Market Spotlight: GBPJPY Breaking Out On UK Data Beat

Strong Services Sector Gains

GBP has been on the rise today as traders digest the latest set of UK economic data. January PMIs saw the UK services sector bouncing back into growth territory last month with the index printing 53.3, up from the prior month’s 48.7 result and above the 49.1 the market was looking for. This marks the first time since July that the sector has been in growth territory after plunging over Q3 and Q4 2022. One particularly encouraging sign for the BOE was the PMI price index- used to determine expected future price inflation – was seen falling to its lowest level since April 2021.

Manufacturing Rises Also

Along with the increase in the services sector reading the manufacturing index also recorded an increase, jumping to 49.2 from 47 prior. While still in negative territory, the trajectory is encouraging and the reading was above the 47.5 the market was looking for.

UK Econ Outlook Improving

The data reinforces the view that the UK economy is doing a little better than expected when measured against projections being made into the back end of last year. The BOE recently said that while it still expects a downturn this year, the dip will likely be milder than expected. Following the UK economy narrowly avoiding falling into recession in Q4, this initial January data is being taken as an encouraging sign that the worst of it is over and the economy is back on the up, helping lift GBP sentiment.

Technical Views

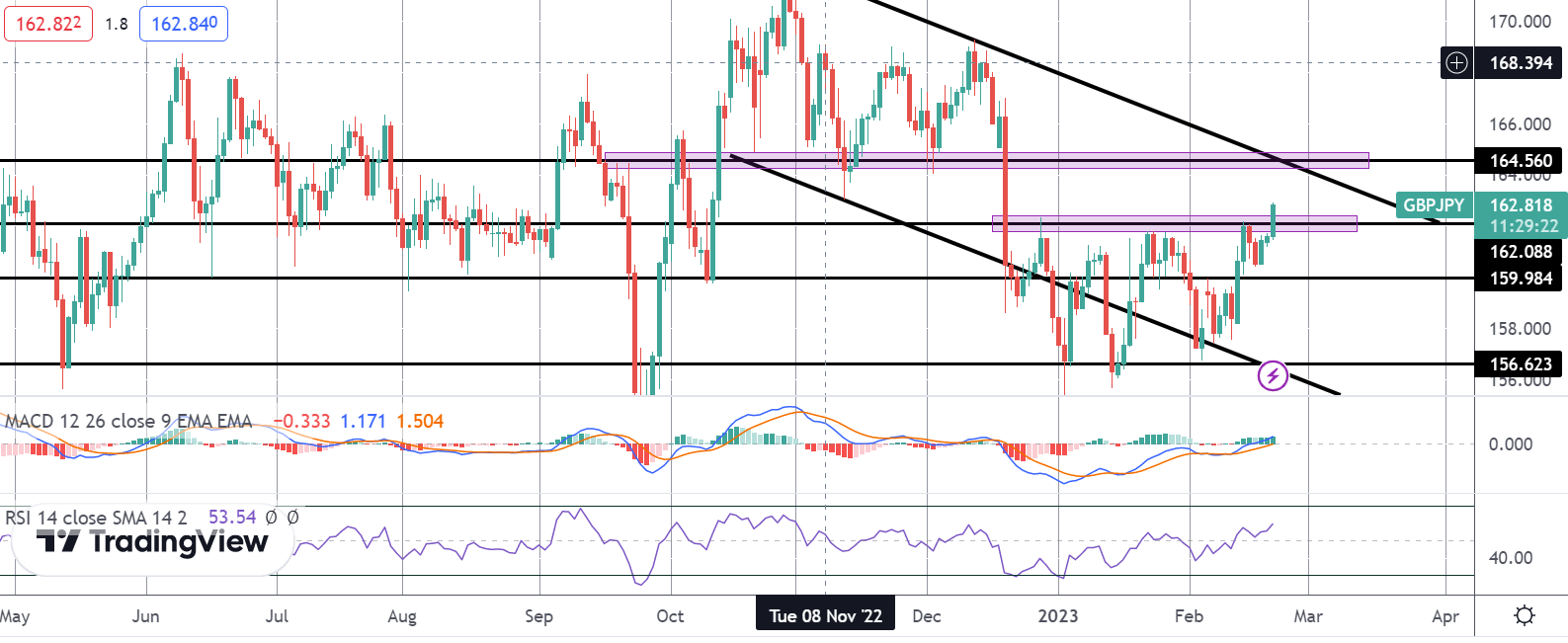

GBPJPY

The rally in GBPJPY off the Feb lows has seen the market breaking out above the 159.98 level and more recently the 162.08 level. The latest break marks a significant development and while above here the focus is on a further push higher and a test of next resistance at 164.56, with the bear channel highs around there also. Retail market heavily short and momentum studies bullish, supporting the move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.