SP500 LDN TRADING UPDATE 18/6/25

SP500 LDN TRADING UPDATE 18/6/25

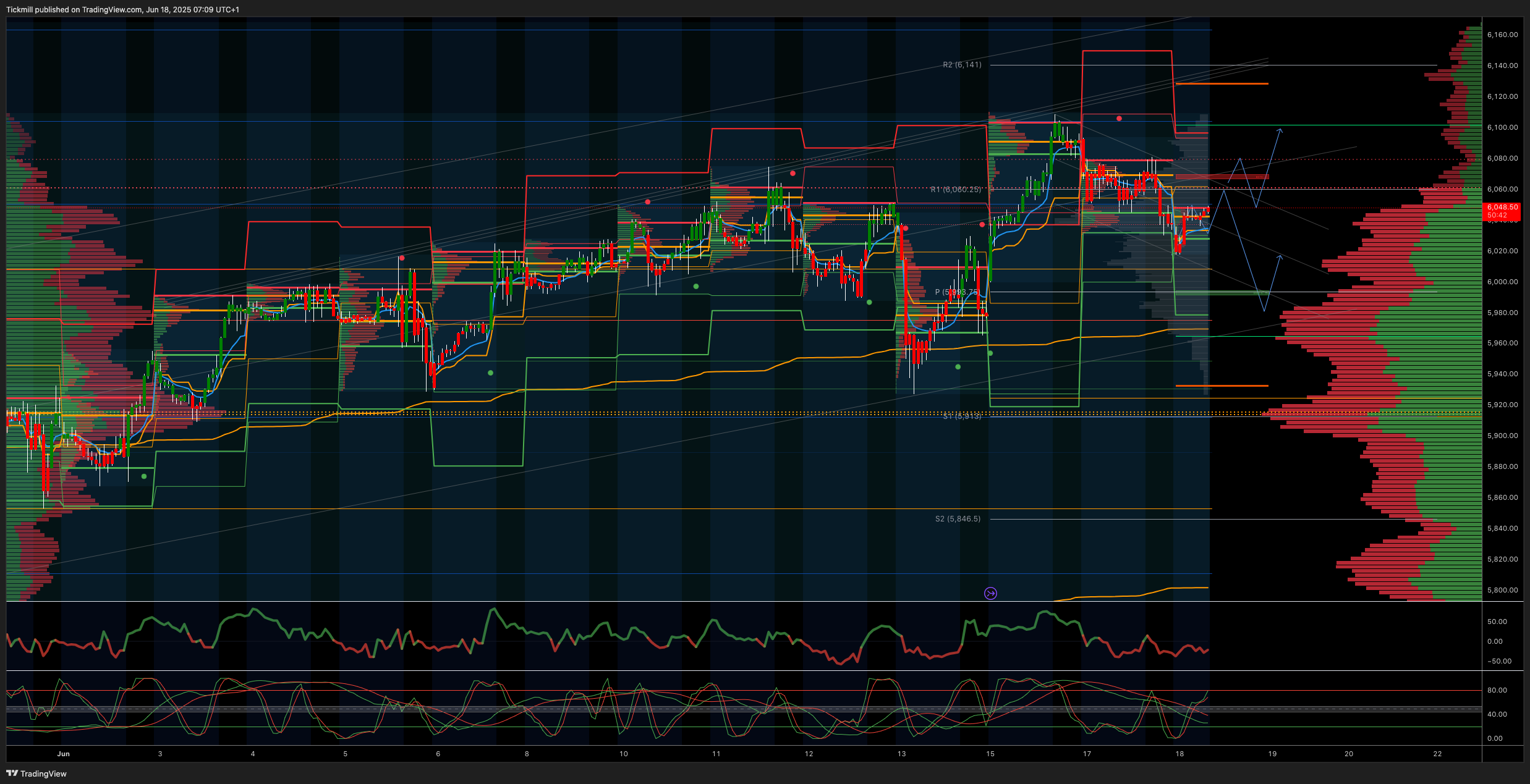

WEEKLY & DAILY LEVELS

***QUOTING SEP CONTRACT FOR JUNE CONTRACT OR CASH US500 EQUIVALENT LEVELS SUBTRACT ~50 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6090/6100

