Market Spotlight: Crypto Panic As Binance Cancels FTX Buyout

Fresh Fears For Crypto Traders

Crypto markets are still awash with fear and panic today as the possibility of crypto exchange FTX collapsing ratcheted higher on news that Binance has walked away from a buyout. Amidst a huge exodus of capital and the more than 90% loss of value in its native token FTT, FTX was due to be acquired by main rival Binance in a deal which would cover the exchange’s roughly $8 billion in liabilities, preventing unmanageable client losses.

Binance Baulks At Buyout

Binance cited reports of “mishandled customer funds and US agency investigations” as the main drivers behind its decision to abort the takeover. While FTX is reportedly seeking similar buyout options from other firms, nothing concrete has been established yet and as withdrawals continue, the situation is becoming more perilous.

Retail Trader Impact

If FTX does go bankrupt, this would be the latest high-level insolvency in the crypto-sphere this year. On the back of stable coin TerraUSD collapsing and the crypto fund Three Arrows Capital tanking, the news would have major repercussion for the crypto sector. Retail interest and trading volume have already fallen massively this year when compared with last year and FTX going under would likely see volumes plunging further with the crypto winter growing colder still.

Technical Views

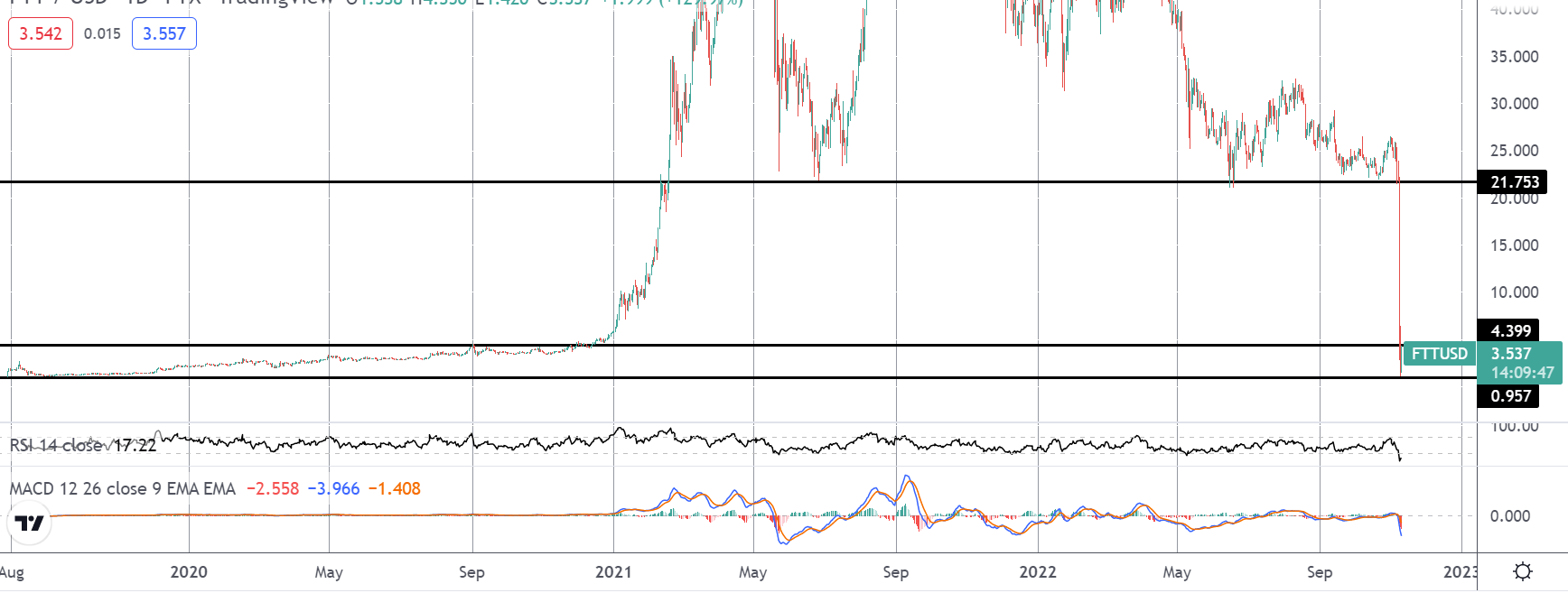

FTT/USD

The chart really puts the plunge in perspective. Trading at around the $25 level just a week ago, FTT is now below $4, having tested the all time lows at $0.95. The outlook remains very bearish for the company. However, given that price is at such historically subdued levels and with the

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.