SP500 LDN TRADING UPDATE 19/6/25

SP500 LDN TRADING UPDATE 19/6/25

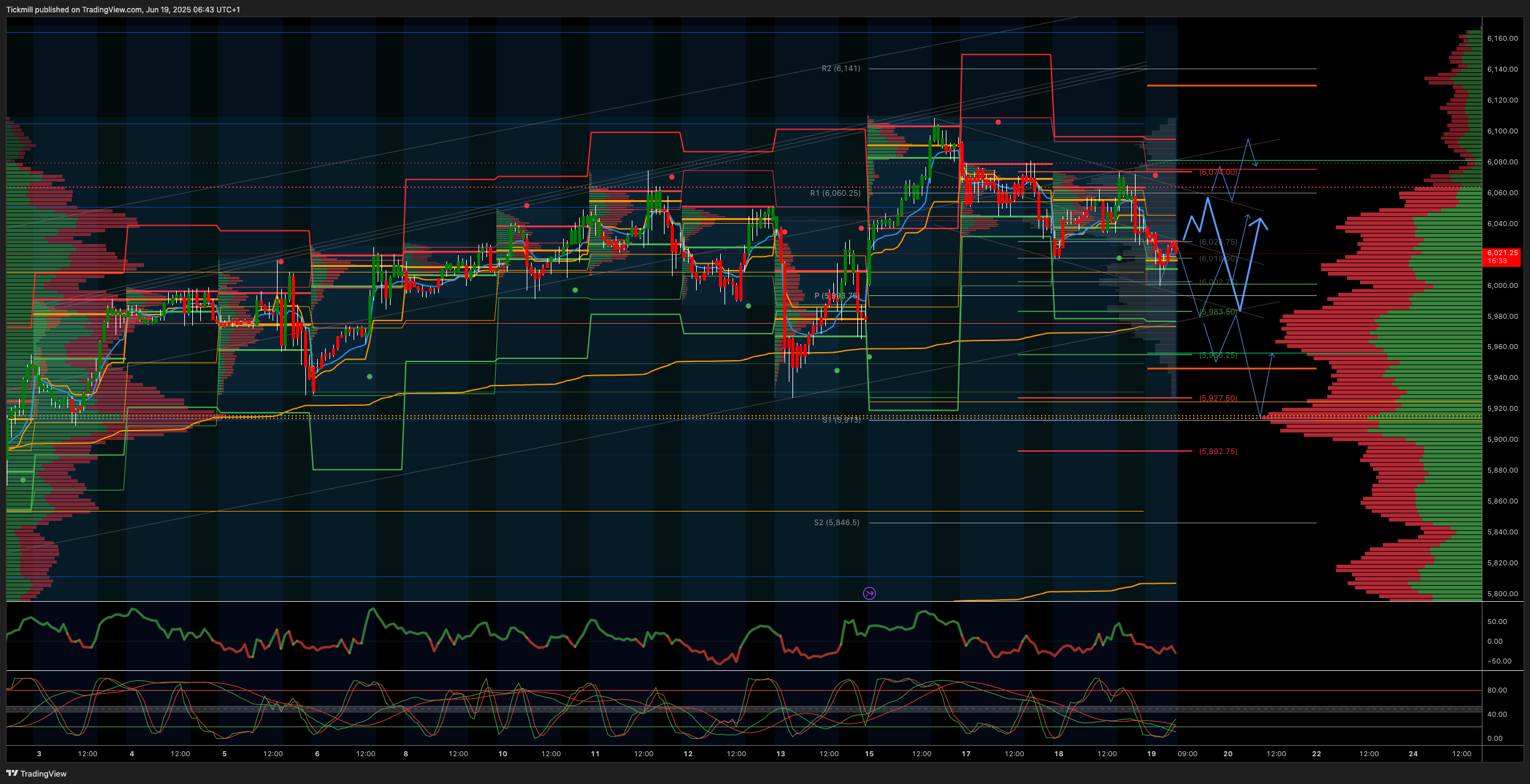

WEEKLY & DAILY LEVELS

***QUOTING SEP CONTRACT FOR JUNE CONTRACT OR CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6090/6100

WEEKLY RANGE RES 6150 SUP 5914

DAILY BULL BEAR ZONE 6050/60

DAILY RANGE RES 6095 SUP 5977

2 SIGMA RES 6154 SUP 5917

GAP LEVELS 5843/5741/5710 - 5979 (ESM25 CONTRACT GAP)

