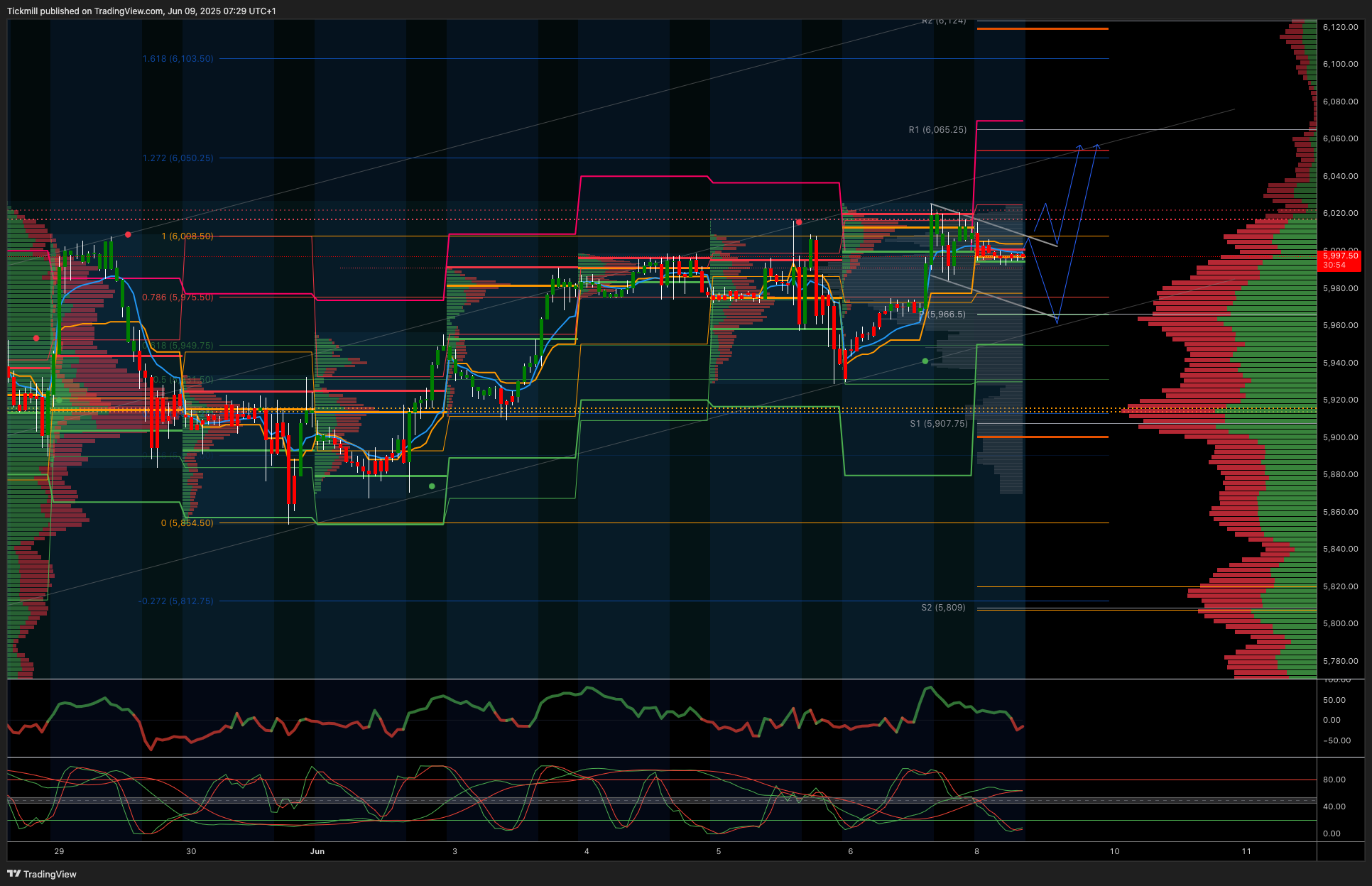

SP500 LDN TRADING UPDATE 09/06/25

SP500 LDN TRADING UPDATE 09/06/25

WEEKLY BULL BEAR ZONE 5940/50

WEEKLY RANGE RES 6098 SUP 5914

DAILY VWAP BULLISH 5971

WEEKLY VWAP BULLISH 5878

DAILY ONE TIME FRAMING UP 5984

WEEKLY ONE TIME FRAMING UP 5870

MONTHLY ONE TIME FRAMING UP

GAP LEVELS 5843/5741/5710/5339

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement..

