SP500 LDN TRADING UPDATE 22/01/25

SP500 LDN TRADING UPDATE 22/01/25

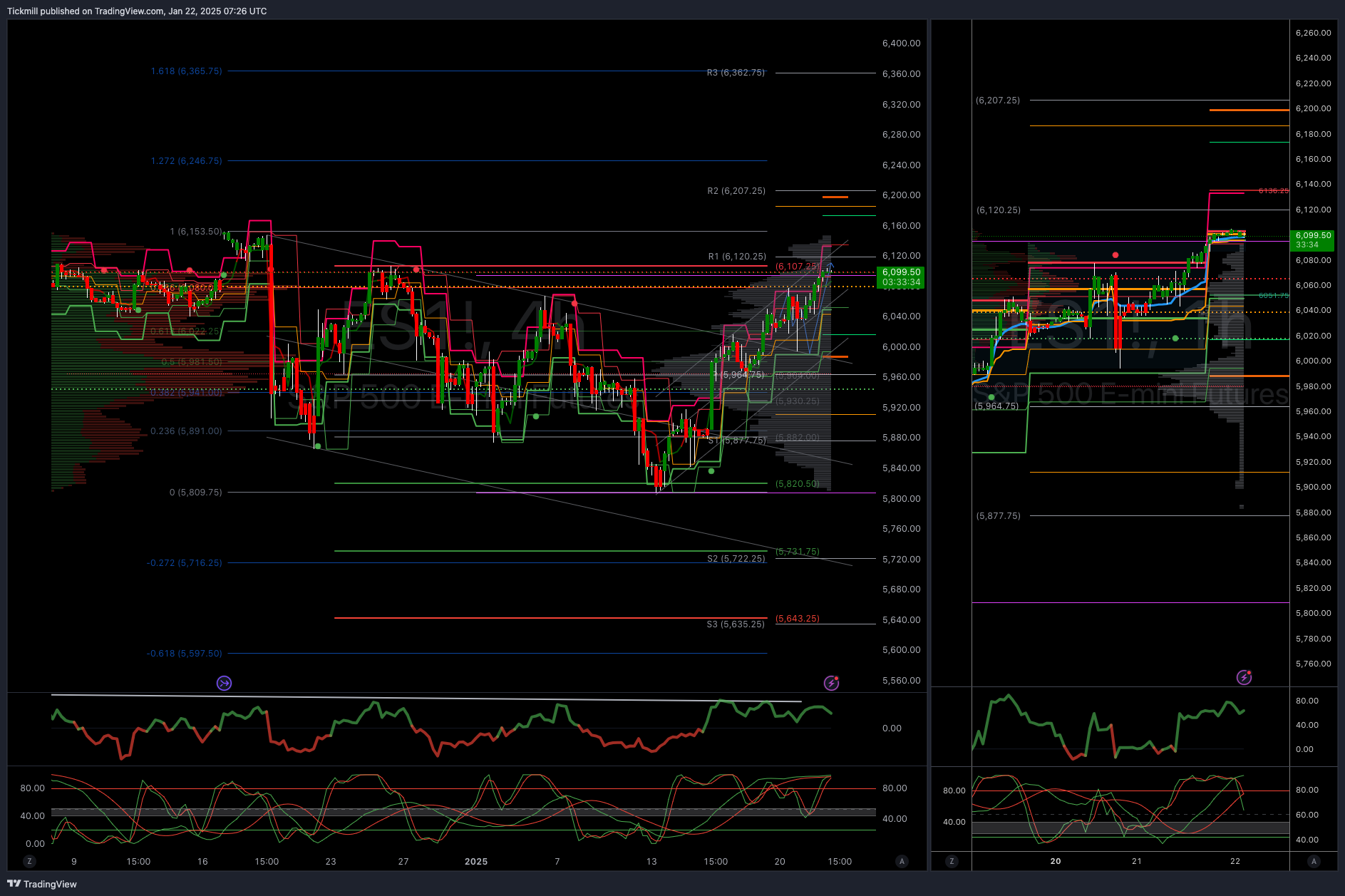

WEEKLY BULL BEAR ZONE 6070/80

WEEKLY RANGE RES 6119 SUP 5945

DAILY BULL BEAR ZONE 6075/65

DAILY RANGE RES 6133 RANGE SUP 6049

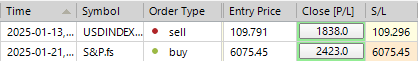

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET WEEKLY>DAILY RANGE RES

SHORT ON TEST/REJECT WEEKLY/DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON ACCEPTANCE BELOW DAILY RANGE SUP 6009

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

Risk off.......risk on....

We've already experienced a year of four seasons...to summarise from Pete Callahan: “Week 1 = Rates / Hard landing (strong NFP) .. Week 2 (last week) = Goldilocks vibes (bank earnings + CPI) .. Week 3 (this week) = Trump’s inauguration / policy watch .. Week 4 (next week) = will be Big Tech earnings.”

