SP500 LDN TRADING UPDATE 24/03/25

SP500 LDN TRADING UPDATE 24/03/25

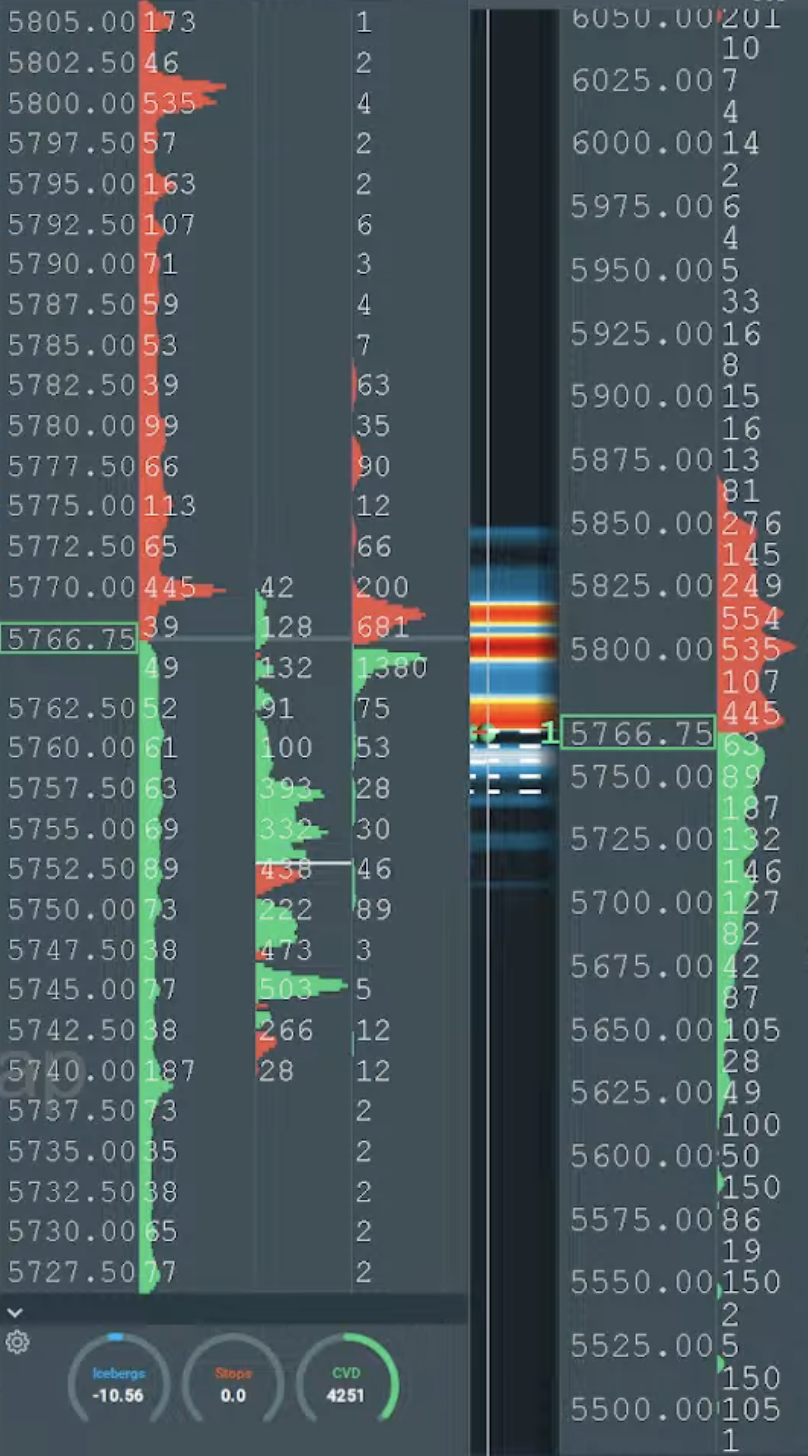

WEEKLY BULL BEAR ZONE 5690/5700

WEEKLY RANGE RES 5850 SUP 5590

DAILY BULL BEAR ZONE 5720/10

DAILY RANGE RES 5763 SUP 5677

DAILY 2 SIGMA RES 5860 5580

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: WEEKLY RECAP

FICC and Equities

Market Overview:

The SPX, NDX, and RTY indices posted modest weekly gains despite ongoing volatility. Beneath the surface, market activity tilted toward pro-cyclical sectors, with Energy, Financials, and Industrials advancing +1% to +3%, while Tech/Mag7 lagged, down -70bps. While current positioning suggests more upside than downside risk, investor sentiment remains cautious and likely to fluctuate daily until clarity emerges on the April 2nd tariff developments and Q1 earnings.

Key themes this week included:

Anemic top-of-book liquidity.

Re-emerging retail investor demand.

Supply relief from systematic strategies.

End-of-month pension rebalancing, which brought $29bn of U.S. equity demand—ranking in the 89th percentile historically.

Flow Analysis:

Long-Only funds (LOs) were net sellers of $4bn this week, despite purchasing $5bn on Friday for rebalancing purposes. This brings their total net sales to $22bn over the past four weeks (~$15bn MTD).

Hedge Funds (HFs) were modest buyers, adding +$200m on the week and +$2bn over the past four weeks. The primary trend has been selling in post-election outperformers, with notable selling skews in Tech, Macro Products, and Discretionary sectors. No sector showed a significant net buying trend this week.

Looking ahead, it will be interesting to monitor mutual fund (MF) cash levels in the coming weeks to determine whether this cash is being held for reallocation or rotated into Rest of World (RoW) equities.

Derivatives Market:

Activity in the options market slowed, with both volatility and skew slightly lower. Friday’s OPEX involved $4.7 trillion in notional options expirations; however, the gamma profile remains relatively flat due to dealer positioning. Client flows showed some interest in VIX upside, as the VIX holds a 19 handle and VVIX briefly surpassed 90. Key data releases next week include GDP and PCE, with the full-week straddle priced at 1.95%.

Prime Brokerage Trading Flows:

Hedge Funds net sold U.S. equities for the 6th consecutive week (and 11 of the last 12 weeks), though the pace of selling slowed compared to the prior three weeks.

Macro Products saw net buying for the first time in 12 weeks, driven by long purchases and short covers (3.6 to 1 ratio).

Single Stocks experienced the largest net selling in seven weeks, with short sales outpacing long buys (2.6 to 1 ratio).

U.S. Industrials stocks were net sold for the 4th consecutive week at the fastest pace in 10 months (-1.9 SDs), led by short sales and, to a lesser extent, long sales (2 to 1 ratio).

Conversely, U.S. Financials were net bought at the fastest pace since December, driven by long purchases and some short covering (~4 to 1 ratio).

Next Week’s Outlook:

The SPX implied move through 3/28 is 2.23%. With fewer catalysts on the horizon, investor focus will shift to key economic data, including:

Consumer Confidence (Tuesday).

Final 4Q GDP reading (Thursday).

PCE and University of Michigan sentiment data (Friday).

Additionally, $183bn in Treasury supply will be auctioned across 2-, 5-, and 7-year notes. A handful of investor events and late-reporting consumer company earnings will also be in focus, including KBH (Monday), DLTR & WOOF (Wednesday), and RH & LULU (Thursday).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!