SP500 LDN TRADING UPDATE 22/05/25

SP500 LDN TRADING UPDATE 22/05/25

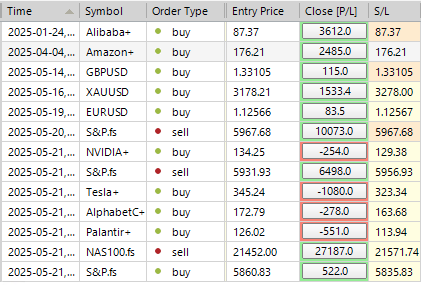

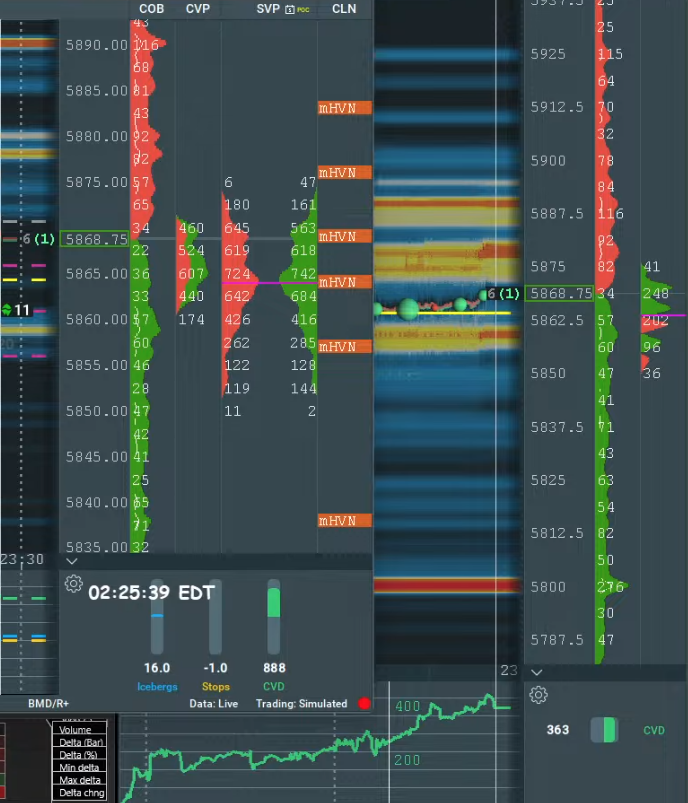

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5860/50

WEEKLY RANGE RES 6049 SUP 5849

DAILY BULL BEAR ZONE 5815/25

DAILY RANGE RES 5919 SUP 5798

2 SIGMA RES 5980 SUP 5737

GAP LEVELS 5741-5806

VIX BULL BEAR ZONE 22.25

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET PULLBACK

FICC and Equities | 21 May 2025 |

Market Performance:

- S&P 500: -161bps, closing at 5,844 with a MOC of $1.4B to BUY

- NASDAQ 100 (NDX): -134bps, closing at 21,080

- Russell 2000 (R2K): -280bps, closing at 2,046

- Dow Jones: -191bps, closing at 41,860

Trading Volume & Volatility:

- 19.5B shares traded across U.S. equity exchanges (vs YTD daily average of 16.5B)

- VIX: +1537bps, closing at 20.87

Other Key Markets:

- Crude Oil: -114bps, at $61.32

- U.S. 10-Year Yield: +10bps, at 4.59%

- Gold: +79bps, at $3,316

- DXY (Dollar Index): -51bps, at 99.61

- Bitcoin: +105bps, at $108,080

Market Overview:

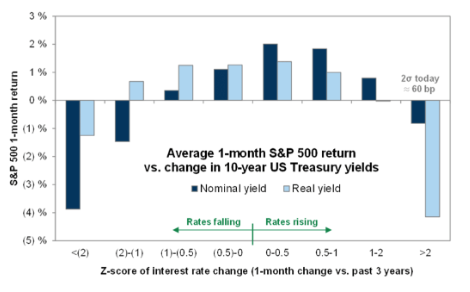

The market experienced a pullback today, driven by rising yields following a weak 20-year auction at 1 PM. This added pressure to equities after several weeks of strong performance. The U.S. 10-year yield surpassed 4.5%, a level not seen since the Liberation Day volatility. The critical question remains: at what yield level will equities face significant pressure? While 5% is the psychological threshold, a more nuanced view suggests yields above 4.7% (before the end of May) could weigh on stocks, especially given the speed of rate moves. Historically, when the 10-year yield rises by 2 standard deviations (60bps) within a month, equities tend to falter.

Activity Levels & Flows:

- Activity levels were subdued, rated 4 on a 1-10 scale.

- Net flows: Market finished -3% for sale vs a 30-day average of +189bps.

- Both Long-Only (LO) and Hedge Funds (HF) were slight net sellers, driven by macro product supply.

Sector & Stock Highlights:

- Apple (AAPL): Declined 2% following news of Jony Ive (former AAPL designer) joining OpenAI to develop AI-powered devices.

- Mega-cap tech outperformed non-profitable tech by ~4%, a trend we continue to favor.

Post-Bell Movers:

- Zoom (ZM): +3% (earnings)

- Snowflake (SNOW): +6% (earnings)

- Navitas Semiconductor (NVTS): +100% on collaboration with NVIDIA

- Medicare-related stocks (HUM, CVS, UNH): -7% after CMS announced expanded auditing for Medicare Advantage plans.

Derivatives Market:

Volatility surged as equities sold off following the 20-year auction tail. Initial client activity involved unwinding positions during the decline, but as the market stabilized around -150bps, clients re-engaged with SPX downside trades.

- Desk View: Prefers being long volatility and short skew at current levels. Upside risk/reward appears less attractive.

- VIX Outlook: VIX call spreads (July expiry) look appealing, given the tariff pause deadline on 9 July 2025.

- Weekly Straddle: Closed at ~1.20%.

The market remains focused on bond yields, with 10-year rates moving closer to levels that could significantly impact equities.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!