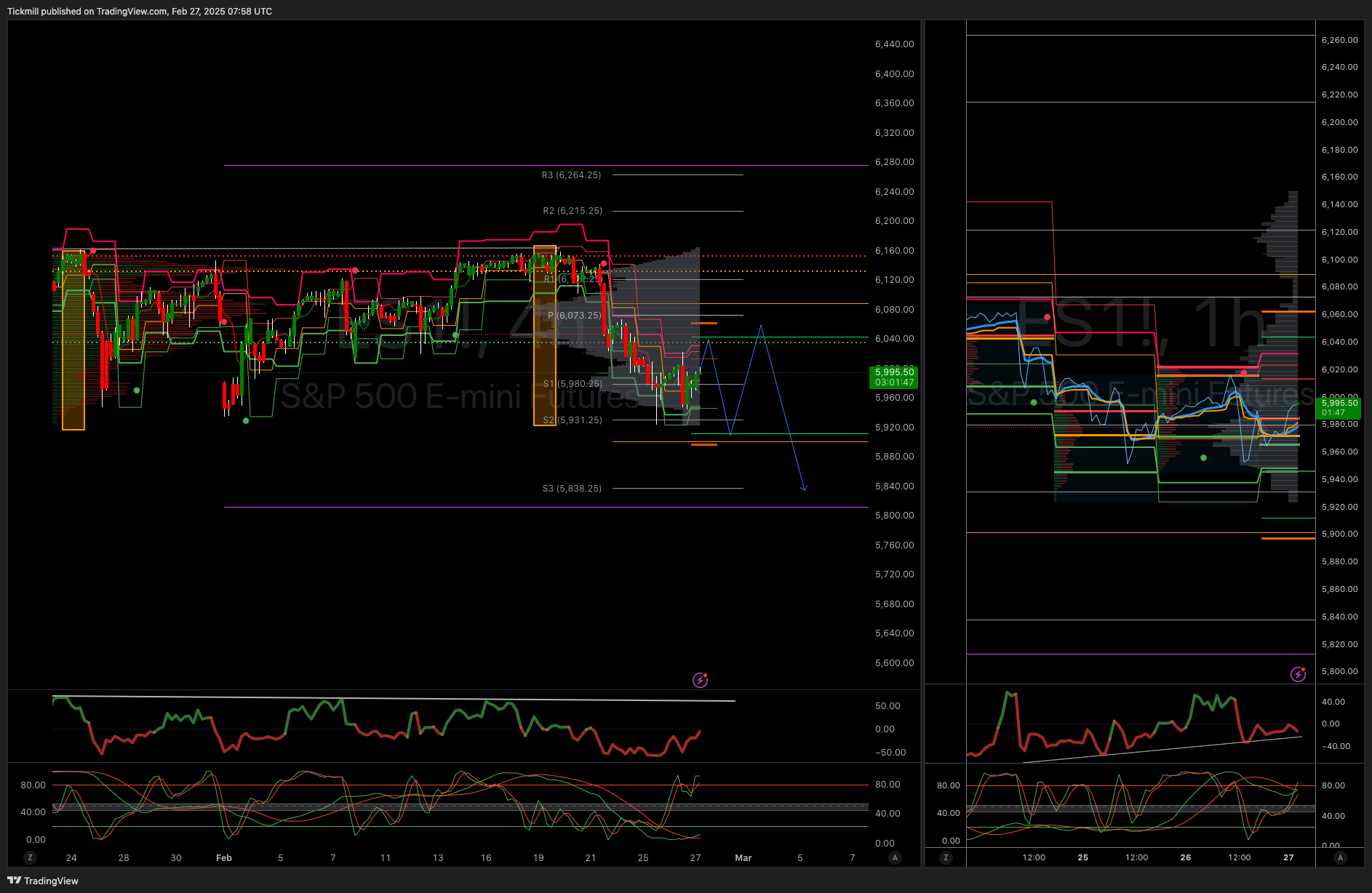

WEEKLY BULL BEAR ZONE 6060/70

WEEKLY RANGE RES 6142 SUP 5916

DAILY BULL BEAR ZONE 6032/42

DAILY RANGE RES 6032 SUP 5948

UNFILLED GAP 5909

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT OF WEEKLY RANGE SUP/UNFILLED GAP TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW THE WEEKLY ACTION AREA VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: A SENSE OF RELIEF

