SP500 LDN TRADING UPDATE 10/03/25

SP500 LDN TRADING UPDATE 10/03/25

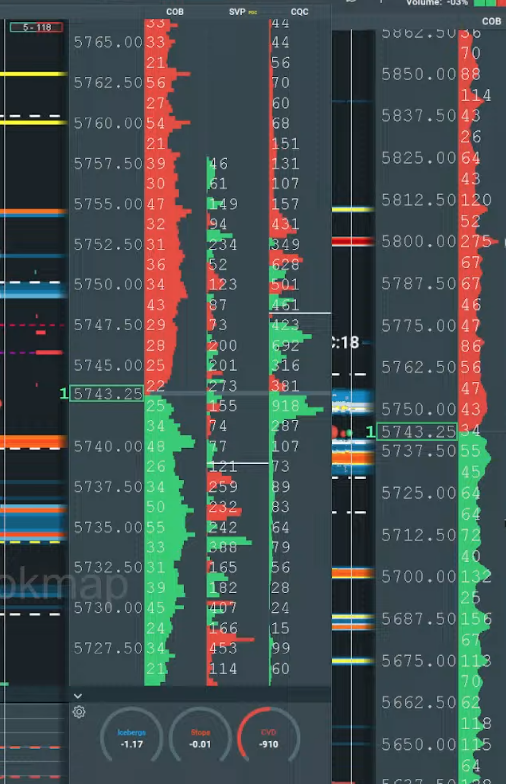

WEEKLY BULL BEAR ZONE 5850/60

WEEKLY RANGE RES 5928 SUP 5624

DAILY BULL BEAR ZONE 5730/20

DAILY RANGE RES 5813 SUP 5729

EQUALITY TARGET AGAINST 6000 SWING HIGH 5680

5680 MONTHLY PROJECTED RANGE SUPPORT

5550 10% COTTECTION FROM ATH’S

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

COLOUR OF U.S. EQUITIES: ON THE WEEK...

Equities and FICC | March 7, 2025

Another gruelling week as MKT struggles with a mountain of issues (see the top 10 below). Momentum Longs (GSCBHMOM) - 9%, RTY - 3.9%, NDX - 3.7%, and SPX - 3.1% (Equal Weight 2%). Although "pain" was felt most anecdotally on our desk, the long/short unwind grew significantly worse yesterday through today (there are undoubtedly worse things out there beneath the surface). From the standpoint of flow, asset managers began rotating into defensives (insurers, telcos, and staples) late in the week after gradually lowering risk in relative underperformers. In line with last week's action, HFs closed with +$1.5b net buys and LOs finished with -$5b net sellers.

Tech, finance, and discretionary have the largest sell skews, while communications services have the largest buy skews.

Most relevant:

1) Growth Issues (poor confidence indicators are followed by payrolls and ISM manufacturing)

2) Thematic re-pricing in AI amplifies Tariff Fatigue

3) Global Complexity (China rising on JD, BABA QwQ 32B AI Model, and Ger & Fra Yields breaking out)

Technicals Weak (SPX flirting with 200dma 5732, offset by bellwethers for specific stocks and the majority of key indices reaching technically "oversold" levels)

Systematic Supply (CTAs sold over $30 billion worth of SPX and nearly $60 billion worth of US equity delta in the last week)

6) Positioning Elevated (HF Gross Leverage increased by 1.1 points this week, placing it in the 100th percentile compared to the previous year; nets stayed relatively level, placing them in the 47th percentile).

7) Liquidity is struggling and hitting new lows.

8) Reduction of LO Risk (seen in relative outperformers like HCare, Utilities, and Semi)

9) Consumer problems (consider cruise lines, ANF, FL, ROST, VSCO, etc.)

10) Poor Seasonality (the bounce is scheduled on March 14)

Next Week: The S&P is expected to to see a +/- 3% through 3/14. The week's major focus is still on tariff headlines and the sell-side conference season, which is primarily focused on HC, Consumer, and Industrials. The major macro event is the CPI on Wednesday, and the FOMC is under a blackout period before its meeting on March 18–19. On the micro front, earnings are mostly behind us (for example, ORCL Mon + ADBE Wed and a few late reporting consumer names).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!