Precious Metals Mondays 08-08-19

It's that time of the week and we're back with our latest installment of Precious Metals Mondays 08-08-19, a look into how the metals market has developed over the past 7 days.

Gold

It's very interesting time for gold traders at the moment, with the yellow metal breaking out to fresh highs this week. Gold is now trading at its highest level since early 2013 as a combination of factors continue to drive prices higher.

Last week’s FOMC meeting provided the first lift for gold. While the Fed went ahead with a .25% rate cut as expected, USD was seen sharply higher in the wake of the decision as the Fed downplayed the likelihood of further easing. In comments made during the press conference following the meeting, Fed chairman Powell said that the bank viewed the cut as a “mid cycle adjustment” and not as the start of a lengthy easing cycle. The market has been expecting a much more dovish tone that, and a clearer signalling that further rate cuts were due.

Following the FOMC meeting, gold prices then received further support from the shock announcement of fresh US tariffs on Chinese goods. President Trump took the market by surprise when he tweeted last week:

...during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%...

— Donald J. Trump (@realDonaldTrump) August 1, 2019

The announcement came on the back end of two days of trade talks between US and Chinese negotiators. These were the first talks since negotiations broke down in May and although further talks are scheduled in September. The news of fresh tariffs (along with the potential for Chinese retaliation) has raised serious doubts once again over the prospect of the two countries delivering a deal. While Trump labelled the talks “constructive”, this seem at odds with his latest batch of tariffs and certainly will not be taken kindly by China.

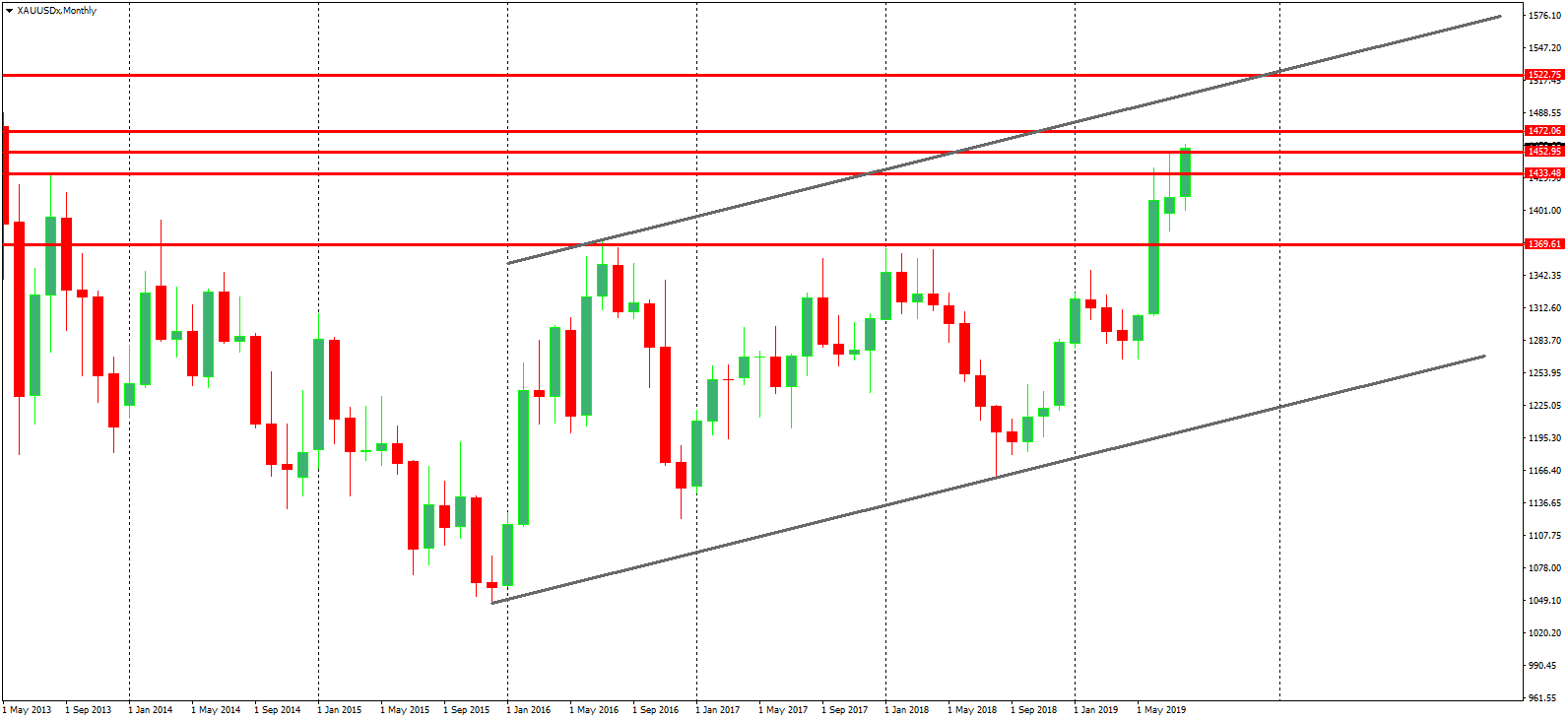

Technical Perspective

Gold prices have broken higher once again this week with price now trading above the 1452.95 resistance. While above here, focus remains on further upside. To the topside, the next key levels to watch are 1472.06 and above there, 1522.75 which is a major, long term level. 1522.75 has yet to be retested since it broke in 2013. Coming in around that level also, we have the top of the bullish channel running from the 2015 lows.

