SP500 LDN TRADING UPDATE 26/6/25

SP500 LDN TRADING UPDATE 26/6/25

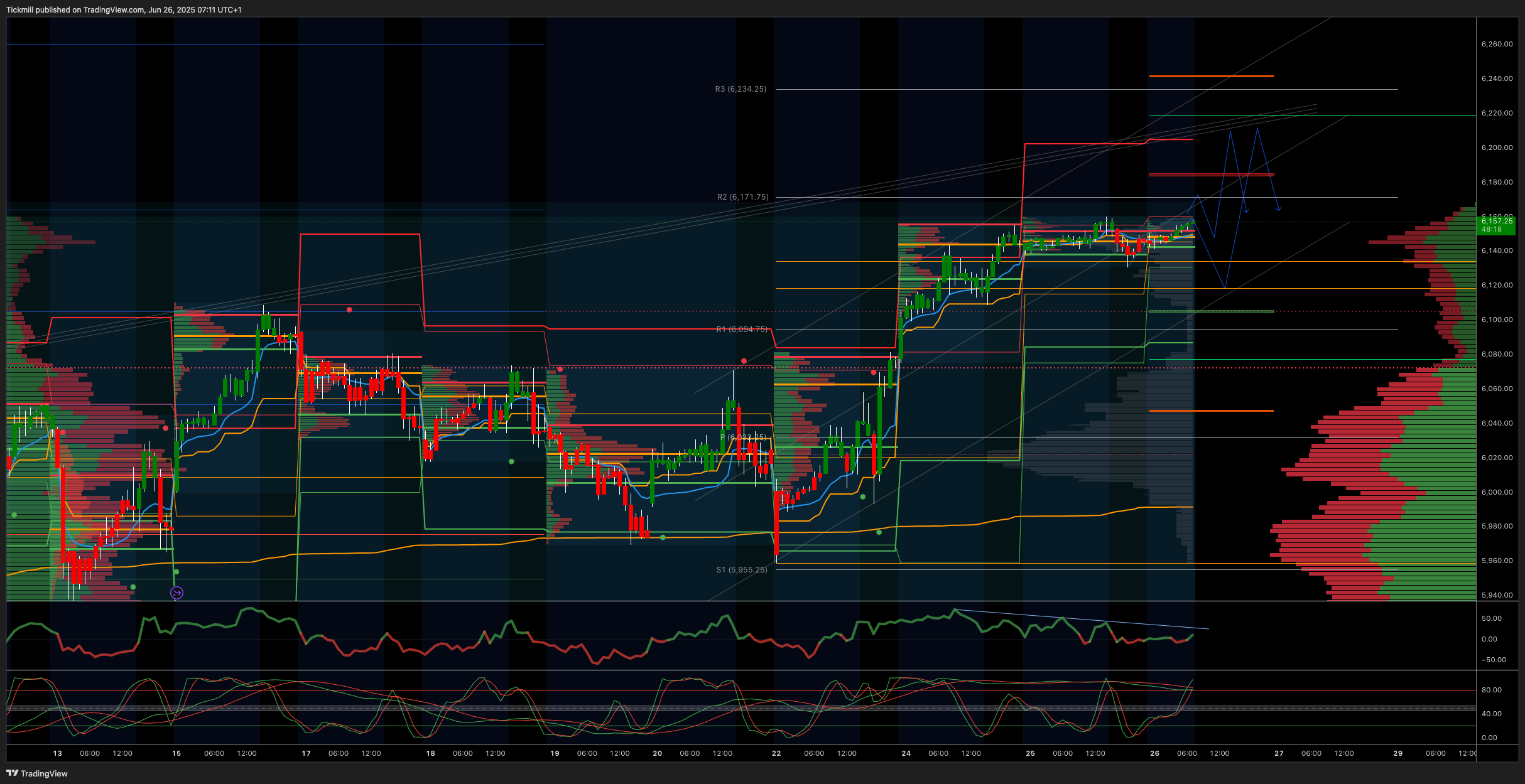

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6130 SUP 5900 (6180 50% WEEKLY RANGE EXTENSION)