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: Week of June 6, 2025

Market Overview:

The S&P 500 gained approximately 1.5% this week, now just 144 points away from its all-time high (ATH) set on February 19. Investors processed mixed economic data, including stronger-than-expected non-farm payrolls for May (+139k) and softer ISM Manufacturing and Services surveys, which collectively suggest a reasonably resilient U.S. economy.

Desk Flows:

- Long-Only Funds (LOs): Net sellers of $3 billion this week.

- Hedge Funds (HFs): Flat overall, with notable underperformance in the GS HF VIP basket (-8% vs. GS Most Short basket), marking the 7th worst week in the past five years.

- Sector Skews:

- Largest Sell Skews: Industrials and Consumer Discretionary.

- Largest Buy Skews: Large-cap biotech (positive momentum in commercial launches), Communication Services, and supercap tech.

Prime Brokerage Activity:

Hedge funds net bought U.S. equities for the fifth consecutive week, driven by long buys in single stocks and some short covering in macro products. U.S. L/S gross leverage experienced its largest weekly decline since early April, falling to 210.6% (92nd percentile, 1-year). Meanwhile, net leverage increased for the fourth straight week to 51.2% (28th percentile, 1-year).

Looking Ahead:

- The S&P 500 implied move through next Friday (June 13) is 1.45%.

- Key Events:

- Conferences: GS Healthcare Conference (Mon–Wed), plus investor days for AON (Mon), CGNX, FTV, DE, AAON (Tues), DV (Wed), and ESTA, ADP, BLK, CAH (Thurs).

- Macro Highlight: CPI data release on Wednesday (Fed remains in blackout ahead of the June 18 meeting).

Derivatives Market:

Volatility declined across the board following a strong NFP report. The market rallied sharply in the morning, with skew flattening further.

- Client Activity:

- Short-dated downside hedges in financials and semiconductors were popular.

- SPX put spread buying extended into July, reflecting concerns around the tariff pause deadline.

- Increased interest in FXI and KWEB upside after the announcement of a U.S.-China trade meeting on Monday.

- VIX: Dropped to its lowest level since February (16 handle). VIX call spreads out to July remain attractive as hedges ahead of the July 9 deadline.

Sector Highlights:

Technology:

- The Nasdaq 100 (NDX) rose 2% this week, now up ~30% from its lows and nearing ATHs.

- Positive drivers included AI-related earnings beats (e.g., CRDO, AVGO) and improved sentiment as the VIX closed below 17 for the first time since mid-February.

- Best Performers: Most Short baskets (+10%) and TMT 12-month laggards (+7%) as investors scrambled to keep pace.

- Focus Stocks: MDB (limited follow-through), AVGO (AI outlook feedback), GOOGL/AAPL/AMZN (lagging peers), and cyclical semis (ON, MU posted significant weekly gains).

Healthcare:

- A shift in sentiment for small/mid-cap biotech, driven by M&A activity (e.g., BNTX-BMY, SNY acquisition, MLTX reports), clinical updates at scientific conferences, and accommodative FDA posturing.

- Notable Volatility: VERA surged +67% on positive clinical data Monday but fell -28% Friday on competitive developments.

- Upcoming Focus: GS Healthcare Conference next week, where end-market updates and policy uncertainty will dominate discussions ahead of quarter-end.

Financials:

- Fed Vice Chair Michelle Bowman outlined a pro-deregulatory stance in her first speech, focusing on:

1. Near-term SLR reform (in line with expectations, enabling greater bank participation in Treasury markets).

2. A July conference to address GSIB surcharge and capital requirements (potentially lowering bank capital requirements).

3. Tailoring regulations to exempt smaller banks from stricter rules.

4. Supportive comments on bank M&A, including reforms to regulatory ratings and processing delays.

Consumer:

- Cooling sentiment as major staples companies flagged continued consumption challenges impacting Q2 top-line growth, alongside higher promotional activity (e.g., LULU, PVH).

- Dollar stores reported the highest trade-down activity in four years.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!