WEEKLY RANGE RES 6150 SUP 5914

DAILY BULL BEAR ZONE 6060/70

DAILY RANGE RES 6097 SUP 5978

2 SIGMA RES 6156 SUP 5918

GAP LEVELS 5843/5741/5710 - 5979 (ESM25 CONTRACT GAP)

VIX BULL BEAR ZONE 23

DAILY MARKET CONDITION – BALANCE – 6109/6030

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts

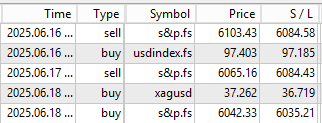

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 6010/00 > DAILY RANGE SUP

LONG ON TEST/REJECT DAILY RANGE SUP TARGET 6000/10 > DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES OVERVIEW: RISK-OFF SENTIMENT

FICC and Equities | 17 June 2025 | 9:11 PM UTC

Market Performance

- S&P 500: -84bps, closing at 5,982 with MOC buy orders totaling $850m.

- NASDAQ 100 (NDX): -100bps, ending at 21,719.

- Russell 2000 (R2K): -108bps, closing at 2,118.

- Dow Jones (Dow): -70bps, settling at 42,215.

- Volume: 16.7 billion shares traded across all U.S. equity exchanges, matching the YTD daily average.

Volatility and Commodities

- VIX: +13%, closing at 21.60.

- Crude Oil: +513bps, reaching $75.54.

- U.S. 10-Year Yield: -5bps, now at 4.38%.

- Gold: -30bps, closing at $3,407.

- DXY (Dollar Index): +84bps, ending at 98.82.

- Bitcoin: +11bps, trading at $104,510.

Key Drivers

U.S. equities broadly declined due to:

1. Heightened geopolitical tensions in the Middle East (Tehran evacuation orders raising fears of U.S. involvement, unresolved G7 discussions).

2. Weak macroeconomic data (disappointing retail sales, industrial production, and NAHB housing survey).

3. Sector-specific pressure:

- Renewables fell 7% as the Senate draft budget phases out solar and wind energy tax credits.

- Gym stocks dropped due to the exclusion of gym memberships from HSA payment eligibility.

- Travel-related stocks (hotels, cruise lines, casinos) weakened on a 4% rise in crude oil prices.

- JBLU fell 8% on a memo citing softer-than-expected travel demand.

FOMC Outlook

The Federal Reserve is expected to deliver the first of three rate cuts in December, followed by two more in 2026, targeting a terminal rate of 3.5%-3.75%. Since the last FOMC meeting:

- Trade tensions have eased.

- Inflation remains subdued.

- Hard economic data show limited signs of softening.

At its June meeting, the FOMC is likely to emphasize a cautious stance, reiterating plans to remain on hold until greater clarity emerges, while downplaying long-term projections given the uncertain economic and policy environment.

Trading Desk Insights

- Activity levels on the floor were rated 4/10.

- Floor performance: -772bps for sale vs. a 30-day average of -44bps.

- Long-Only Funds (LOs): Net sellers of $1b, driven by tech and discretionary supply, with demand in REITs.

- Hedge Funds (HFs): Net sellers of $1.4b, with broad-based supply across all sectors.

Derivatives Market

- Volatility and skew were bid across the board as Middle East tensions rattled markets.

- Clients actively hedged downside risks, with significant buying of VIX call spreads and SPX put spreads.

- Ahead of VIX expiry tomorrow, dealers remain short topside, although much of the short crash risk is expected to roll off, potentially allowing freer market movement.

- Dealers still hold considerable downside gamma through Friday’s expiry.

- The straddle for the remainder of the week priced at ~1.58%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!