SP500 LDN TRADING UPDATE 23/05/25

SP500 LDN TRADING UPDATE 23/05/25

WEEKLY & DAILY LEVELS

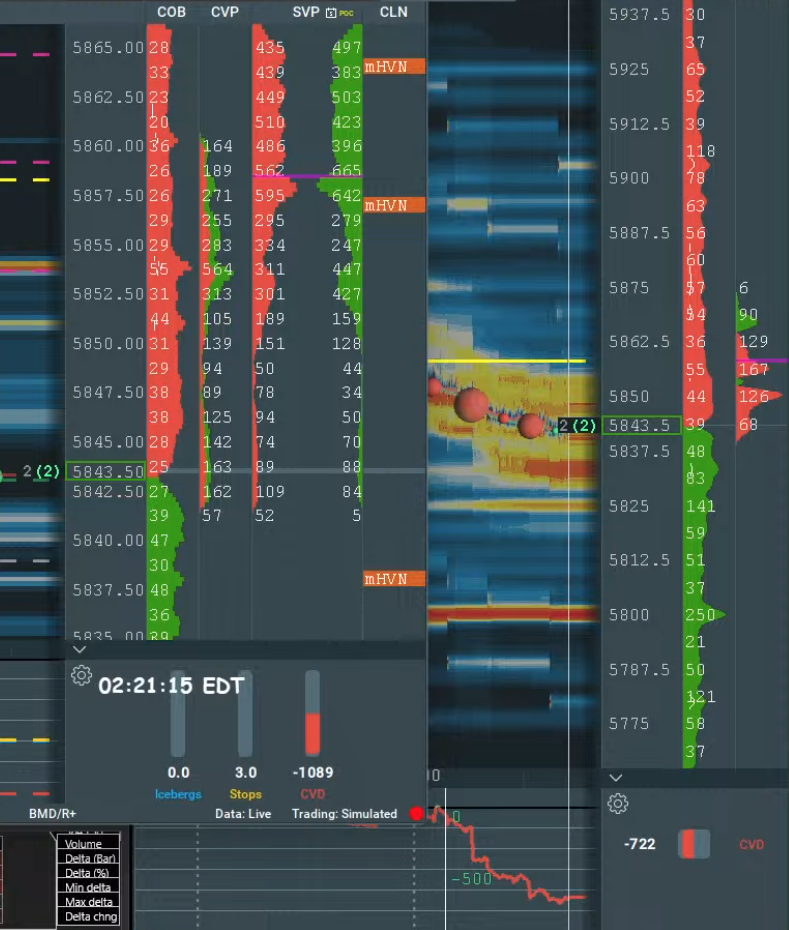

WEEKLY BULL BEAR ZONE 5860/50

WEEKLY RANGE RES 6049 SUP 5849

DAILY BULL BEAR ZONE 5815/25

DAILY RANGE RES 5928 SUP 5807

2 SIGMA RES 5988 SUP 5747

GAP LEVELS 5741-5806

VIX BULL BEAR ZONE 20.75

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

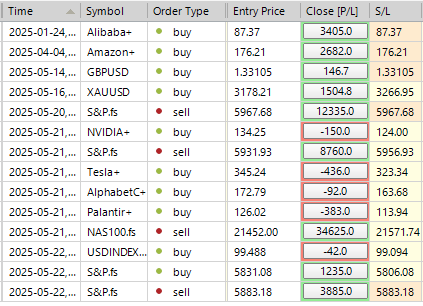

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: UNCHANGED

FICC and Equities | 22 May 2025 |

- S&P 500: -34bps, closing at 5,852 with MOC of $2.2B to BUY.

- NASDAQ 100 (NDX): +15bps, closing at 21,112.

- Russell 2000 (R2K): Unchanged at 2,051.

- Dow Jones (Dow): Unchanged at 41,859.

Market Activity:

- 16.6B shares traded across U.S. equity exchanges, slightly above the YTD daily average of 16.5B shares.

- VIX: -283bps at 20.28.

- Crude Oil: -120bps at $60.82.

- U.S. 10-Year Yield: +6bps at 4.52%.

- Gold: +58bps at $3,220.

- DXY: +36bps at 99.92.

- Bitcoin: +259bps at $111,080.

A quiet trading session with equities finishing largely unchanged. The 10-year yield dropped 6bps to 4.52%. Market breadth was narrow, with 311 S&P names declining. The MAG7 stocks, particularly GOOGL, continued to edge higher, reflecting tactical sentiment shifts driven by positioning, valuation (a cost-effective way to add exposure in a pricey market), improved macro sentiment for 2Q/2H, and renewed enthusiasm for AI trends.

Sector Highlights:

- In consumer stocks, earnings dominated focus:

- URBN: +22% on strong results and guidance.

- AAP: +57% after a robust quarter.

- NKE: +2%, set to sell on Amazon again (first time since 2019), with potential price hikes on shoes over $100 reported by CNBC, deemed manageable.

Trading Floor Activity:

- Activity level: 4/10.

- Floor finished -3% for sale vs. 30-day average of +161bps.

- Long-only (LO) and hedge fund (HF) skews were flat and not noteworthy:

- LOs were small net sellers in tech and healthcare but buyers in communication services.

- HFs were slight net sellers in tech but buyers of macro products.

Post-market Action:

- WDAY: -4%.

- INTU: +4%, raising FY tax/consumer growth forecast to +10% (prior +8%) and boosting FY EPS guidance.

Liquidity is expected to decline tomorrow ahead of the long weekend.

Pension Update:

Early estimates indicate U.S. pensions are projected to SELL $19B of U.S. equities for month-end. This figure ranks in the 89th percentile of all buy/sell estimates in absolute dollar terms over the past three years and in the 85th percentile since January 2000.

Derivatives Market:

- Volatility declined slightly, with skew bid, ending close to flat.

- Crypto saw significant activity, with IBIT call volumes hitting record highs for two consecutive days. Interest in call spreads for GLXY emerged following its options listing yesterday.

- Retail weakness remains a concern, with continued checks on XRT downside.

- Emerging markets (EM) upside appears attractive as volatility decreased alongside the S&P, with inflows continuing at favorable valuation levels.

- Tomorrow’s straddle is priced at 0.80%. .

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!