Ultimately, January began with concerns about re-inflation, rising yields, and a softer performance from mega-cap tech and US equities. Last week provided some relief. The softer CPI was sufficient to reignite investor enthusiasm. Tech/Nasdaq rallied, with the latter up 3% for the week, and US bank earnings were robust, supporting the equity rebound. Attention then turned to last night’s Trump inauguration and what might follow. How quickly could deregulation occur? What form will tariffs take, and how soon will they be implemented?

The excitement surrounding the inauguration was palpable, as was the media coverage, the numerous parties, the attendance of tech oligarchs, former UK politicians eager to be present, and celebrities endorsing, donating, and DJing throughout this week’s events. US exceptionalism was rapidly priced in following Trump’s victory, as was the regime change regarding market freedom. We navigated through several rounds of appointment anxiety, optimism versus reality stress, inflation/re-inflation concerns, the effects of tariffs, and geopolitical stress, ultimately arriving at a healthier equilibrium—less ‘hodl’ and more hopeful. (As a side note, the Trump meme coin—$Trump—at one point generated around $70 billion in ‘value’ within 24 hours last weekend). In the early hours of ‘T2’, we encountered headlines about 25% tariffs on Mexico and Canada, an EU VAT, and heard nothing substantial regarding China (yet), along with discussions of regional expansion and ‘drill baby drill’ in relation to oil, and that was just the first evening. It’s going to be a wild ride.

What has characterized 2025 so far? A lack of action...continuing the same playbook as 2024 and increasingly seeking downside protection in various forms. There’s a growing sense of consensus and crowding in how people are positioning themselves: long US equities, long dollar, long the Trump trade, long deregulation, short Europe, underweight UK, long Japan, etc. The margin for error is slim given how crowded certain consensus trades have become.

What can we expect next? The market is closely monitoring the noise surrounding a ‘flood of executive actions’. There appears to be a belief that the initial moves will concentrate on deregulation, and then more specifically on Energy and Immigration. The latter will necessitate funding and will involve Senate approvals and spending implications. Tariffs and retaliatory responses to tariffs are concerns, as are headline risks related to all of the above.

Flows

. Global equities experienced net selling for the third consecutive week (four out of the last five). As Trump’s inauguration approached, emerging market (EM) stocks faced the most significant net selling since October, primarily due to EM ex China. Globally, Macro Products were entirely responsible for the net selling, which was driven solely by short sales. Conversely, Single Stocks recorded the highest net buying in five weeks. This indicates a tug-of-war between long gross positions... some single stock additions... but also a persistent emphasis on hedges and maintaining relatively low net positions. Luxury Goods made a strong comeback this week. On Tuesday, news that Trump’s team was considering incremental tariffs of 2-5% per month instead of immediate sharp increases was met with enthusiasm. The real boost occurred on Thursday when Richemont led the luxury sector with a 16.3% surge after surpassing quarterly sales expectations, with LVMH, Dior, Kering, and Hermès also reporting gains of 9.1%, 8.6%, 4.6%, and 4.9% respectively. Additionally, TSMC's earnings positively influenced sentiment in the semiconductor space, with a favorable print/guide rekindling interest in AI. The debate surrounding AI continues... 2024 witnessed considerable discussion about 'discovery', potential, capital expenditures, revenue pathways, where value will be generated... and the timeline for value creation. We will receive some answers in 2025, and some of the value that has been priced in may be accurate, overvalued, or simply premature. Lastly, M&A remains a key focus for investors, with recent public speculation surrounding Bureau Veritas and SGS, as well as Rio/Glencore... possibly indicating that larger-scale M&A activity may be on the horizon.

Defensive tilts

. Thus far, most of the activity has centered on defensive strategies. The sector that has seen the most buying is Pharma. There has been a noticeable preference for sectors and stocks that are large-cap, liquid, and exhibit lower volatility. We have observed sellers in volatile regions (e.g., the UK). There has been supply in crowded consensual factors (e.g., Momentum). We have seen a flight to safety (U.S. and the dollar). We have witnessed supply in the primary value creators of 2024 (Mag7). Overall, our flows, client discussions, and hedging activities have been orientated towards safety, addressing left-tail risks, and maintaining liquidity. This may be a slight response to the beta chase and euphoria experienced following Trump’s victory (particularly from a U.S. perspective).

Tail bets.

Delving deeper into the above... I’ve noticed an increase in tail bets. Starting with left tails... we’ve observed significantly higher tail bets on rates, much lower tail bets on GBP, much higher tail bets on VIX, ETF shorting, and basket hedging tail bets... but generally speaking, we’ve seen a range of rate, FX, equity... macro and micro tail bets being placed... again with a focus on left tails.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!