SP500 LDN TRADING UPDATE 1/12/25

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

WEEKLY BULL BEAR ZONE 6750/40

WEEKLY RANGE RES 6943 SUP 6775

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

The SPX aggregate gamma flip point is at 6720, whereas we're currently close to the relative peak around 6850. This indicates that dealers typically support the price and will act to stabilise it as it fluctuates upward and downward.

DAILY VWAP BULLISH 6782

WEEKLY VWAP BEARISH 6722

MONTHLY VWAP BULLISH 6757

DAILY STRUCTURE – ONE TIME FRAMING LOWER - 6831

WEEKLY STRUCTURE – BALANCE - 6892/6539

MONTHLY STRUCTURE – BALANCE - 6952/6539

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

US stocks are trading moderately higher on Friday, heading toward a notably flat performance for the month despite a ~3.5% gain this week (S&P 500 as of Friday at 12:00 PM). Investors are navigating mixed sentiment regarding the next Federal Reserve rate cut (which now seems likely), the reopening of the federal government, a robust Q3 corporate earnings season, and ongoing analysis of the evolving AI revolution's impact on trading and fundamentals.

### Key Market Drivers:

1. Corporate Earnings: Stable but Strong Results

The Q3 earnings season concluded in November, offering substantial insights but few surprises. Major companies like NVIDIA (NVDA) met high expectations, with accelerating datacenter compute revenue driving optimism (Jim Schneider’s Nov-19 note). Walmart (WMT) showed strength with same-store sales growth of 4.5% and raised FY25 guidance (Kate McShane’s Nov-20 note). Overall, S&P 500 companies demonstrated solid performance, particularly in AI adoption, as highlighted in Ben Snider’s Nov-14 Kickstart review.

2. Federal Reserve Rate Cut: Likely in December

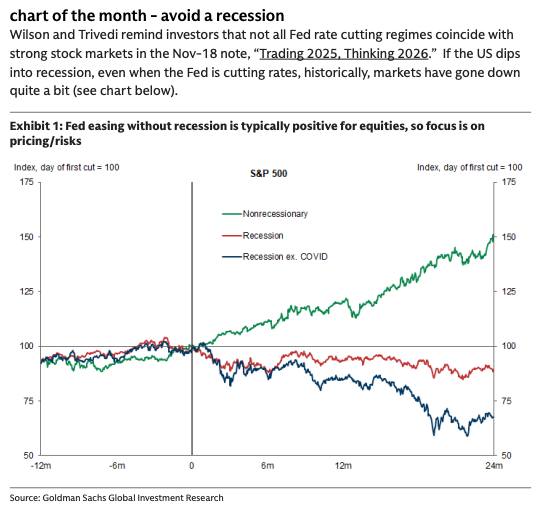

November began with a Fed rate cut, but confidence in another cut wavered mid-month as the government reopened. The S&P 500 dipped to ~6500 amid uncertainty. However, bond markets now suggest an 80%+ probability of a December rate cut, supported by weaker economic indicators like the September Payrolls report (unemployment up to 4.4%) and flagging business sentiment from regional Fed surveys. Jan Hatzius’s latest Global Views note points to a likely 25bp cut at the Dec 9-10 FOMC meeting, with limited data ahead to disrupt this trajectory.

3. AI Trade: Sustained Momentum

AI remains a significant driver of market activity. Hyperscalers continue to ramp up capital expenditures, as discussed in Eric Sheridan’s Nov-20 note. Investor focus is shifting to the scale of AI spending, its return on investment, and the monetization potential of AI applications. Competitive dynamics around foundational AI models are expected to intensify, influencing market sentiment.

### Broader Market Observations:

Mag-7 Transition and Market Concentration

The Mag-7 stocks show mixed performance. While Alphabet (GOOGL) and NVIDIA (NVDA) are up 68% and 32% year-to-date, respectively, others like Apple (AAPL), Meta (META), Amazon (AMZN), Tesla (TSLA), and Microsoft (MSFT) have lagged or merely matched the S&P 500. Notably, GOOGL outperformed NVDA by 25 percentage points in November alone, reflecting heightened scrutiny of competitive dynamics in AI.

Broadening Market Leadership

Market concentration remains high but is broadening beyond traditional tech giants. Large-cap stocks like Broadcom (AVGO, up 72% YTD), Eli Lilly (LLY, up 39% YTD), Walmart (WMT, up 22% YTD), JPMorgan Chase (JPM, up 31% YTD), and Johnson & Johnson (JNJ, up 42% YTD) are taking the lead. This trend highlights the shift from a narrow tech-focused trade to diversified sector dominance in retail, banking, and healthcare. Ben Snider’s Nov-21 Kickstart report emphasizes that the top 10 S&P 500 constituents now account for 41% of market cap—the highest concentration in over 40 years.

AI Investment Phases: Future Opportunities

Ryan Hammond’s Nov-18 note explores the trajectory of AI capital expenditures and identifies emerging beneficiaries of corporate AI adoption. As 2026 approaches, attention may shift to Phase 3 and Phase 4 AI stocks—those leveraging AI to enhance productivity and reduce costs. This transition could gain traction if competitive pressures within the AI space intensify.

Concerns about a potential AI bubble have surged this month, prompting our strategists to weigh in on the debate through a series of notes:

- Diversify: Peter Oppenheimer advises diversifying across sectors and geographies as the AI trade continues to evolve, detailed in “From Concentration to Diversification.”

- Market > Macro: Dominic Wilson and Vickie Chang caution that the $19 trillion market valuation increase since ChatGPT’s debut already aligns with the upper range of AI's expected economic contribution, as outlined in “Some Simple Macro AI-rithmetic.”

- Bubble Watch: Wilson and Chang highlight rising risks of an AI market bubble due to greater reliance on debt financing, a shrinking corporate financial surplus, complex vendor financing structures, and a Federal Reserve cutting rates outside of a recessionary period. These insights are explored in their Nov-9 update, “AI Versus the 1990s—The Path from Macro Boom to Macro Bubble.”

- Rising Risks: The debate over AI investment returns and identifying the right beneficiaries is intensifying, heightening market vulnerability to potential disappointments or event risks, according to Wilson and Kamakshya Trivedi in their Nov-18 note, “Trading 2025, Thinking 2026.”

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpg)