CAD GDP Up Next

On the back of the recent weakness we’ve seen in CAD, Canadian GDP will be in focus today. With little expected in the way of fireworks (consensus 0.1% vs 0.1% prior) only a meaningful surprise to the upside will help lift CAD currently. While CAD is finding some support from the bounce back in oil prices this week, near-term forecasts remain skewed lower with the BOC nearing the end of its tightening program.

Central Bank Policy Divergence

With other central banks, such as the ECB, RBNZ and BOE well-expected to continue pushing ahead with further rate hikes into next year, the divergent policy expectations between these banks opens up plenty of downside opportunities in CAD.

Additionally, the broader soft-patch we’ve seen in risk appetite recently is also weighing on CAD. With this in mind, any downside surprise today will likely see CAD coming under fresh selling pressure. The situation in China also needs to be monitored as any fresh outbreak of unrest or any uptick in covid restrictions these will no doubt see oil prices head lower, weighing on CAD near-term.

Technical Views

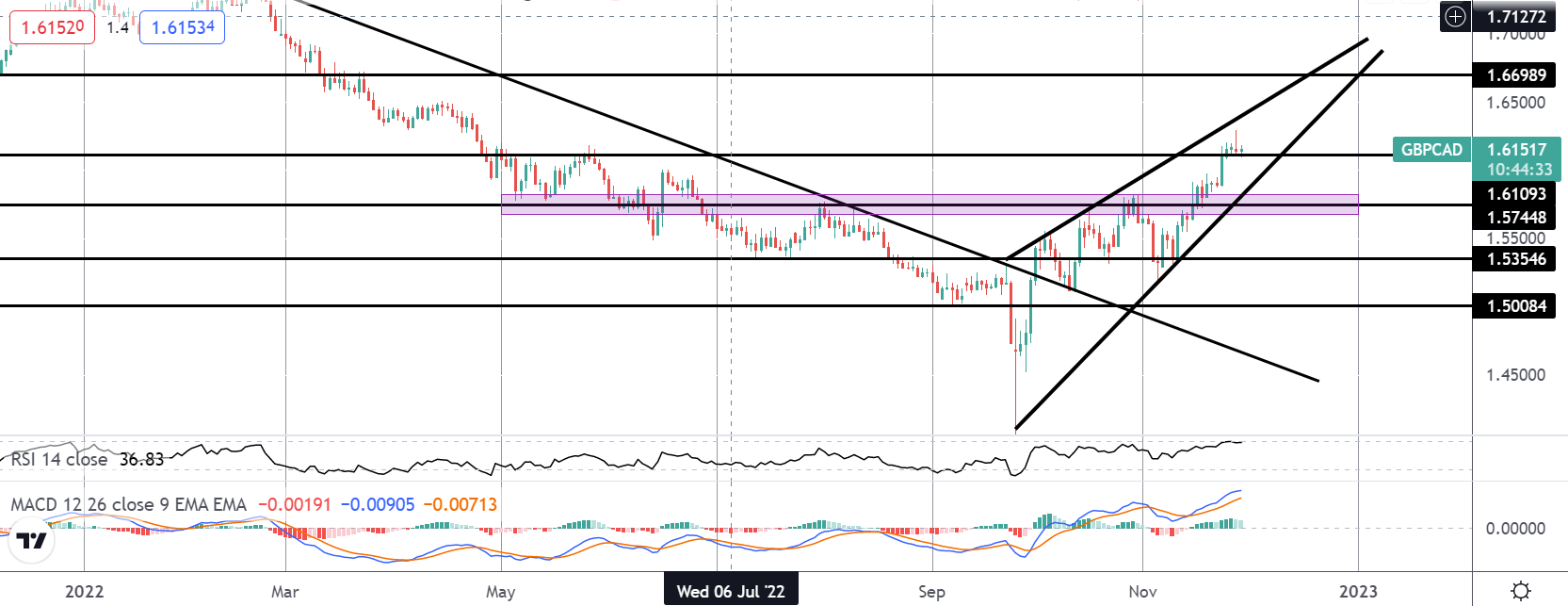

GBPCAD

The rally in GBPCAD has seen the market breaking above the 1.6190 level, marking an important technical development. While price holds above this level, the near-term focus is on a continuation higher towards the 1.5744 level. However, it is worth noting that the move higher has been framed by a rising wedge formation, suggesting the potential for a downside corrective move. Again, key level to watch as a pivot is the 1.5744 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.