SP500 LDN TRADING UPDATE 11/03/25

SP500 LDN TRADING UPDATE 11/03/25

WEEKLY BULL BEAR ZONE 5850/60

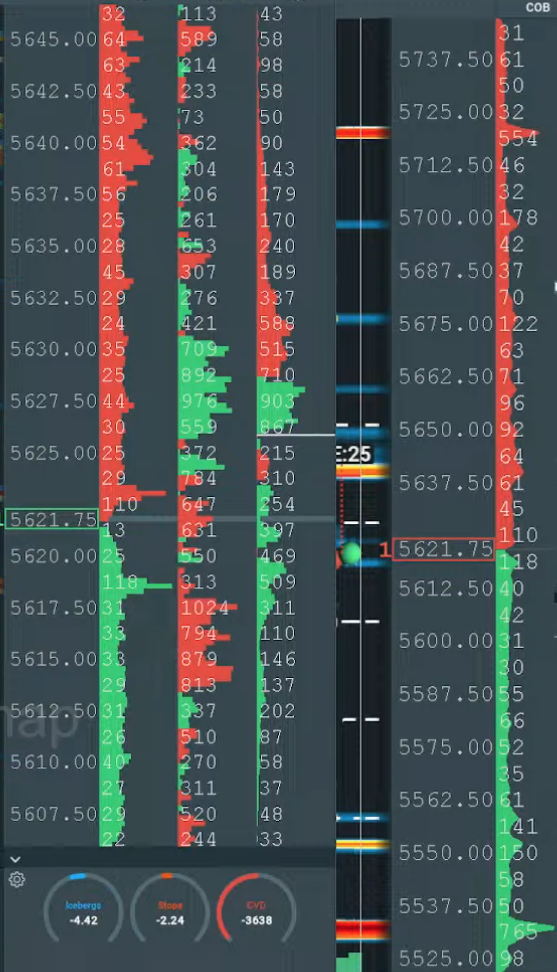

WEEKLY RANGE RES 5928 SUP 5624

DAILY BULL BEAR ZONE 5595/5605

DAILY RANGE RES 5670 SUP 5586

5550 10% COTTECTION FROM ATH’S

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: RISK-OFF

FICC and Equities

10 March 2025 |

Market Performance:

- S&P 500: -270 bps, closing at 5,614 with minimal MOC activity.

- Nasdaq 100 (NDX): -381 bps, closing at 19,430.

- Russell 2000 (R2K): -259 bps, closing at 2,023.

- Dow Jones (Dow): -208 bps, closing at 41,911.

Trading volume surged with 18.9 billion shares exchanged across all U.S. equity markets, significantly above the YTD daily average of 15.3 billion shares.

Volatility & Commodities:

- VIX: +19%, closing at 27.9.

- Crude Oil: -151 bps, settling at $66.03.

- U.S. 10-Year Yield: -8 bps, ending at 4.21%.

- Gold: -50 bps, closing at $2,899.

- DXY (Dollar Index): -9 bps, at 103.93.

- Bitcoin: +10 bps, trading at $79,343.

Market Drivers:

Equities plummeted sharply after President Trump, in a Fox Business interview, declined to rule out a potential recession and downplayed the recent market downturn. He cautioned that his policies would take "a little time" to show economic benefits.

The S&P 500 broke below its 200-day moving average (5730) and entered "oversold" territory, with a 14-day RSI at 29.91. Asset manager cash balances are at an all-time low (1.3% of total AUM), while hedge fund gross exposure remains at all-time highs, creating significant headwinds for market positioning.

Trading Floor Activity:

Activity levels on our floor were rated a 7 out of 10. The floor closed -267 bps versus a 30-day average of -11 bps.

- Long-Only Funds (LOs): Net sellers by $1.5 billion, with notable tactical trims in technology and financials.

- Hedge Funds (HFs): Balanced positioning, with supply in healthcare and discretionary sectors offset by scattered covers in macro products.

A small bounce into the close was constructive but insufficient to signal a recovery, suggesting further caution is warranted.

After the Bell:

- Delta Airlines (DAL): -18% following a negative guidance update ahead of its presentation at a competitor conference tomorrow.

Key Quote:

"The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in domestic demand. Premium, international, and loyalty revenue growth trends remain consistent with expectations, reflecting the resilience of Delta’s diversified revenue base."

Derivatives Market:

U.S. indices faced broad-based declines as momentum unwound sharply. The VIX spiked to an intraday high of 29.56, the highest level since the August 5th spike. Despite the front end of the curve being completely inverted, the front-month VIX futures outperformed the spot move by 1.1 vol. Flow trends included clients unwinding downside protection and selling VIX calls to capitalize on the volatility spike. While implied volatilities have reset higher, options remain relatively expensive further out on the curve. The Friday PM straddle is priced at 2.72%. Given today’s move and upcoming macro events like CPI, this could present an attractive opportunity.

1) Gross Leverage Dynamics: Gross leverage is calculated as Gross Market Value (MV) divided by Equity. While Gross MV has decreased due to degrossing activities, Equity has declined at a faster pace as hedge funds (HFs) experienced losses in profit and loss (PnL) from both long and short positions. As a result, gross leverage has increased.

2) Shorting Activity in Macro Products: Shorting in macro products, including indices and ETFs, accounted for 45% of the overall net selling last week. This marks the 10th consecutive week of net selling, primarily driven by short sales. US-listed ETF shorts rose by 0.7% week-over-week, bringing the month-over-month increase to 7.2%. The shorting activity was concentrated in sector-specific, international, and broad-based equity ETFs.

3) Key Market Observations:

- Liquidity Concerns: Liquidity remains poor, with S&P 500 top-of-book liquidity dropping below $4 million, compared to the 2021 average of $13 million.

- Technical Conditions: Oversold technical conditions suggest potential for a rebound; however, any rallies are likely to be met with selling pressure due to persistent headwinds. These include Washington-related disruptions (tariffs and debt ceiling issues), slowing economic growth, and relatively high valuations.

4) Investment Recommendations: Within the equity market, we continue to recommend a focus on the Health Care sector, which provides defensive characteristics at attractive valuations. Specifically, Large-Cap Pharmaceuticals and Distributors remain our top subsector picks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!