SP500 LDN TRADING UPDATE 11/6/25

SP500 LDN TRADING UPDATE 11/6/25

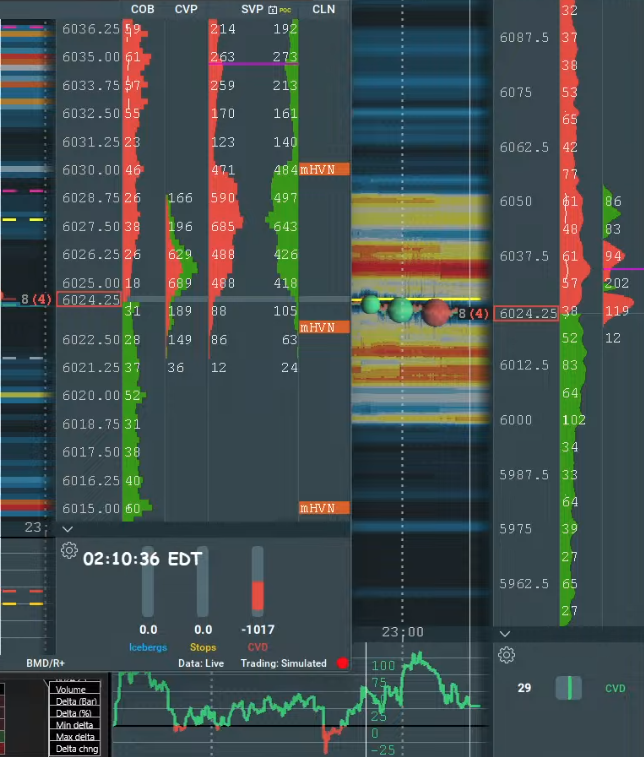

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=soMdGyfVSpE&t=9s

WEEKLY BULL BEAR ZONE 5940/50

WEEKLY RANGE RES 6098 SUP 5914

DAILY BULL BEAR ZONE 6015/05

DAILY RANGE RES 6100 SUP 5980

2 SIGMA RES 6160 SUP 5920

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 18.00

DAILY MARKET CONDITION -ONE TIME FRAMING UP - 6005

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 3 POINTS)

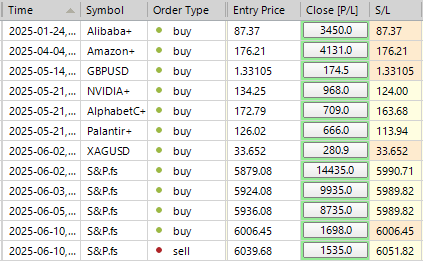

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

Key Focus:

- Persistent squeezy price action with low-quality themes continuing to outperform:

- Small caps > Large caps

- Cyclicals > Defensives

- Laggards > Leaders

- High Beta stocks and 12M Losers (GSCBLMOM) gained +270bps; Most Short Rolling (GSCBMSAL) added +110bps, topping the screens again.

- Sharp midday reversal driven by rising geopolitical tensions, with 10YR yields nearing the 4.5% level—a key focus for investors:

- IRAN BECOMING 'MUCH MORE AGGRESSIVE' IN NUCLEAR TALKS, TRUMP TELLS FOX NEWS (RTRS).

- Healthcare sector faced a particularly challenging day:

- Healthcare Most Short (GSCBMSHC) rose +250bps.

- Flows favored buying in therapeutics, with rotations observed from providers into large-cap pharma due to increasing utilization concerns and easing drug pricing fears.

- Staples sector remained at the bottom of the screens:

- Continued to fall out of favor as the market focuses on beta.

- Guarded Q2 corporate commentary from sell-side conferences contributed to the trend.

- PB data indicates L/S ratios are still hovering near 1-year lows. (H/T Feiler)

Notable Highlights:

- GS TMT Momentum Pair (GSTMTMOM) declined -270bps, continuing its downward trajectory:

- Now down ~750bps over six days, underperforming the NDX by >800bps during this period. (H/T Callahan)

May CPI Preview (Rindels/Walker):

We anticipate a 0.25% increase in May's core CPI, slightly below the consensus of 0.3%. We emphasize four key component-level trends expected in this month's report. Looking ahead, tariffs will likely contribute to a modest rise in monthly inflation, and we project core CPI inflation to be around 0.35% in the coming months.

Our Franchise:

- Our activity level is rated at 4 on a scale of 1 to 10. In terms of flow, we are 220 basis points better for sales, driven by hedge fund supply in Utilities, Materials, and Communication Services.

- Long-only investors are 550 basis points better to buy, focusing on Energy, Utilities, and macro expressions while selling Consumer Staples, Consumer Discretionary, and Materials.

- Hedge funds are 850 basis points better for sales, purchasing Healthcare, REITs, and macro expressions, while selling Utilities, Materials, and Communication Services.

March 7th and March 10th stand out as two of the most challenging back-to-back trading sessions I’ve observed, marked by significant PnL destruction and derisking within a large portion of the hedge fund community. Recent market price action is beginning to show similar underlying tremors. Notably, trading activity on our desk reflects little to no panic.

The risk of a sharp upside move (right tail risk) in this market remains a tangible concern, continuing to act as the "pain trade." US Fundamental Long/Short Nets are at 51, placing them in the 28th percentile on a 1-year lookback and the 23rd percentile on a 5-year lookback. Our Most Short Basket (GSCBMSAL INDEX) has surged higher in 6 of the last 7 sessions, gaining over 13% during this period. Meanwhile, our Power Up America Basket (GSENEPOW INDEX—comprised of names hedge funds have recently repurchased) is down 210bps today. Additionally, our high Beta Momentum Pair (GSPRHIMO) has fallen 350bps.

Why is Momentum/Growth under significant pressure? The better-than-expected Non-Farm Payroll (NFP) data seems to have triggered this, and now there are whispers of a softer CPI print tomorrow. We anticipate May Core CPI at +25bps versus the expected +30bps. If the CPI print does come in softer, expect today’s price action to accelerate: indexes (notably the Russell) moving higher, growth and momentum under more pressure, and shorts continuing to rise. Progress in China trade discussions, combined with stronger economic data, is also contributing to the current market dynamics.

However, our house economic view remains that US economic data will likely deteriorate over the summer, suggesting that this squeeze is temporary. As my colleague Lou Miller aptly put it: “The backdrop is that long themes, short Russell has been a 3-sharpe proposition over the past three months. Some of these trades have over-earned, and a bit of a reset given where gross is positioned is acceptable. Another sharp unwind won’t occur from the long side going down—or better said, if the long side does decline, it will recover quickly. The real risk lies in the short side moving higher, which is exactly what we’re seeing now.”

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!