Pound Slips On Weak UK Data & Strong Dollar

Pound Slips on Weak UK Data

The British Pound has come under fresh selling pressure on Friday as a combination of a stronger US Dollar and weak UK economic data hit sentiment. On the data front, UK retail sales were seen plunging 1.2% last month, down sharply from the 2.9% increase seen the month before and well below the -0.6% reading the market was looking for. Additionally, public sector net borrowing was seen above forecasts at £13.6 billion vs £10.8 billion expected. The data marks a shift in tone for GBP on the back of recent strength in GDP and labour market readings and stickiness in CPI. While the data isn’t likely to bring easing expectations forward, it should certainly stop them from being pushed further out.

USD Rallying on Trump

On the US side of the coin, a resurgence in USD through the middle of the week has also added to bearish pressure in GBPUSD. With traders’ perceived likelihood of a second Trump presidency growing in the wake of his assassination attempt and rising fears over the health of President Biden, USD has seen renewed safe-haven demand this week. Indeed, USD has found fresh buying interest despite growing expectations that the Fed will press ahead with easing in September, on the back of dovish comments from Fed chairman Powell. Near-term, while USD remains bid GBP has room to pull back further.

Technical Views

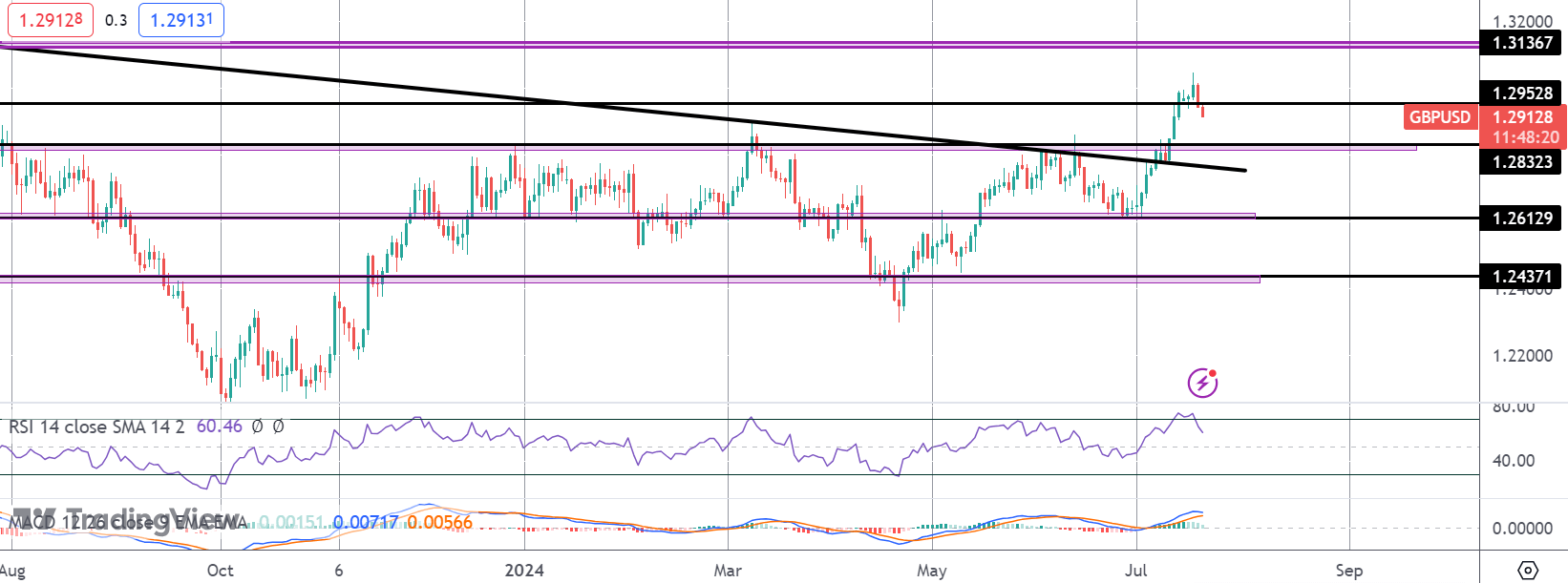

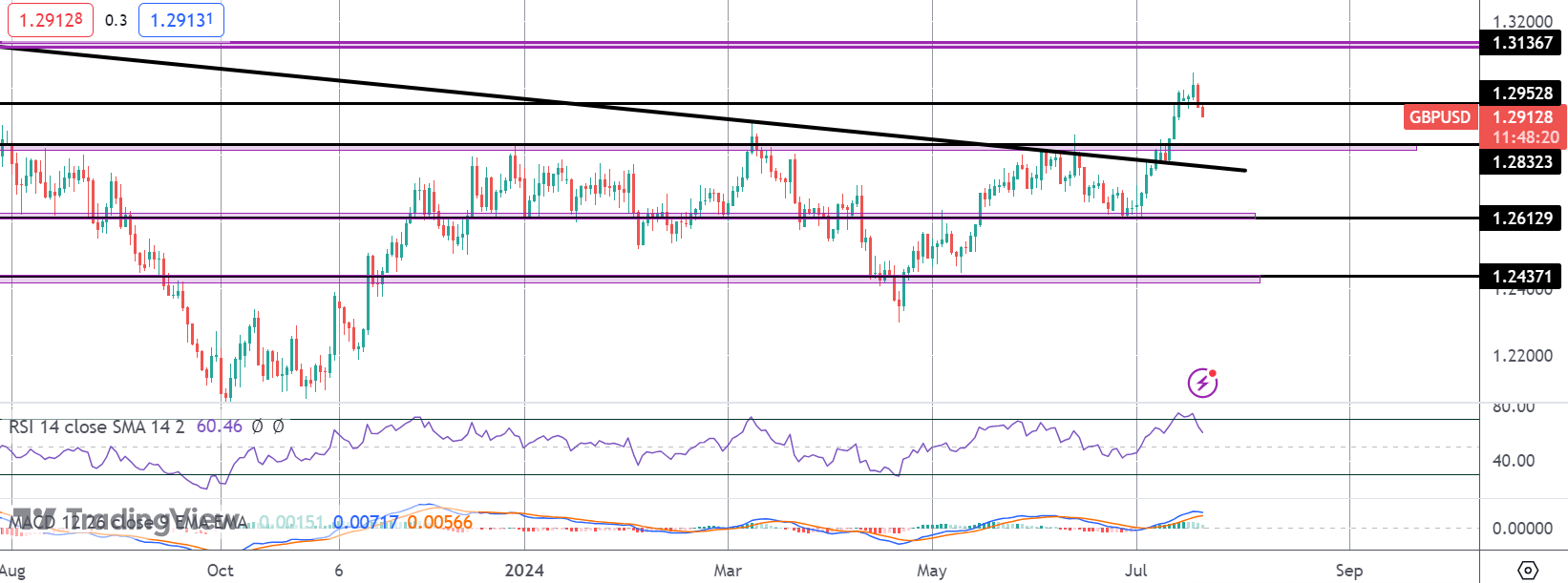

GBPUSD

The breakout in GBPUSD above the 1.2832 level has stalled for now above 1.2952 with price since reversing back below the level. The retest of the 1.2832 area and the broken bear trend line will now be key for the market. Bulls need to defend this area to maintain the bullish outlook. Back below, 1.2612 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.