SP500 LDN TRADING UPDATE 14/03/25

SP500 LDN TRADING UPDATE 14/03/25

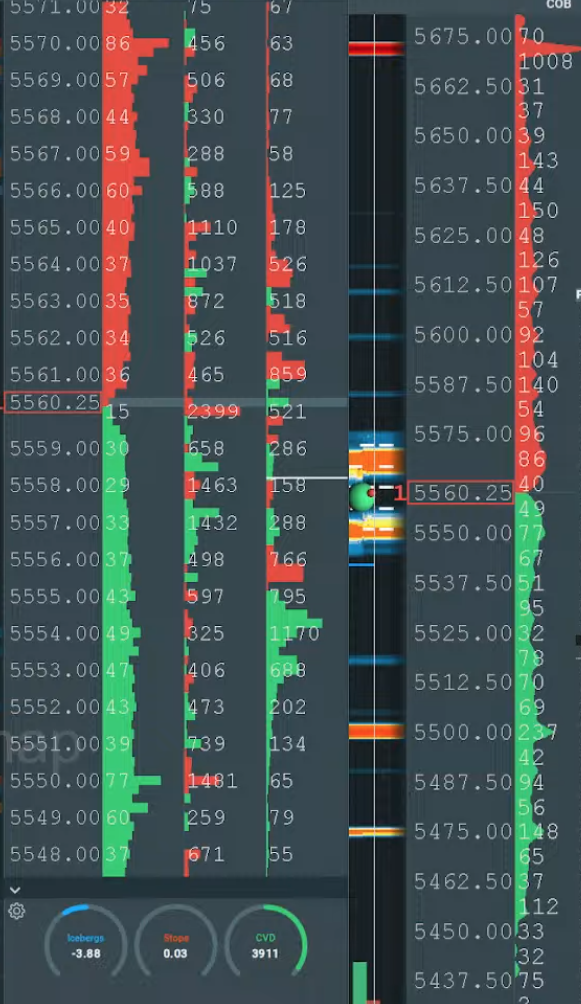

WEEKLY BULL BEAR ZONE 5850/60

WEEKLY RANGE RES 5928 SUP 5624

DAILY BULL BEAR ZONE 5570/80

DAILY RANGE RES 5579 SUP 5495

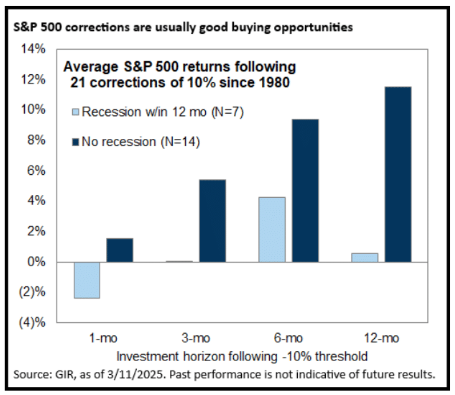

5550 10% COTTECTION FROM ATH’S

WEEKLY ACTION AREA VIDEO

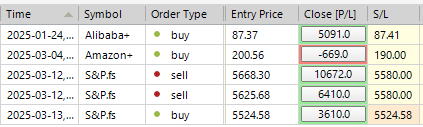

TODAY'S TRADE LEVELS & TARGETS

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET 5610/5670

SHORT ON ACCEPTANCE BELOW 5500 TARGET 5500/5475

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: DEFENSIVE POSTURE

FICC and Equities | 13 March 2025 |

Market Overview:

- S&P 500: -139bps, closing at 5,599, with a MOC imbalance of $155M to BUY.

- NASDAQ 100 (NDX): -189bps, closing at 19,225.

- Russell 2000 (R2K): -156bps, closing at 1,996.

- Dow Jones: -130bps, closing at 40,813.

Trading Volume:

15.2 billion shares traded across all U.S. equity exchanges, slightly below the YTD daily average of 15.4 billion shares.

Volatility and Key Asset Movements:

- VIX: +1.7%, closing at 24.66.

- Crude Oil: -167bps, closing at $66.55.

- U.S. 10-Year Yield: -4bps, now at 4.26%.

- Gold: +151bps, closing at $2,991.

- DXY (Dollar Index): +23bps, at 103.85.

- Bitcoin: +17bps, trading at $80,462.

Sector Performance:

The market adopted a defensive posture today, with strong outperformance in Telecoms and Utilities, while Internet, Software, and other speculative sectors (crypto, momentum, retail longs) saw significant declines.

Sentiment:

Bearish sentiment is widespread. The AAII U.S. Investor Bearish Sentiment hit 59.2%, marking its second-highest reading ever. Investors are speculating whether the current administration is shifting away from pro-growth policies, potentially allowing the economy to dip into a recession to enact changes and claim credit for a recovery ahead of midterms.

Activity Levels:

Monday was the busiest trading day of the year, but activity sharply declined today. Asset managers were net sellers, particularly in ETFs, Industrials, and Discretionary sectors.

- Floor Activity: Rated 5/10 for overall activity levels, finishing at -554bps compared to the 30-day average of -58bps.

- Flows: Long-Only funds (LOs) net sold $2.7B, while Hedge Funds (HFs) net sold $1B. Over the past three weeks, LOs have sold approximately $18B, while HFs have been modest net buyers (+$700M).

Liquidity:

S&P 500 top-of-book liquidity remains at $3M, an extremely low level that could exacerbate market moves in either direction.

After-Hours Updates:

A few SMID-cap earnings prints showed positive results:

- TTAN: +6%.

- RBRK: +11%.

- DOCU: +4%.

Derivatives Market:

The market saw a slow grind lower as selling pressure persisted throughout the day. While volatility has increased, it remains stable compared to the August shock.

- Positioning: Dealers remain flat gamma locally but are slightly longer on the downside. CTAs are short $16B in U.S. equities and are sellers in most scenarios over the next week, albeit not in large size.

- Flows: Clients primarily rolled hedges down and out.

- Trade Ideas: For upside exposure, shorter-dated 1x1.5 and 1x2 call spreads in the S&P are attractive for playing a potential reversal to recent highs. The straddle for tomorrow is priced at 1.15%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!