OECD Bearish on UK Growth

The latest report from the OECD yesterday has cast further dark clouds over the UK economy. The group warned that the UK, the fifth largest global economy as of last year, is facing a unique downturn which other economies in the G7 are not facing. Indeed, in a table of 22 world economies, the UK is among only three economies looking at negative growth next year, alongside Russia and Germany. While the global economy as a whole is forecast to grow 2.2% next year, largely propped up by rebounding growth in emerging markets economies, the UK economy is forecast to shrink by 0.4%.

UK Inflation Woes

One of the key drivers behind the harsher economic outlook for the UK is inflation. While we have started to see inflation moderating in the US and Eurozone for example, UK inflation was seen soaring to fresh multi-decade highs last month at 11.1%, a full 1% jump on the prior month’s reading. With inflation looking likely to remain entrenched at higher levels well into next year, the impact on growth will be significant. The OECD now forecasts UK inflation to cool to only 6.6% next year and 3.3% in 2024, still above the BOE’s 2% target.

OECD Worried About UK Energy Payments Scheme

In particular, the OECD took issue with the UK government’s energy price guarantee scheme which will see all domestic electricity users paid £400, to help reduce financial stress. However, the OECD argues that this will only drive inflation further higher, causing the need for more aggressive tightening from the BOE, which will have harsher consequences on growth yet again. Additionally, with the minimum wage set to rise next year in the UK, consumer spending power will be marginally boosted, potentially offsetting some of the weaker demand seen in the face of the cost-of-living crisis, again underpinning inflation and harming UK growth.

December BOE In Focus

Looking ahead, the main focus for UK investors now will be the last remaining BOE meeting of the year. With inflation still at record highs, a further hike from the BOE is widely expected though a smaller .5% hike is the consensus call for now. While the BOE has cited a desire to slow the pace of tightening, inflation is not yet allowing for this and if CPI continues to outperform into next year, we will likely start to see current BOE peak-rate projections revised higher, further damaging the UK growth outlook.

Technical Views

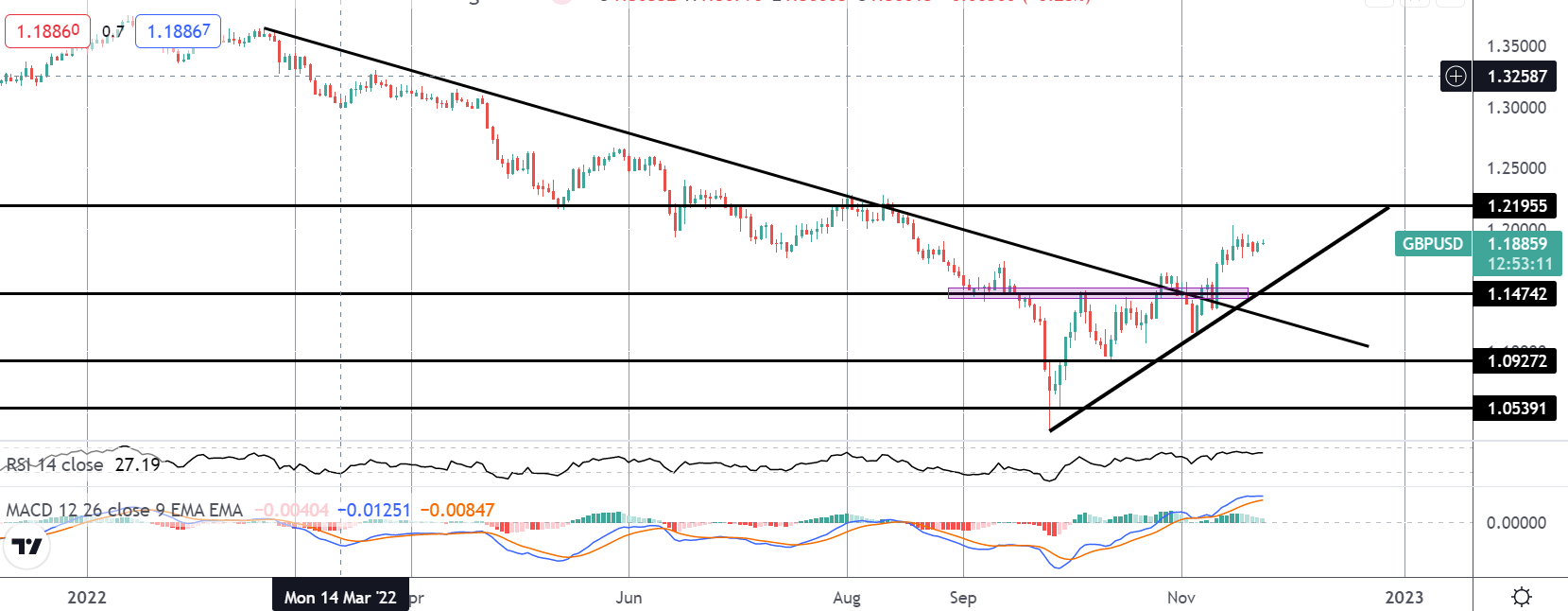

GBPUSD

The rally off the YTD lows in GBPUSD remains intact for now, underpinned by the rising trend line. Price has recently broken above the bear trend line from YTD highs and above the 1.1474 level. With momentum studies bullish, the outlook remains in favour of further rallies while 1.1474 holds, with 1.2195 the next resistance for bulls to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.