SP500 LDN TRADING UPDATE 20/11/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

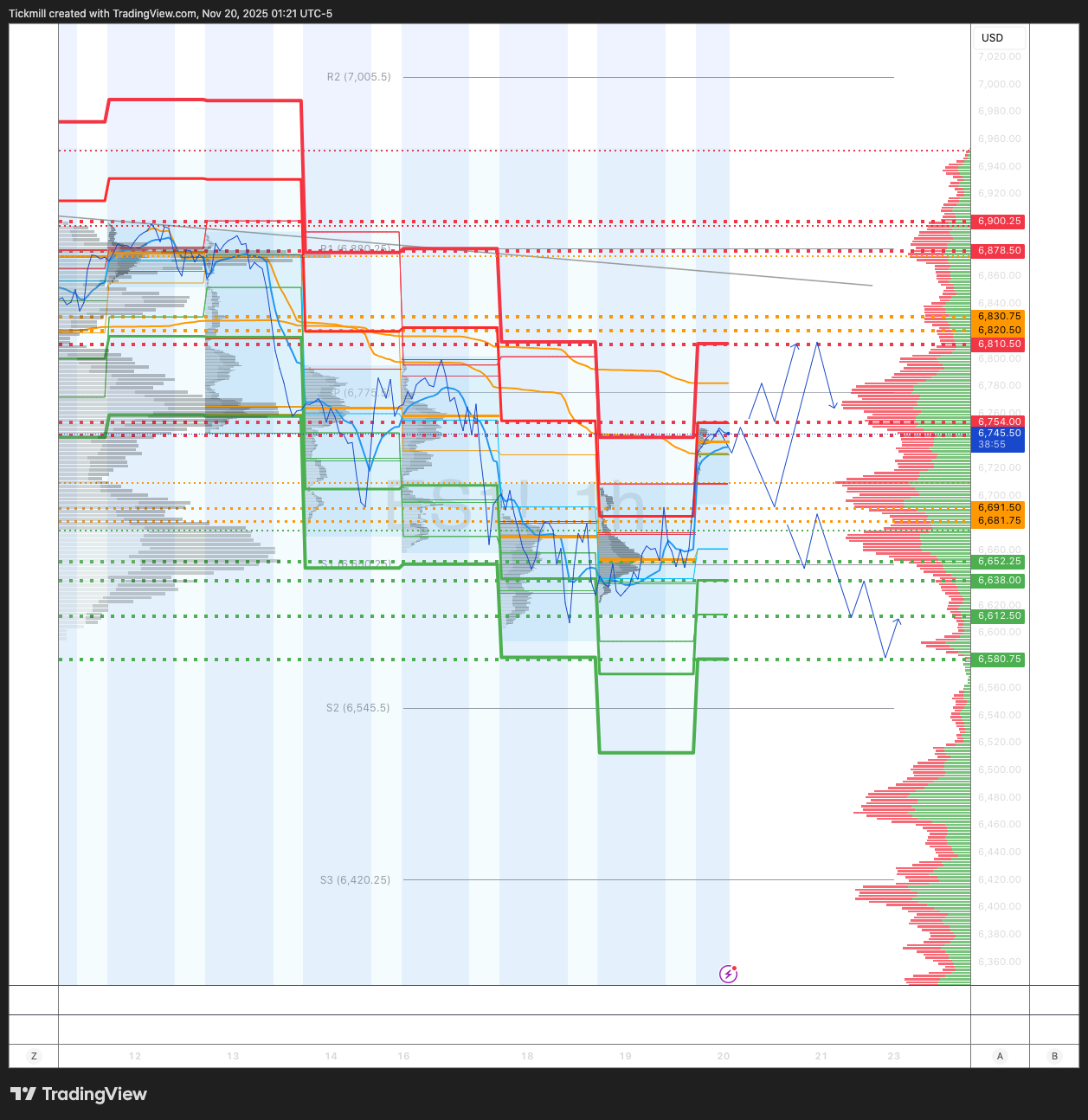

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6900/6610

WEEKLY VWAP BEARISH 6792

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

DAILY STRUCTURE – BALANCE - 6709/6594

DAILY BULL BEAR ZONE 6691/81

DAILY RANGE RES 6753 SUP 6638

2 SIGMA RES 6810 SUP 6580

DAILY VWAP BULLISH 6685

VIX BULL BEAR ZONE 23.3

TRADES & TARGETS

LONG ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ACCEPTANCE ABOVE DAILY BULL BEAR ZONE 2 SIGMA RES

SHORT ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: NVIDIA

S&P closed up +38bps at 6,642 with a Market-On-Close (MOC) imbalance of $125mm to SELL. NDX gained +56bps to finish at 24,640, while R2K edged down -4bps to 2,348, and the Dow rose +10bps to 46,139. A total of 17.2 billion shares traded across all U.S. equity exchanges, slightly below the year-to-date daily average of 17.48 billion shares. VIX dropped -417bps to 23.66, WTI Crude fell -196bps to $59.55, the U.S. 10-year yield ticked up +2bps to 4.13%, gold gained +3bps to 4,068, DXY climbed +65bps to 100.2, and Bitcoin declined -289bps to $89,781.

The session saw strong dispersion with notable moves in individual stocks—GOOG/L, NVDA, and AVGO all up over 3%—while 12-month laggards underperformed significantly. The market is currently pricing a 30% probability of a rate cut on December 10, following Fed minutes that leaned slightly hawkish, with split opinions among committee members and many deeming a December rate cut as “likely not appropriate.” Healthcare continues to show strong demand, both from hedge funds (HF) and long-only (LO) investors. Rotational trading within tech was evident, with funds flowing into GOOGL and other positive momentum-driven names. Notably, LO activity picked up today.

Elsewhere, NVDA was quiet ahead of its earnings print but surged +5% after hours following a beat and guidance above consensus. The company guided Q4 revenues to $63.7-$66.3bn versus consensus of $62bn, which was deemed "good enough" relative to expectations. NVDA’s positioning was rated 8/10, as the stock has been consolidating for around four months, trading at similar levels to its August pre-earnings setup.

Overall activity levels were moderate, rated 5/10. Our floor finished -188bps for sale versus the 30-day average of -175bps. Flow skews were benign at the top level, with both cohorts ending as slight net sellers. LOs net sold tech and discretionary sectors while buying financials and healthcare. HFs net sold discretionary names, non-profitable tech (refer to PB chart), and macro products (short > long). After hours, PANW dropped -4% despite a beat and reiteration, alongside the announcement of its acquisition of Chronosphere.

In derivatives, volatility compressed during the session as market stress eased following VIX expiry. We favor buying SPX and NDX call spread collars into year-end, given the recent bid in short-dated skew, making it attractive to sell downside risk to fund bullish positions. Clients remain optimistic despite VIX closing above 23, reflecting lingering uncertainties around NVDA and economic data. The straddle for the remainder of the week priced at ~1.70%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!