DAILY BULL BEAR ZONE 6130/20

DAILY RANGE RES 6205 SUP 6086

2 SIGMA RES 6264 SUP 6027

GAP LEVELS 6077/6018/5843/5741/5710

6166.5 PRIOR ALL-TIME HIGHS

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 19.75

DAILY MARKET CONDITION – ONE TIME FRAMING UP – 6130

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

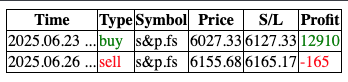

TRADES & TARGETS

SHORT ON TEST REJECT OF 6180 TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT DAILY RANGE RES TARGET 6160 > DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET 6166 > 6180 > DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED, THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS.)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. Equities Update: Little Changed

Date: 25 June 2025 | Time: 8:52 PM UTC

Market Summary:

- S&P 500: Unchanged, closing at 6,092 with Market-on-Close (MOC) flows of $1.6 billion to sell.

- NASDAQ 100 (NDX): +21bps, closing at 22,237 (new all-time high).

- Russell 2000 (R2K): -129bps, ending at 2,150.

- Dow Jones: -25bps, finishing at 42,098.

- Trading Volume: 16.1 billion shares traded across U.S. equity exchanges versus the year-to-date daily average of 16.7 billion shares.

Volatility & Commodities:

- VIX: -4%, closing at 16.76.

- Crude Oil: +115bps, ending at $65.11.

- Gold: +40bps, finishing at $3,347.

- US 10-Year Yield: Unchanged at 4.29%.

- Dollar Index (DXY): -12bps, settling at 97.47.

- Bitcoin: +157bps, surging to $107,860.

Market Insights:

Markets were relatively muted amid a quiet news cycle, though underlying breadth remained weak, with 366 S&P 500 constituents trading lower. The focus remained on AI-driven trades, with NVIDIA (NVDA), AMD, and Alphabet (GOOG) acting as the largest positive contributors to the index.

Micron Technology (MU) surged +5% after-hours following strong quarterly results, beating revenue and EPS estimates, and providing upbeat guidance for FQ4 revenues and margins. Despite high expectations heading into the release, Micron cleared the bar, reinforcing bullish sentiment in the semiconductor and AI sectors. This performance is expected to intensify rotation pressure from software to semiconductors, especially as payroll software names lagged significantly, with Paychex (PAYX) dropping -9% today on earnings and marking its largest monthly drawdown in over 20 years (-15% relative to the S&P 500 for June).

Elsewhere, NYC REITs were under pressure, declining 4–6%. The political landscape shifted as Zohran Mamdani won the mayoral primary, with Andrew Cuomo conceding shortly after polls closed. Mamdani now faces incumbent Eric Adams (running as an independent) and Curtis Silwa (Republican candidate) in the general election.

Trading Floor Activity:

Activity levels on the trading floor ranked a 5 out of 10, slightly elevated compared to recent averages. The floor finished +163bps versus a 30-day average of -77bps. Long-only funds (LOs) were net sellers of $1.5 billion, with selling concentrated in technology, financials, and communication services. Hedge funds (HFs) were modest net sellers, focusing on technology and discretionary sectors. Attention now shifts to quarter-end rebalancing dynamics, with U.S. pensions projected to sell $26 billion in equities, ranking in the 89th percentile historically.

Derivatives Market:

Derivatives saw limited activity, with both volatility and skew remaining stable. Client interest was observed in short-dated topside options, particularly in NDX, where July topside spreads show roughly 3 volatility points over SPX. Despite record highs, demand for hedging remains subdued. Wide put 1x2 strategies continue to present attractive breakevens for pullback plays, such as the SPX August 5200/6000 put 1x2, priced at ~1% with a downside breakeven below Liberation Day lows.

Additionally, renewed interest in China upside was noted. Hedge funds have been net sellers of Chinese equities for four consecutive weeks, marking the fastest pace in 2.5 months, primarily driven by short sales. Positive headlines outside trade deal updates have sparked interest in plays like KWEB September 39 calls at $0.81 to position for a potential rally. The straddle for the remainder of the week closed at ~0.71%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!