NFP Uncertainty Prevents EURUSD from Leaving the 1.09 Area as Fed March Cut Still Under Question

The EURUSD experienced a corrective phase and stabilized below 1.0950 early on Thursday, finding support above the 1.0900 level tested the day before. The pair's technical trajectory indicates a potential recovery, but investors are exercising caution ahead of the NFP report on Friday.

During the middle of the week, the US Dollar gained strength due to the prevailing cautious sentiment in the market, continuing its outperformance against the Euro. Furthermore, the minutes from the Federal Reserve's December meeting revealed a relatively hawkish tone, providing support for the currency during the American session.

The Fed's release highlighted that some policymakers contemplated maintaining the current policy rate for a longer period than initially anticipated.

In German regional data, the annual inflation in North Rhine-Westphalia, measured by the Consumer Price Index (CPI), rose from 3% in November to 3.5% in December. The German CPI followed estimates, accelerating from 3.2% to 3.7% during the same period. However, French inflation in December surprised on the downside, increasing by 0.2% to 3.7%, missing the estimated 3.8%. The absence of bearish surprises in price data allowed the Euro to consolidate its position in the 1.09+ range.

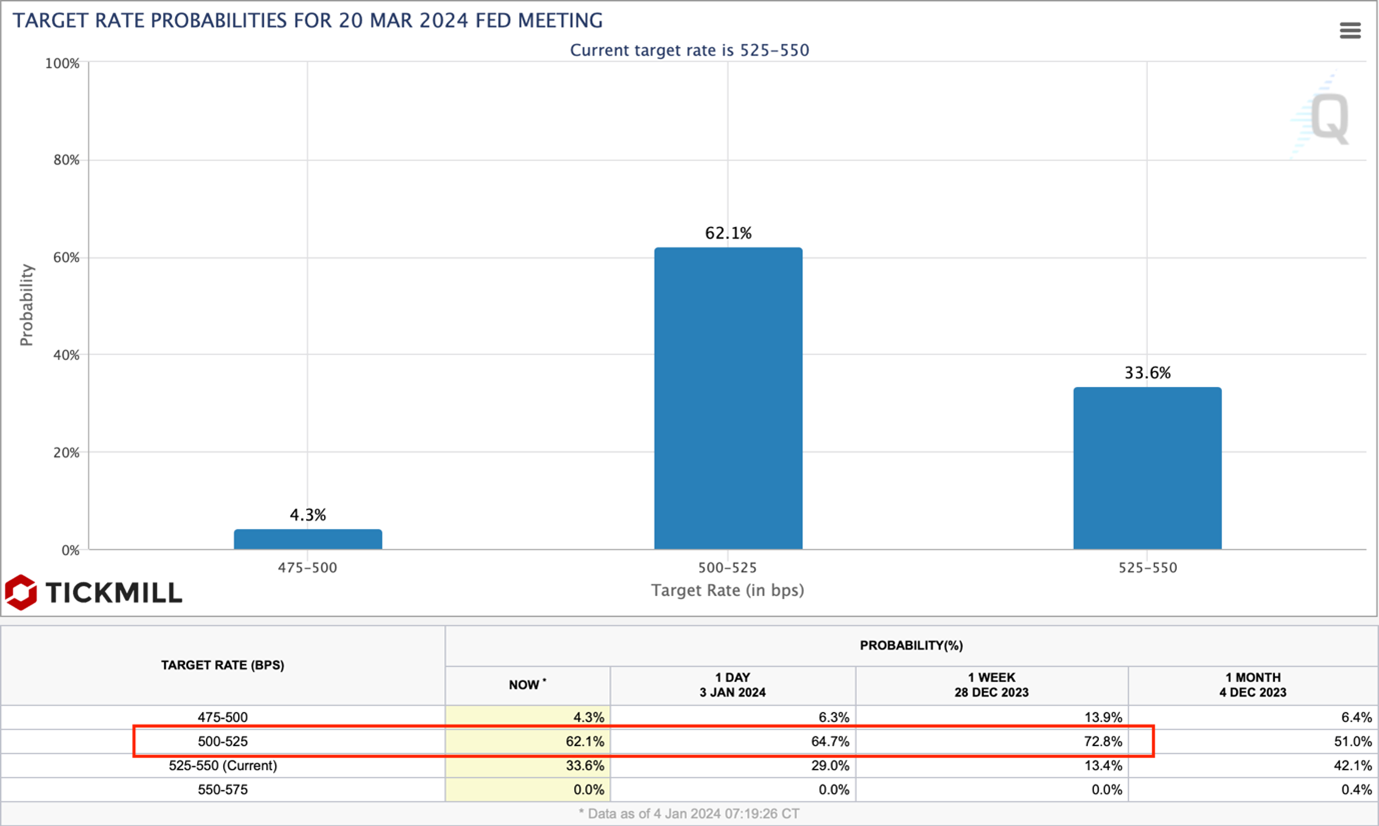

On the US front, private sector employment increased by 164,000 in December, exceeding the consensus estimate of 115K, according to Automatic Data Processing (ADP). Interestingly, major dollar currency pairs did not exhibit a significant reaction to the report, suggesting that market participants may be waiting for the official Non-Farm Payroll (NFP) report to adjust their expectations for a Fed rate cut in March. The current probability stands at 62.1%, down from 72.8% observed a week ago:

Factors influencing this repricing include the recovery of US bond yields, particularly on the short end of the curve, and weak stock market performance reflecting a corresponding increase in the discount rate—a crucial variable in stock market asset pricing.

The upcoming Non-Farm Payroll report, scheduled for Friday, is anticipated to reveal a decrease in job gains in the US economy for December, with expectations of 150K compared to November's 199K. Additionally, average hourly earnings are projected to slow down from 0.4% in November to 0.3%, while unemployment is expected to edge higher from 3.7% to 3.8%.

Analyzing the Dollar index (DXY) price action on Wednesday, it is evident that the USD rally faced resistance near the upper bound of the bearish channel, emphasizing its significance as a resistance line. A continuation of the dollar rally beyond this level could serve as a key technical signal, attracting more buyers and fueling momentum. Conversely, a decline below this line may trigger bearish pressure, signaling a potential fade in the dollar's rebound since the beginning of the year:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.