SP500 LDN TRADING UPDATE 19/03/25

SP500 LDN TRADING UPDATE 19/03/25

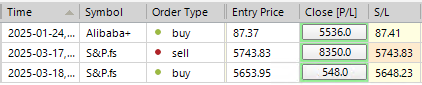

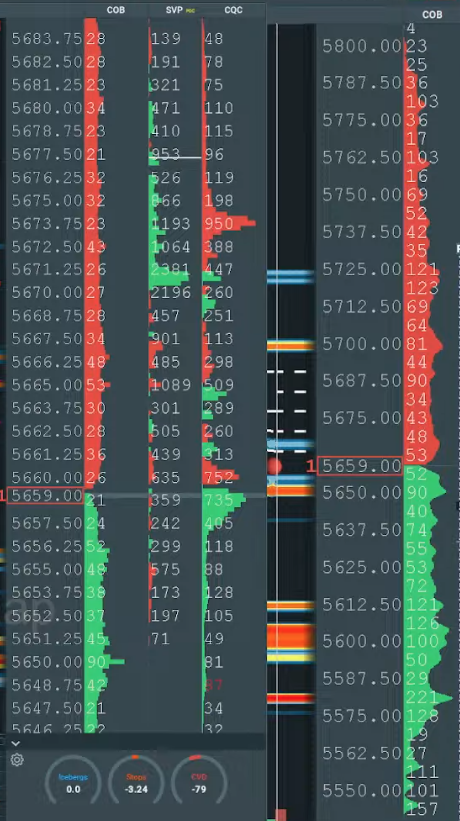

WEEKLY BULL BEAR ZONE 5650/60

WEEKLY RANGE RES 5850 SUP 5550

DAILY BULL BEAR ZONE 5680/90

DAILY RANGE RES 5711 SUP 5627

5640 MARCH CONTRACT GAP

TODAY'S TRADE LEVELS & TARGETS

LONG ABOVE DAILY BB ZONE TARGET DAILY>5733>5760>5786>5809(2SIG)

LONG ON TEST/REJECT OF 5640 DAILY RANGE SUP TARGET DAILY BB ZONE

SHORT BELOW 5600 TARGET WEEKLY RANGE SUP

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MAG7 UNDER PRESSURE

FICC and Equities

Market Performance

- S&P 500: -107 bps, closing at 5,614 with a Market-on-Close (MOC) imbalance of $500M to buy.

- NASDAQ 100 (NDX): -166 bps, ending at 19,483.

- Russell 2000 (R2K): -83 bps, finishing at 2,068.

- Dow Jones: -62 bps, closing at 41,581.

- Volume: 13.5 billion shares traded across U.S. equity exchanges, below the YTD daily average of 15.3 billion.

Volatility and Commodities

- VIX: +5.8%, closing at 21.70.

- Crude Oil: -123 bps, settling at $66.75.

- Gold: +118 bps, reaching $3,041.

- U.S. 10-Year Yield: -1 bp, now at 4.28%.

- Dollar Index (DXY): -12 bps, at 103.25.

- Bitcoin: -2.3%, trading at $81,992.

Market Drivers

The downward move in equities appeared macro-driven, with no clear catalyst but several crosscurrents at play:

- Tariffs remain scheduled for April 2nd.

- Awaiting updates from the Trump-Russia dialogue on Ukraine.

- Rising tensions in the Middle East, particularly Israel/Gaza and Houthis in Yemen.

- Anticipation around Jensen’s keynote.

Notably, the MAG7 underperformed for the second consecutive day, with Tesla (TSLA) down ~11% over two days. This marks the first time in ~30 months that the MAG7 has lagged the NDX by more than 1% on back-to-back sessions. Meanwhile, Chinese tech stocks rallied on repetitive AI model progress headlines, contrasting with U.S. Tech/AI names, which struggled amid similar competition and complexity narratives.

FOMC Preview

The Federal Open Market Committee (FOMC) meeting tomorrow is the main focus. The Fed is expected to reiterate its stance of not rushing further rate cuts, opting to remain cautious amid policy uncertainty under the new administration.

Projections include:

- A 0.3 percentage point (pp) upward revision to 2025 core PCE inflation, now expected at 2.8%.

- A 0.3 pp downgrade to 2025 GDP growth, revised to 1.8%, largely due to tariff concerns.

Our internal forecasts are more aggressive, with a 0.5 pp adjustment in both cases. However, FOMC participants are likely to take a more measured approach until tariff policies become clearer.

Flows and Activity

- Overall Activity: Our activity level registered at a 5 out of 10. The floor closed -325 bps versus the 30-day average of -104 bps.

- Long-Only Funds (LOs): Net sellers by $2B, driven by supply in supercap tech, industrials, and macro products.

- Hedge Funds (HFs): Balanced, ending slightly net sellers (-$300M), primarily in macro products and discretionary sectors.

Derivatives

It was a quiet session in derivatives, with the intraday trading band between 9:45 AM and the close limited to just 30 handles. Volatility and skew compressed further.

- Following this morning’s VIX expiry (settlement at 21.63), clients monetized short-dated downside protection amid the sharp market decline.

- Limited flows were observed, though there was some interest in upside for Micron (MU) and Nike (NKE) ahead of their earnings later this week.

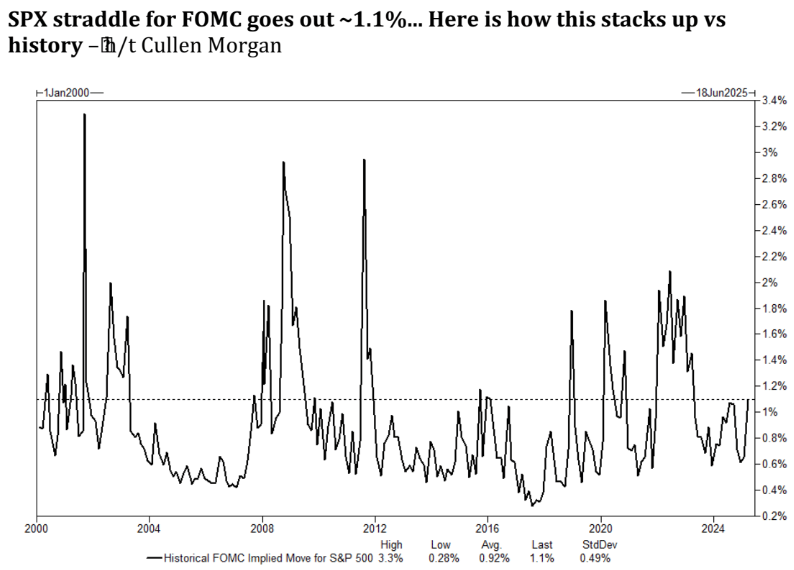

Looking ahead to tomorrow’s FOMC meeting, the SPX straddle is priced at ~1.1%, reflecting moderate expectations for market movement.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!