SP500 LDN TRADING UPDATE 10/6/25

SP500 LDN TRADING UPDATE 10/6/25

WEEKLY & DAILY LEVELS

WEEKLY ACTION AREA & PRICE TARGET VIDEO - https://www.youtube.com/watch?v=soMdGyfVSpE&t=9s

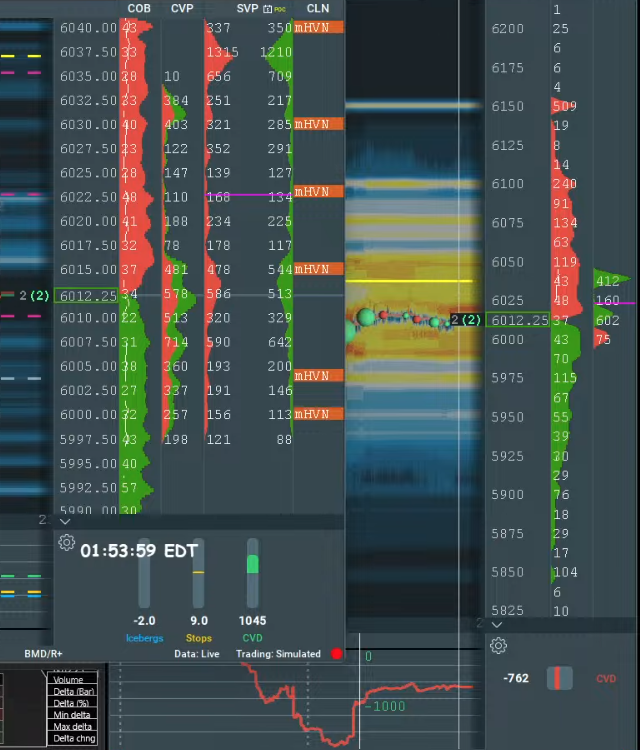

WEEKLY BULL BEAR ZONE 5940/50

WEEKLY RANGE RES 6098 SUP 5914

DAILY BULL BEAR ZONE 5980/90

DAILY RANGE RES 6071 SUP 5952

2 SIGMA RES 6131 SUP 5892

GAP LEVELS 5843/5741/5710

VIX BULL BEAR ZONE 18.50

DAILY MARKET CONDITION -ONE TIME FRAMING UP - 6000

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 1 POINT)

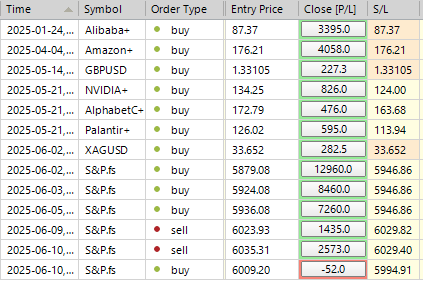

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET SNAPSHOT

FICC and Equities | 9 June 2025 | 9:13 PM UTC

Market Performance:

- S&P 500: +9bps, closing at 6,005 with $4B MOC to BUY.

- NASDAQ 100 (NDX): +17bps, closing at 21,797.

- Russell 2000 (R2K): +70bps, closing at 2,148.

- Dow Jones: Unchanged at 42,761.

Trading Volume & Volatility:

- Total shares traded: 16.5B across U.S. equity exchanges, matching the YTD daily average.

- VIX: +233bps, closing at 17.16.

Key Commodities & Rates:

- Crude Oil: +96bps, closing at $67.11.

- Gold: +25bps, closing at $3,354.

- US 10YR Yield: -3bps, at 4.47%.

- Dollar Index (DXY): -19bps, at 98.99.

- Bitcoin: +52bps, at $109,355.

Market Dynamics:

A rangebound session with slowing leadership under the surface. Notably, the Megacap Tech vs. Non-profitable Tech pair is down for the fifth consecutive day, marking its worst 5-day stretch in over three months (-445bps).

Our Most Rolling Short basket (GSCBMSAL) has surged 16% in the past month, including a +10.8% gain over the last five sessions. This move appears driven by:

1. Resilient macro data (ISM and NFP last week, with CPI due Wednesday).

2. Easing rates backdrop (30YR consolidating below 5%).

3. Hedge fund positioning (June MTD grosses +0.9 to 100th percentile 5-year, nets +1.6 pts to 68th percentile 5-year).

4. Systematic covering (CTAs have net bought ~$30B in U.S. equities over the past month).

Despite these factors, we are not yet in "aggressive squeeze" territory.

Healthcare Conference Highlights:

Today marked the start of our 46th Annual Healthcare Conference (June 9-11). Desk flows were notably elevated, with strong demand from the hedge fund community. Healthcare skew ranked in the 88th percentile on a 52-week lookback. Key standouts included PFE, SMMT, and MTSR. Sentiment in Biotech shows more positive undertones compared to one month ago.

Desk Activity Summary:

- Overall activity level: 6/10.

- Desk finished +6% to buy vs. a 30-day average of +26bps.

- Long-only funds (LOs): $5B net buyers, with broad demand across Tech, Discretionary, Services, Financials, and Healthcare.

- Hedge funds (HFs): Slight net sellers, with demand in Healthcare and Materials offset by supply in macro products and Financials.

Derivatives Market Update:

The market rallied in anticipation of the U.S.-China trade meetings on Monday. Volatility (vol) was choppy, and skew flattened slightly amid the rally. Flows were muted at the start of the week, with notable activity including:

- Significant upside buying in GLD.

- Short-dated VIX downside purchased ahead of next week's expiry.

- Increased interest in retail upside as investors hedge against potential short squeezes.

Key Focus for the Week:

- U.S.-China trade meetings on Monday.

- CPI data release on Wednesday.

- The straddle for the remainder of the week closed at ~1.30%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!