SP500 LDN TRADING UPDATE 16/05/25

SP500 LDN TRADING UPDATE 16/05/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5740/30

WEEKLY RANGE RES 5810 SUP 5550

DAILY BULL BEAR ZONE 5860/50

DAILY RANGE RES 5995 SUP 5873

2 SIGMA RES 6034 SUP 5834

GAP LEVELS 5741/5710

5967 - 2025 OPENING LEVEL

VIX BULL BEAR ZONE 18.50

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 20 POINTS)

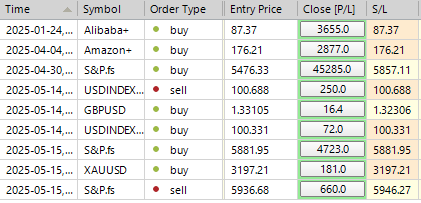

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 2 SIG

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: RE-ROTATION

FICC and Equities | 15 May 2025 |

Market Overview:

- S&P 500: +41bps, closing at 5,916 with $6.5b MOC to BUY

- Nasdaq 100 (NDX): +8bps at 21,335

- Russell 2000 (R2K): +77bps at 2,105

- Dow Jones: +65bps at 42,322

- Volume: 18 billion shares traded across U.S. equity exchanges vs year-to-date daily average of 16.4 billion shares

- VIX: -4% at 17.83

- Crude Oil: -219bps at $61.77

- U.S. 10-Year Yield: -10bps at 4.43%

- Gold: +167bps at $3,241

- Dollar Index (DXY): -23bps at 100.81

- Bitcoin: -9bps at $103,486

Session Highlights:

A quiet session with reversionary price action under the surface. Defensive sectors regained favor, with telcos and stocks like Netflix (NFLX), Visa/Mastercard (V/MA), IBM, Verisign (VRSN), and eBay (EBAY) leading gains. The U.S. 10-Year yield eased by 10bps to 4.43% following weaker-than-expected PPI and retail sales data. Economists revised their Q2 GDP growth tracking estimate down by 20bps to 2.2% (qoq, annualized) and lowered the prior quarter's GDP tracking estimate by 0.1pp to -0.5%.

Crude oil declined after President Trump suggested the U.S. is nearing a nuclear deal with Iran. An Iranian advisor stated on ABC that Iran might abandon nuclear ambitions in exchange for sanctions relief. Late in the session, Meta (META) sold off by -3% following a Wall Street Journal report about delays in rolling out its flagship AI model.

Consumer Sector Developments:

The retail space remains active with notable M&A activity:

- Foot Locker (FL): +85% after acquisition news, marking the second footwear-related deal following Skechers (SKX).

- Starbucks (SBUX): +1% amid reports of exploring options for its China business (Bloomberg).

- Boot Barn (BOOT): +16%, Birkenstock (BIRK): +6% after positive earnings.

- Walmart (WMT): -40bps despite strong earnings; concerns persist over valuation (35X+ multiple) and tariff impacts.

Walmart CFO John David Rainey commented on the challenges posed by trade war dynamics: “The magnitude and speed at which these prices are coming to us is somewhat unprecedented in history. Sales rose steadily last quarter as shoppers sought deals and fast shipping, but the full impact of the trade war on consumers is yet to come.”

Floor Activity:

Activity levels were moderate, scoring a 6 out of 10. The trading floor finished +1% to buy versus the 30-day average of +127bps. Skews were benign, with limited orders (LOs) and hedge funds (HFs) being slight net sellers. LOs were significant sellers in healthcare for the second consecutive session, with UnitedHealth (UNH) dropping -11% after reports of a criminal investigation into Medicare fraud. Hedge funds sold positions in tech, discretionary, and industrials while covering macro products.

Earnings and Post-Market Moves:

- Applied Materials (AMAT): -3% after revenue miss.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!