SP500 LDN TRADING UPDATE 12/6/25

SP500 LDN TRADING UPDATE 12/6/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=soMdGyfVSpE&t=9s

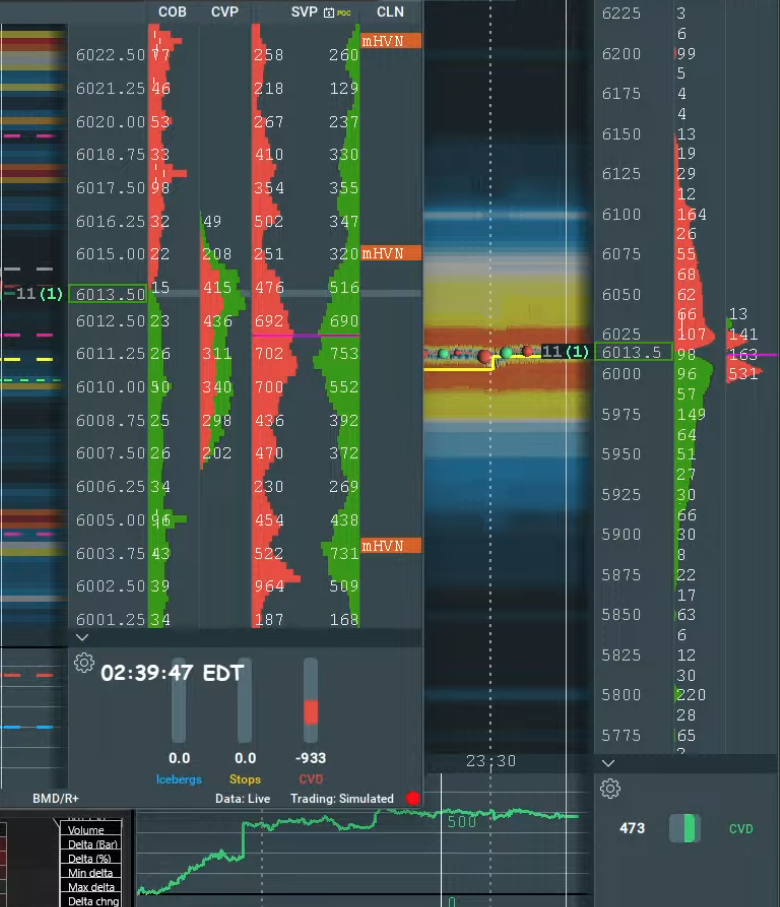

WEEKLY BULL BEAR ZONE 5940/50

WEEKLY RANGE RES 6098 SUP 5914

DAILY BULL BEAR ZONE 6040/50

DAILY RANGE RES 6087 SUP 5968

2 SIGMA RES 6147 SUP 5908

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 18.75

DAILY MARKET CONDITION -ONE TIME FRAMING UP - 6006.25

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 3 POINTS)

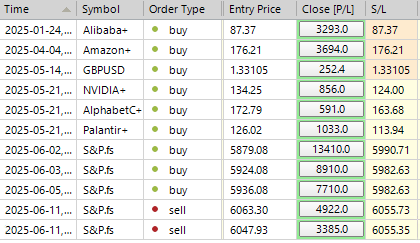

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE THE DAILY BULL BEAR ZONE TARGET DAILY/WEEKLY RANGE RES

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES SUMMARY: SOFT CPI

FICC and Equities | 11 June 2025 | 9:00 PM UTC

Indexes Performance:

- S&P 500: -27bps, closed at 6,022 with MOC $1.4B to SELL.

- Nasdaq 100 (NDX): -37bps, closed at 21,860.

- Russell 2000 (R2K): +47bps, closed at 2,149.

- Dow Jones (Dow): Unchanged at 42,865.

Market Volume & Volatility:

- Total volume: 19.2B shares traded across all U.S. equity exchanges (vs YTD daily avg of 16.6B).

- VIX: +183bps, closed at 17.26.

Commodities and Treasury:

- Crude Oil: +470bps, ended at $68.04.

- U.S. 10-Year Treasury Yield: Unchanged at 4.47%.

- Gold: +19bps, closed at $3,373.

- DXY (Dollar Index): -44bps, ended at 99.66.

- Bitcoin: -97bps, closed at $108,919.

CPI Update:

The CPI report came in softer than expected, with core CPI rising +13bps MoM, bringing the YoY rate to 2.79%. Declines were seen in goods price inflation (e.g., used and new cars), shelter components (lower OER and rent), and travel services (airfares and lodging).

Market Reaction:

Former President Trump commented: "CPI JUST OUT. GREAT NUMBERS! FED SHOULD LOWER ONE FULL POINT. WOULD PAY MUCH LESS INTEREST ON DEBT COMING DUE. SO IMPORTANT!"

The market displayed renewed confidence in economic growth, leading to a beta bounce and continued de-rating of quality stocks. Notably, NVDA underperformed the SOX index on 5 of the last 6 days, largely due to the semiconductor rally being driven by cyclical and China optimism.

Geopolitical Impact:

An intra-day wobble occurred on reports (from a lower-quality source) about the U.S. embassy preparing for evacuation in Iraq. WTI spiked +4% to $68/b. Key geopolitical questions include:

1. What would the influx of Iranian barrels look like if they return to the market?

2. Which geopolitical headlines (e.g., China/U.S.) are more relevant now?

Sector Activity:

Healthcare remained active for Day 3 of the desk’s conference, with strong demand for large-cap pharma and mid-sized biotech companies.

Desk Activity Levels:

- Overall activity level: 5/10.

- Floor performance: -85bps vs 30-day avg of +51bps.

- Long-Only (LO) investors: Net buyers of $1.7B, driven by consumer, healthcare, tech, and industrials.

- Hedge Funds (HFs): Net sellers of -$900M, driven by tech, industrials, and financials.

Post-Bell Highlights:

- Oracle (ORCL): +3% after-hours (was -2% intraday) following a Q4 revenue beat.

Derivatives Market:

- Large SPX downside put spreads were bought for August and September expiries.

- Significant VIX downside purchases were observed.

Following Iran-related headlines, the market sold off, spiking the VIX above 18. Volatility of volatility (vol-of-vol) was highly bid, and short-dated skew steepened aggressively as the market moved lower, reversing the recent flattening trend.

The dealer community remains long gamma, particularly on the downside. The desk favors short skew and long upside volatility, which could perform well even in minor rallies. NDX front-end volatility appears undervalued relative to SPX, with the 1M 25-delta call spread trading at 3-year lows. Fading skew bids may be profitable when paired with a long volatility bias.

The weekly straddle closed at ~0.90%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!