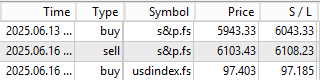

SP500 LDN TRADING UPDATE 17/6/25

SP500 LDN TRADING UPDATE 17/6/25

WEEKLY & DAILY LEVELS

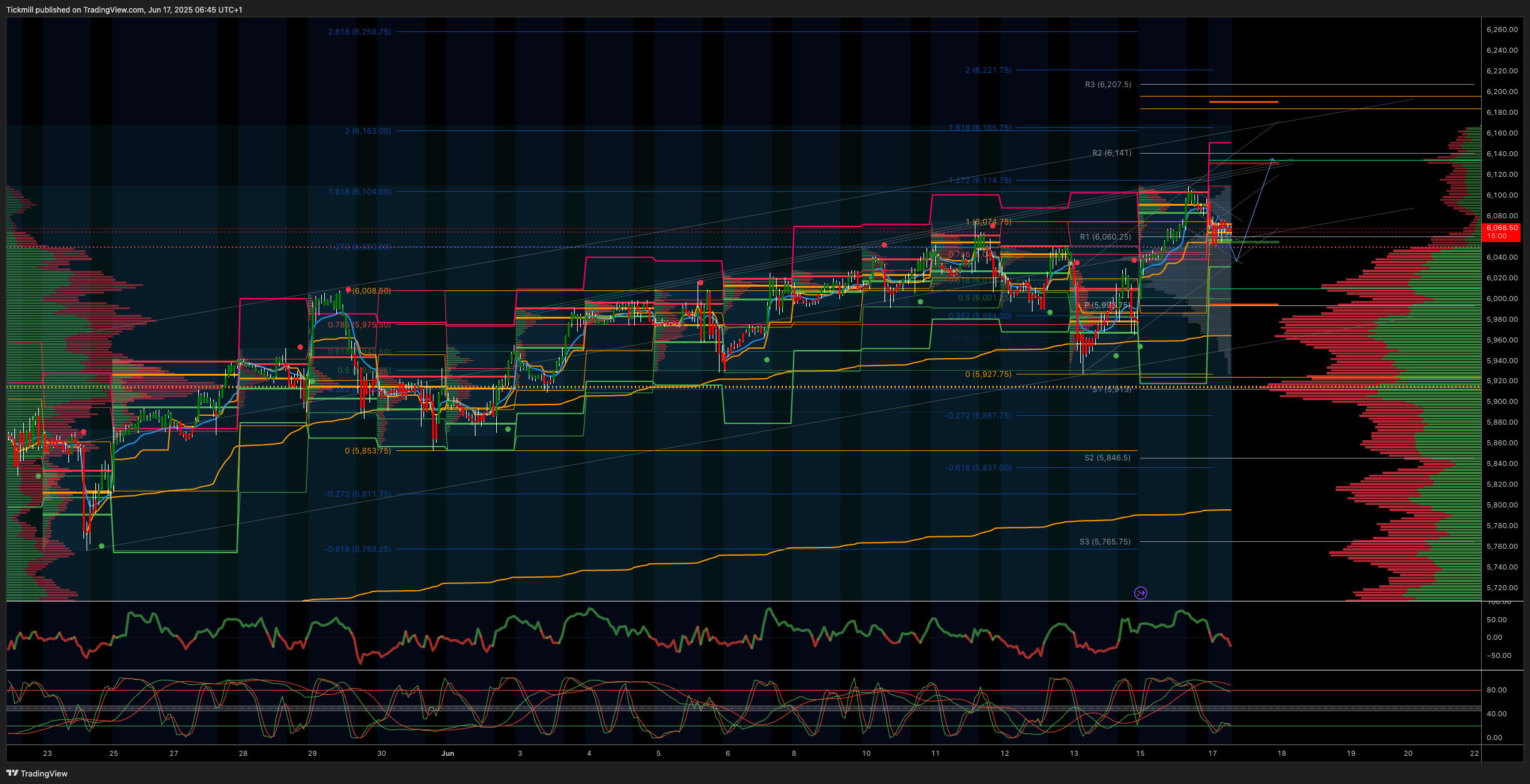

***QUOTING SEP CONTRACT FOR JUNE CONTRACT OR CASH US500 EQUIVALENT LEVELS SUBTRACT ~52 POINTS***

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=JGai0yB4XYE&t=218s

WEEKLY BULL BEAR ZONE 6090/6100

WEEKLY RANGE RES 6150 SUP 5914

DAILY BULL BEAR ZONE 6030/40

DAILY RANGE RES 6151 SUP 6031

2 SIGMA RES 6211 SUP 5971

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 20.25

DAILY MARKET CONDITION -ONE TIME FRAMING UP - 6066

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signalling a strong and consistent upward movement.

