SP500 LDN TRADING UPDATE 25/6/25

SP500 LDN TRADING UPDATE 25/6/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6130 SUP 5900 (6180 50% WEEKLY RANGE EXTENSION)

DAILY BULL BEAR ZONE 6125/15

DAILY RANGE RES 6202 SUP 6084

2 SIGMA RES 6261 SUP 6025

GAP LEVELS 6077/6018/5843/5741/5710

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 19.75

DAILY MARKET CONDITION - ONE TIME FRAMING UP - 6109

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

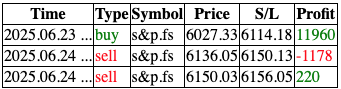

TRADES & TARGETS

SHORT ON TEST REJECT OF 6180 TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE RANGE SUP

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: NASDAQ HITS NEW ALL-TIME HIGH

FICC and Equities

24 June 2025 | 8:34 PM UTC

Market Performance:

- S&P 500: +1.11% closing at 6,092 with minimal MOC impact.

- NASDAQ 100 (NDX): +1.53% closing at 22,190 (new all-time high).

- Russell 2000 (R2K): +1.34% at 2,161.

- Dow Jones (DJIA): +1.19% at 43,089.

Trading Volume:

16.9 billion shares traded across U.S. equity exchanges, slightly above the YTD daily average of 16.7 billion.

Volatility & Key Indicators:

- VIX: -11.8% at 17.48.

- Crude Oil: +5.17% at $64.98.

- U.S. 10-Year Yield: -5 bps at 4.29%.

- Gold: -1.34% at $3,323.

- DXY (Dollar Index): -0.47% at 97.96.

- Bitcoin: -1.98% at $105,860.

Highlights:

The Nasdaq closed at a record high of 22,190, supported by optimism around the ceasefire and favorable seasonal trends heading into July 4th. The S&P 500 is eyeing its previous all-time high of 6,144 (set on February 19, 2025).

Notable price action included a strong performance by the Most Rolling Short (GSCBMSAL) basket, which gained +2.90% and has outperformed the S&P 500 by ~10% over the past month. Semiconductor stocks surged +4%, with broad-based gains of +2-4% across the group, likely driven by positive AI developments and improving macroeconomic conditions favoring "secular cyclicals."

Sector Insights:

- TMT Commentary (Callahan): The market remains challenging for alpha generation due to single-stock volatility and a squeezy/laggard tape. Some safe-haven names (e.g., EBAY, LYV, DUOL, Security Software) are showing signs of weakness, potentially being used as funding sources.

- Standouts: UBER +7%, benefiting from Tesla challenges, travel recovery, and the Waymo/Atlanta launch.

Key Events Tomorrow:

- Macro: New Home Sales, Powell’s testimony.

- Earnings: PAYX, MU.

- Conferences: AI-focused events (Cerebral Valley, VB Transform), HPE Discover, TSM China Symposium.

- Other: GS-hosted IBM event, NATO Summit, EQIX analyst day.

Market Activity:

- Floor activity was moderate, rated 5/10, finishing -75 bps vs. a 30-day average of -99 bps.

- Long-Only investors were net sellers (-$2 billion), primarily in tech, financials, and energy.

- Hedge Funds were net buyers (+$750 million), with broad-based demand across sectors.

Post-Bell Updates:

- FedEx (FDX): -5% after reporting Q4 EPS of $6.07 vs. $5.81 consensus. Fiscal Q1 guidance of $3.40-4.00 falls short of the $4.03 consensus. Capex guidance reduced to $4.5 billion vs. $5 billion consensus. Implied move ~7%, with earnings call at 5:30 PM. Full-year EPS guidance suggests $15-20, below the consensus of $19.51.

Derivatives Market:

Volatility dropped sharply as the VIX hit its lowest level since early June. Skew flattened on the market’s upward move. SPX flows were concentrated in short-dated upside buying.

Banks were in focus ahead of expected regulatory reform developments this week. KRE and XLF call volumes were ~3x their 20-day averages, as investors sought upside exposure.

The straddle for the rest of the week is priced at 0.98%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!