Silver

Silver prices have been higher this week also, though have yet to break out to the same extent as gold, given the heavy move lower in equities. Due to silver’s frequent industrial usage, it is often impacted by extreme moves in equities, particularly the Dow Jones which has been cratering lower this week. Indeed, there is potential for further losses in equities given the risk of Chinese retaliation. Already today we have seen USDCNH breaking above the 7 level for the first since the GFC, if China reacts with its own tariff increase (or indeed, other measures) this could fuel much lower moves in equities and higher safe haven inflows.

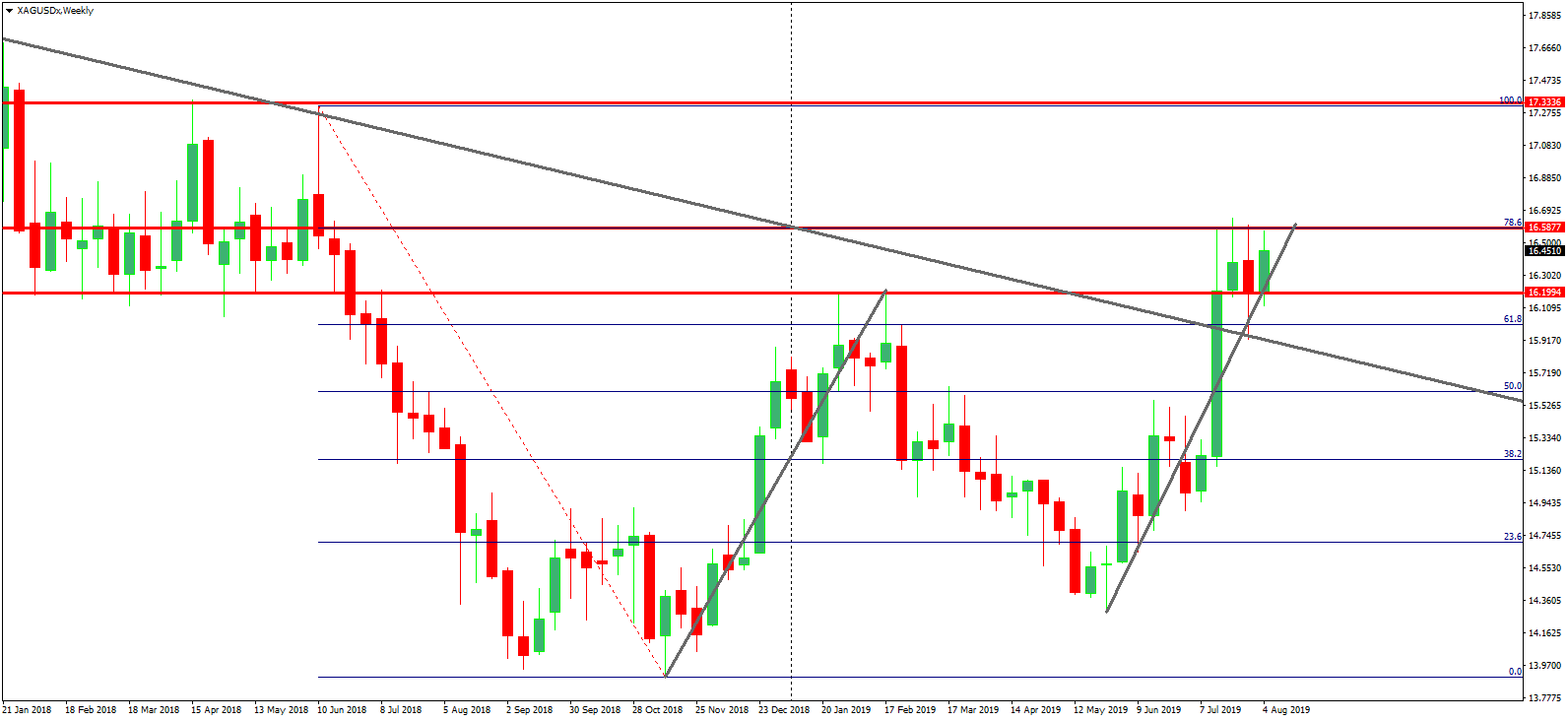

Technical Perspective

For now, silver prices remain hemmed in against the 16.5877 which holds the completion of a large, ABCD symmetry pattern into the 78.6% retracement from mid 2018 highs. Price has been capped by the level now for the last four weeks. While above the 16.1994 level focus remains on further upside. If price can break above the current highs, the next level to watch will be the 17.3336 region (mid 20218 highs).

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.