VIX BULL BEAR ZONE 21

DAILY MARKET CONDITION -ONE TIME FRAMING DOWN - 6073

One-Time Framing Down: This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

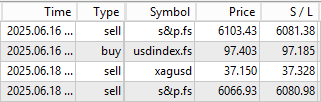

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET 6000/10 > DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: Unchanged

FICC and Equities | 18 June 2025 | 9:01 PM UTC

Market Summary:

- S&P 500: Flat, closing down 3bps at 5,980 with MOC buy orders totaling $3.9B.

- NASDAQ (NDX): Unchanged at 21,719.

- Russell 2000 (R2K): Up 63bps, closing at 2,132.

- Dow Jones (Dow): Down 10bps, ending at 42,171.

- Volume: 16.4B shares traded across all U.S. equity exchanges, slightly below the YTD daily average of 16.7B shares.

Other Markets:

- VIX: Down 6.7%, closing at 20.14.

- Crude Oil: Up 33bps, settling at $75.09.

- U.S. 10-Year Yield: Unchanged at 4.38%.

- Gold: Down 70bps.

- DXY (Dollar Index): Up 4bps to 98.85.

- Bitcoin: Up 47bps, reaching $104,900.

Market Dynamics:

A relatively quiet session with stocks finishing mostly flat ahead of tomorrow's U.S. holiday. The market continues to consolidate, with the NASDAQ remaining steady over the last 10 days, as geopolitical developments remain in focus.

Sector Highlights:

Payments were a key topic today, as COIN surged +16% on news of its new product enabling direct stablecoin payments from consumers to merchants, bypassing traditional card networks. This negatively impacted Visa (V) and Mastercard (MA), both down ~5%, along with smaller declines in COF and AXP. The broader payment ecosystem, including PYPL and others, also experienced pressure.

Hedge Fund Activity:

Hedge fund VIP longs versus most shorts (GSPRHVMS) were down 171bps. Investor frustration is growing as the market struggles to price in current developments.

FOMC Update:

As anticipated, the Federal Open Market Committee (FOMC) kept the target range for the federal funds rate unchanged at 4.25%-4.50% during its June meeting. While noting that uncertainty has "diminished but remains elevated," the Committee made minimal changes to its post-meeting statement.

The Summary of Economic Projections (SEP) showed:

- Two rate cuts expected in 2025 (unchanged from March SEP).

- One additional cut in 2026 (down from two previously).

- A terminal rate of 3.375% in 2027 (up from 3.125%).

- Higher core inflation and unemployment projections for 2025-2027.

- Lower GDP growth forecasts for 2025-2026.

Trading Floor Activity:

Activity levels remained subdued, rated a 4 on a 1-10 scale. The floor finished flat compared to a 30-day average of -75bps. Client activity was muted, with skews benign. Long-only funds (LOs) and hedge funds (HFs) were slight net sellers, primarily in Healthcare, Financials, and Technology due to overlapping supply.

Month-End Outlook:

Pensions are projected to sell ~$20B in U.S. equities as we approach month-end. This estimate ranks in the 90th percentile for absolute dollar value among all buy/sell estimates over the past three years but falls in the 7th percentile on a net basis.

Upcoming Events:

- Sparse calendar on Friday.

- Key reports: Philadelphia Fed Index, ACN, DRI, KMX, and KR (all reporting before market open).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!