SP500 LDN TRADING UPDATE 08/05/25

SP500 LDN TRADING UPDATE 08/05/25

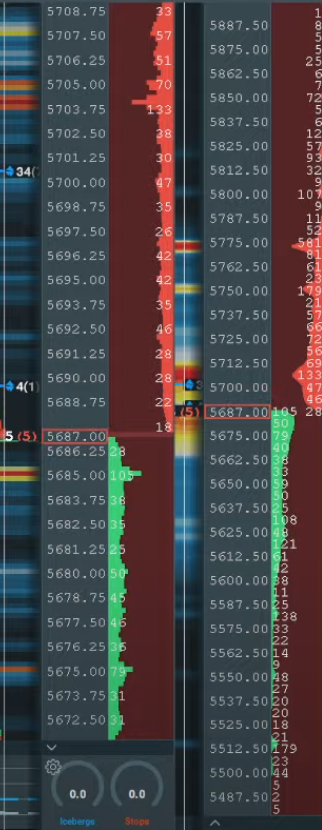

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5630/40

WEEKLY RANGE RES 5840 SUP 5580

DAILY BULL BEAR ZONE 5630/20

DAILY RANGE RES 5705 SUP 5585

2 SIGMA RES 5931 SUP 5359

5339 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS SUBTRACT CIRCA 25 POINTS)

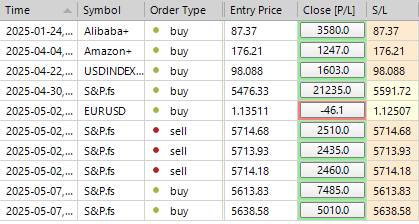

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 5721>5739>WEEKLY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: STALEMATE

FICC and Equities | 7 May 2025 |

Market Performance:

- S&P 500: +43bps, closing at 5,631, with MOC flows of -$2.6B to SELL (first negative MOC since April 17).

- Nasdaq 100 (NDX): +39bps, closing at 19,867.

- Russell 2000 (R2K): +32bps, closing at 1,995.

- Dow Jones: +70bps, closing at 41,113.

Trading Volume:

15.7 billion shares traded across U.S. equity exchanges, below the YTD daily average of 16.4 billion.

Other Markets:

- VIX: -489bps, closing at 23.55.

- Crude Oil: -173bps, closing at $58.07.

- U.S. 10-Year Yield: -2bps, at 4.27%.

- Gold: +90bps, closing at $3,391.

- DXY (Dollar Index): +60bps, closing at 99.82.

- Bitcoin: +32bps, closing at $97,100.

Market Sentiment:

Equities experienced listless price action amidst a tug-of-war on mixed headlines.

- Tech: Selling pressure led by GOOG/L (-7.5%) as Apple explores AI alternatives to Google search, combined with weak performance on AI-related prints (**ANET, ALAB, VST, SMCI**).

- Healthcare: Continued policy/regulatory uncertainty hit crowded longs, while some under-owned names rallied on earnings (**ELAN, CRL, OSCR, LIVN**).

- Media: Positive momentum from DIS (+10%) on strong results and guidance.

- Travel & Leisure: Gains in Hotels/Leisure and Travel sectors, supported by lower crude prices.

- Semiconductors: Late-day strength following headlines on chip policy changes.

Key Headline:

TRUMP TO RESCIND GLOBAL CHIP CURBS AMID AI RESTRICTIONS DEBATE

The Trump administration plans to repeal the AI diffusion rule set to take effect on May 15, replacing it with a new policy aimed at strengthening chip export controls. This marks a significant shift from President Biden's tiered chip export regulations.

FOMC Update:

As expected, the Federal Reserve left the target range for federal funds unchanged at 4.25-4.50%. The statement highlighted increased uncertainty in the economic outlook, citing rising risks of higher unemployment and inflation. Despite this, recent economic indicators have shown solid expansion, albeit with volatility in net exports.

Desk Activity:

Floor activity was subdued, scoring a 4/10 in terms of overall engagement. The floor finished flat versus the 30-day average of -93bps.

- Long-Only (LO) Funds: Net sellers (-$1B), with supply concentrated in Healthcare, Communication Services, Consumer Discretionary, and Technology.

- Hedge Funds (HFs): Balanced flows, with tech supply offset by covers in Healthcare.

Earnings Highlights Post-Close:

- APP: +10%, driven by stronger-than-expected ad revenues and a significant EBITDA beat. Q2 guidance for ad revenue, EBITDA, and margins exceeded expectations.

- SWKS: +5%, solid Q2 results with upbeat guidance for Q3 revenue and EPS.

- ARM: -6%, weak guidance for Q1 revenue and EPS.

- FTNT: -6%, reiterated FY billings and services guidance.

- ZG: -1%, Q1 revenue slightly better, but Q2 revenue and EBITDA guidance fell short.

Derivatives Activity:

Volumes were lighter ahead of the FOMC decision. Markets remained choppy following Powell’s "wait-and-see" approach.

- China Exposure: Modest upside buying in the morning.

- Volatility: Large VIX call buyer observed.

- Russell 2000 (IWM): High short interest (5-year peak) makes it a strong candidate for a short squeeze if momentum builds.

- QQQ Volatility: Screens as cheap relative to the S&P, particularly in short-dated options, where spreads are below the 5th percentile on a 3-year lookback.

- Strategy: Favor downside plays, aiming for a spot down/volatility up dynamic. The straddle for the rest of the week is priced at ~1.35%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!