SP500 LDN TRADING UPDATE 24/9/25

SP500 LDN TRADING UPDATE 24/9/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~61 POINTS***

WEEKLY BULL BEAR ZONE 6600/6590

WEEKLY RANGE RES 6734 SUP 6595

SEP EOM STRADDLE 178 POINTS - 6282/6638

OCT MOPEX 6842/6487

DEC QOPEX 6303/7025

DAILY BALANCE -6756/6687

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

DAILY BULL BEAR ZONE 6740/50

DAILY RANGE RES 6774 SUP 6659

2 SIGMA RES 6836 SUP 6596

VIX DAILY BULL BEAR ZONE 17.5

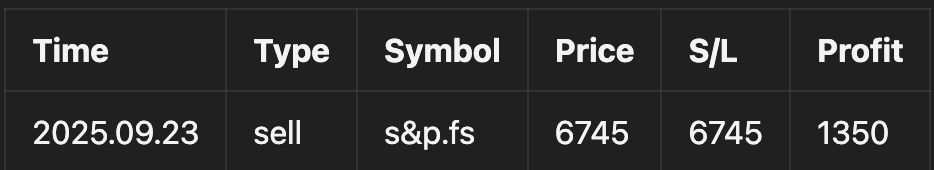

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT OF DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: GIVE BACK

FICC and Equities | 23 September 2025 | 8:50PM UTC

Market Overview:

- S&P 500: Closed -55bps at 6,656, with MOC flows showing +$450m to BUY.

- Nasdaq 100 (NDX): -73bps, closing at 24,580.

- Russell 2000 (R2K): -23bps, ending at 2,476.

- Dow Jones: -19bps, finishing at 46,292.

- Volume: 18.9 billion shares traded across U.S. equity exchanges, surpassing the YTD daily average of 16.8 billion shares.

Key Indicators:

- VIX: +335bps, closing at 16.64.

- WTI Crude: +217bps, ending at $63.63.

- US 10-Year Yield: -4bps, settling at 4.10%.

- Gold: +59bps, closing at $3,797.

- DXY (Dollar Index): -10bps, finishing at 97.25.

- Bitcoin: -95bps, ending at $111.7k.

Sector and Market Insights:

Slight pullback observed in AI winners and large-cap tech stocks following recent explosive gains. Discussions overnight about "circular references" post-NVDA headlines, coupled with Safra's retirement announcement, may have contributed to the reversion. Powell's commentary remained non-committal, noting hiring below breakeven but stable job indicators overall. Tariff increases are expected to drive slightly higher inflation over several quarters. Market volatility continues in the absence of major news catalysts.

Energy Sector Movement:

WTI crude surged +200bps amid multiple factors:

(A) Russia’s potential diesel export ban and extended gasoline ban, following earlier Primorsk terminal attack (a key Baltic Sea oil hub).

(B) Factor rotations within the sector.

(C) NATO’s promise of a robust response to Russian airspace incursions.

(D) Trump’s criticism of EU’s Russian oil/gas purchases during his UN speech, intensifying pressure.

After-Hours Highlights:

- Micron Technology (MU): +4% post solid earnings beat and guidance ~23% above consensus. Despite high expectations (+40% stock rally last month), Q1 guidance exceeded the elevated bar.

- Memory Sector Sympathy Moves: WDC (+1%), SNDK (+1.5%), STX (+1%).

Trading Floor Activity:

Overall activity levels rated 4/10. Floor activity finished flat versus the 30-day average of +44bps.

- Long-Only Flows: ~$800m net sellers, with supply in tech and staples offset by demand in healthcare and macro products.

- Hedge Fund Flows: Flat/benign, no sector skew exceeding $100m.

Short Themes in Focus:

1. Junk Food & Alcohol: GSCNSJNK & GSXGBOOZ.

2. Cross-Border Payments: GSFINCBP.

3. Legacy Tech & IT Services: GSTMTOLD & GSXGITSV.

4. Low-Income Discretionary: GSXULOWD Index.

5. Mutual Fund Tax Loss Selling: GSCBMF25 Index.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!