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY/WEEKLY RANGE SUP TARGET 6100 > DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET 6100 > DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: ANOTHER MELT-UP

FICC and Equities | 16 June 2025 | 8:37 PM UTC

Indices Performance:

- S&P 500: +94bps, closing at 6,033 with insignificant MOC volumes.

- Nasdaq 100 (NDX): +142bps, closing at 21,937.

- Russell 2000 (R2K): +123bps, closing at 2,144.

- Dow Jones: +75bps, closing at 42,515.

Market Activity:

- Total trading volume: 17.8bn shares across all U.S. equity exchanges (vs. YTD daily avg. of 16.7bn).

- VIX: -821bps, closing at 19.11.

- Crude Oil: -230bps, settling at $71.31.

- U.S. 10-Year Treasury Yield: +5bps, closing at 4.45%.

- Gold: -144bps.

- DXY: Unchanged at 98.16.

- Bitcoin: +369bps, reaching $108,625.

Market Overview:

U.S. equities surged as geopolitical tensions eased, with reports indicating Iran's willingness to de-escalate hostilities with Israel. Market activity slowed as investors entered a news vacuum ahead of the July 4th holiday. Shorts and momentum names saw a notable 2-4% surge.

Floor activity was subdued, scoring a 4 on a 1-10 scale for overall engagement. The floor closed -559bps for sale (30-day avg. +17bps). Skew movements were marginal, with long-only accounts slightly selling and hedge funds ending roughly flat.

Sector Highlights:

- Healthcare: Mixed flows amid biotech crosscurrents:

1. SRPT: -43% following a second patient death over the weekend.

2. KALV: Disclosed delays in its PDUFA timeline.

3. SAGE: Announced acquisition by SUPN.

4. INCY: +5% on mCALR update at EHA.

Corporate Blackout Periods:

Approximately 40% of corporates entered blackout windows today, expected to end around July 25. Blackouts typically begin 4-6 weeks before earnings and end 1-2 days post-earnings.

Upcoming Events:

- G7 Summit, BoJ meeting, and Retail Sales data tomorrow.

- FOMC decision on Wednesday (market whisper suggests a "dovish pause").

- BoE meeting on Thursday.

- U.S. equity and treasury markets will remain closed.

Derivatives Market:

Volatility dropped sharply pre-open as skew softened across the board. This trend persisted throughout the day, with investors largely ignoring Middle East headlines. Notable activity included:

- Unwinds of IWM upside and VIX tail cleanups ahead of Wednesday’s print.

- Approximately 4.5mm June VIX options are set to expire Wednesday morning (~35% of total open interest), with calls significantly outnumbering puts.

- Increased demand for EEM upside calls, as foreign investors have been net buyers of EM equities since April.

Focus for the rest of the week will be on VIX expiry, OPEX, and FOMC. The straddle for the remainder of the shortened week priced at ~1.27%.

SuperCap Tech Sentiment Rankings:

Desk views on investor sentiment and debates within the group (ranked most to least favored):

1. META: Despite tactical debates on OPEX and AI positioning post-Scale AI headlines, limited structural concerns leave room for investor optimism on multiples and EPS growth.

2. NVDA: While not the "max long" it was in 2024, consensus remains strong on EPS visibility and power into 2026, making it the least controversial name in over a year.

3. MSFT: Hedge funds moved quickly to go long, with long-only investors following. Debates center on the sustainability of mid-30%+ y/y Azure growth and its impact on GMs/OMs.

4. AMZN: The focus has shifted from Retail/Tariffs to AWS, now seen as a more critical KPI in the AI race.

5. GOOGL: Tactical bulls expect 2Q upside, but uncertainty around Search trial remedies and Search/GenAI debates could cap gains.

6. AAPL: Investor sentiment remains bearish, with concerns around GM/mix, a potential Services slowdown, Gen

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!