SP500 LDN TRADING UPDATE 13/6/25

SP500 LDN TRADING UPDATE 13/6/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=soMdGyfVSpE&t=9s

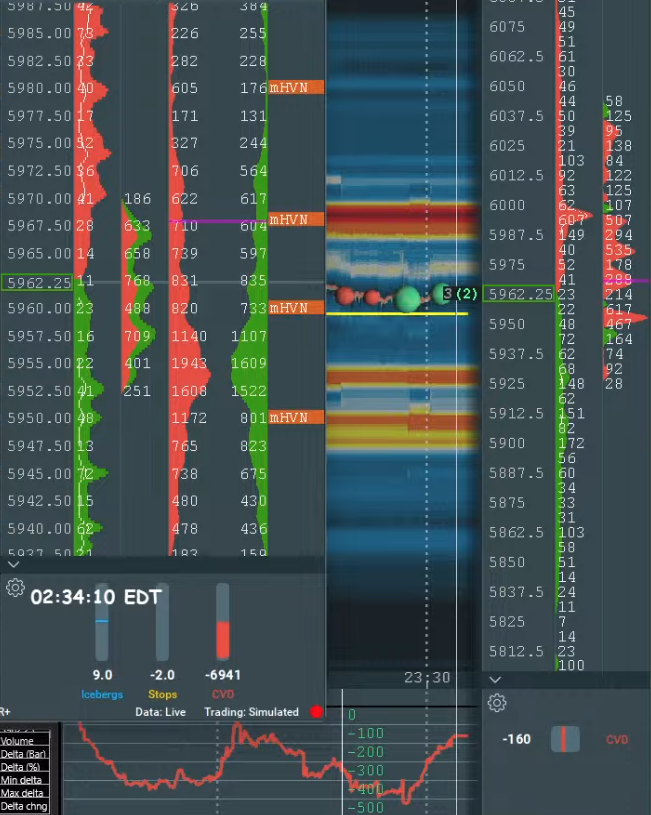

WEEKLY BULL BEAR ZONE 5940/50

WEEKLY RANGE RES 6098 SUP 5914

DAILY BULL BEAR ZONE 5990/6010

DAILY RANGE RES 6108 SUP 5990

2 SIGMA RES 668/ SUP 5930

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 20.25

DAILY MARKET CONDITION -ONE TIME FRAMING DOWN - 6050

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 3 POINTS)

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY RANGE SUP

LONG ON TST REJECT OF WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: HIGHER CLOSE

FICC and Equities | 12 June 2025 | 9:01 PM UTC

Market Performance

- S&P 500: +38bps, closing at 6,045 with MOC flows of $1.7 billion to sell.

- Nasdaq 100 (NDX): +24bps, closing at 21,913.

- Russell 2000 (R2K): -54bps, ending at 2,138.

- Dow Jones (Dow): +24bps, closing at 42,967.

Trading Volume

19.5 billion shares traded across U.S. equity exchanges, above the YTD daily average of 16.6 billion shares.

Volatility & Commodities

- VIX: +440bps, closing at 18.

- Crude Oil: +70bps, ending at $68.67.

- Gold: +189bps, closing at $3,406.

- U.S. 10-Year Yield: -5bps, at 4.36%.

- DXY (Dollar Index): -78bps, at 97.859.

- Bitcoin: -267bps, ending at $105,908.

Key Drivers

1. AI Optimism: Bullish commentary on AI demand from Oracle (ORCL) drove its stock up 13%, benefiting mega-cap tech over non-profitable tech.

2. Retail Participation: Increased retail activity, particularly in sub-dollar volume trades, contributed to market momentum.

3. Softer PPI Data: Lower-than-expected PPI figures supported a more optimistic economic outlook.

GIR highlighted expectations for reduced tariff impacts on GDP, now estimating a 0.25 percentage point smaller peak hit to growth. Based on updated PPI and CPI data, the core PCE price index is estimated to have risen 0.14% in May (vs. prior 0.18% expectations), corresponding to a year-over-year rate of +2.58%.

Currency Focus

The USD touched 3-year lows as investors revisited concerns over:

1. Ongoing trade war tensions.

2. Fiscal imbalances and deficit increases linked to reconciliation bills.

3. Section 899 implications, potentially reducing foreign demand for dollars.

4. Hawkish rhetoric from the Fed's "shadow chair," with speculation of aggressive dovish policies following Trump’s call for a full-point rate cut yesterday.

Floor Activity

Overall activity levels were rated 5/10. The floor closed -147bps vs. a 30-day average of +54bps.

- LOs: Net buyers of $3 billion, with broad demand across nearly every sector.

- HFs: Finished flat, showing supply in discretionary and communication services but demand in healthcare, tech, and macro products.

Post-Bell Earnings

- Adobe (ADBE): Closed flat (~$30 off intraday highs). Slight earnings beat; FY EPS guidance revised upward, with FY DM ARR reiterated.

Derivatives Insights

We continue to highlight July SPX put 1x2s as an attractive trade given the steep skew and compressing ATM volatility. For those wary of unbounded tail risks, consider the July 470-535-600 put fly in SPY for 7 (ref 603.2). This strategy profits on selloffs between 1% and 19% over the next month, with maximum risk limited to the premium paid.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!