FICC and Equities | 26 February 2025

Market Overview:

The S&P closed up 1bps at 5956, with a market-on-close (MOC) sell order totaling $820 million. The Nasdaq 100 (NDX) gained 22 points to finish at 21132, while the Russell 2000 (R2K) rose 19bps to 2174. The Dow Jones Industrial Average (Dow) dropped 43bps, closing at 43433. Trading volume across all U.S. equity exchanges reached 14.3 billion shares, slightly below the year-to-date daily average of 15.2 billion shares.

Volatility eased, with the VIX declining 180bps to 19.08. Crude oil fell 25bps to $68.76, U.S. 10-year yields dropped 5bps to 4.24%, and gold edged up 6bps to $2916. The U.S. Dollar Index (DXY) climbed 17bps to 106.49, while Bitcoin tumbled 503bps to $84246.

Key Drivers:

The momentum unwind observed last week reversed somewhat following NVIDIA's (NVDA) after-hours earnings report. NVDA shares rose 3% post-market (after a prior 5% increase during regular trading) on a thinner-than-expected earnings beat but stronger quarter-over-quarter guidance. Q4 revenues were reported at $39.3 billion, exceeding consensus estimates of $38.25 billion, with Q1 revenues projected at $43 billion versus expectations of $42.26 billion. Investor sentiment and positioning for NVDA are at their most supportive levels in over two years. The solid results, coupled with favorable sentiment, are expected to act as tailwinds, potentially lifting both NVDA and the broader market. This could also encourage retail investors to re-enter the market.

Sector and Flow Trends:

Notable trends included reduced supply in Semiconductors, AI, and Momentum Longs, alongside increased demand, signaling stabilization. Our Long Momentum Basket (GSCBHMOM) rose 3% today but remains down 10% for the week. Hedge fund trading activity slowed significantly, while asset manager activity increased. Asset managers were net sellers, particularly in Healthcare, while demand was concentrated in Industrials. Private banking data showed U.S. equities were net sold for the third consecutive session (five of the last six), driven largely by short sales. Macro Products and Single Stocks accounted for 69% and 31% of total net selling, respectively. Sectors experiencing the heaviest net selling included Health Care, Information Technology, and Financials. Conversely, Consumer Discretionary, Industrials, and Staples were the most net bought.

Our trading floor activity was rated 7 out of 10, with performance finishing +69bps compared to the 30-day average of +85bps. Skews were largely flat, with hedge funds acting as small net buyers and large operators maintaining balanced positions. Hedge funds increased short positions during the morning rally, particularly in Technology, Media & Telecom, Macro Products, and Health Care, resulting in net selling across most sectors except Consumer Discretionary. Long-only funds reduced supply shortly after the market opened, focusing on defensive moves in AI and Semiconductor names while de-risking Consumer holdings. Long-only funds were net buyers in Macro Products and Industrials but net sellers in Communications Services.

Derivatives Market:

All eyes were on NVDA, with some clients positioning for upside potential ahead of the earnings event. Initial indications suggest NVDA’s realized movement will fall well below the 10% implied volatility, though surprises could emerge during the 5 PM conference call. The VIX ended slightly lower, holding within the 19 range, reflecting elevated volatility compared to the previous 14-15 range. Recent sell-offs have been driven by gamma moves rather than true volatility events, with no widespread panic observed. For long strategies, the desk highlights low upside volatility, particularly in three-month options, suggesting an opportunity to hold volatility outright. Dealers remain slightly short gamma, with the Friday afternoon straddle priced at 1.27%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!