SP500 LDN TRADING UPDATE 20/05/25

SP500 LDN TRADING UPDATE 20/05/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5860/50

WEEKLY RANGE RES 6049 SUP 5849

DAILY BULL BEAR ZONE 5930/40

DAILY RANGE RES 6041 SUP 5919

2 SIGMA RES 6102 SUP 5858

GAP LEVELS 5741/5710

VIX BULL BEAR ZONE 19

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

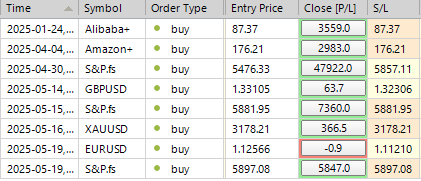

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: UNCHANGED

FICC and Equities | 19 May 2025 |

Market Overview:

- S&P 500: +9bps, closing at 5,963 with MOC of $3.3B to buy.

- NASDAQ 100 (NDX): +9bps at 21,447.

- Russell 2000 (R2K): -42bps at 2,104.

- Dow Jones: +32bps at 42,792.

- Trading Volume: 19.5B shares exchanged across all U.S. equity markets vs. YTD daily average of 16.5B shares.

- VIX: +5% at 18.14.

- Crude Oil: +30bps at $62.66.

- U.S. 10-Year Yield: -2bps at 4.45%.

- Gold: +143bps at $3,232.

- DXY (Dollar Index): -74bps at 100.34.

- Bitcoin: +143bps at $105,582.

Market Sentiment:

Stocks paused after last week’s 5% rally. Trading was subdued, with many traders still underweight beta. Markets drifted over 100bps off the morning lows, following Moody’s downgrade of the U.S. credit rating. Minimal news flow today, though reports emerged of record retail dip-buying in penny stocks. Headlines noted Trump’s involvement in Congressional tax meetings tomorrow, which could influence market momentum. Home Depot (HD) reports earnings pre-market tomorrow.

Floor Activity:

- Activity levels rated a 4/10.

- Floor ended +1% to buy vs. 30-day average of +120bps.

- Long-only funds were slight net sellers and largely on the sidelines.

- Hedge funds (HFs) finished flat after covering and buying macro products, offset by small sales in REITs and Utilities.

- U.S. Fundamental Long/Short HFs net exposure at 48%, ranking in the 5th percentile over a 5-year lookback.

Corporate Actions:

- Corporates remain in an open buyback window through June 13.

- Buyback desk running at 1.2x YTD daily average notional executed.

- CTAs expected to purchase $10B in S&P 500 this week.

- Over $17B of paper issued in May so far, with more expected this week (follows near-zero issuance in April).

- Last week saw strong demand for paper, with every deal at least 3x oversubscribed.

- NVIDIA (NVDA) reports earnings next Wednesday, May 28.

Derivatives Market:

- Slower day with 47M options traded vs. YTD average of 56M.

- Both volatility and skew were slightly bid, finishing the day +9bps.

- Dealer gamma positioning remains short $2B but flips to a small long on a 1% market decline.

- The desk favors owning short-dated SPX or QQQ puts outright as hedges, given low implied volatility in the 1-month space and attractive gamma costs.

- Weekly straddle pricing indicates 1.33% movement expected for the remainder of the week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!