BTC Threatening a Fresh Move Lower?

Following a corrective grind higher over the last month or so, Bitcoin prices turned sharply lower into the back end of last week as fresh central bank hawkishness weighed on risk sentiment. Both the Fed and the ECB seemingly caught markets a little off guard last week, fuelling recession fears in the outlook for the first half of 2023. The Fed lifted its peak rate projection, signalling that rates would need to be higher for longer while the ECB was also seen warning that rates would need to increase significantly further. With US retail sales data then seen tanking in November, markets have gravitated back towards fears for global economic activity, which has driven risk assets sharply lower in recent days.

Early 2023 Outlook

Looking ahead to early 2023, the outlook for crypto remains fairly subdued. However, there are some upside risks worth considering. The biggest one of these is the potential reopening of the Chinese economy in early 2023 which, if confirmed, would be a significant upside driver for risk assets including crypto. Furthermore, if there is any sudden acceleration of the drop in US inflation this might help shift the Fed outlook in favour of an earlier end to tightening which would also help lift the outlook for crypto.

Technical Views

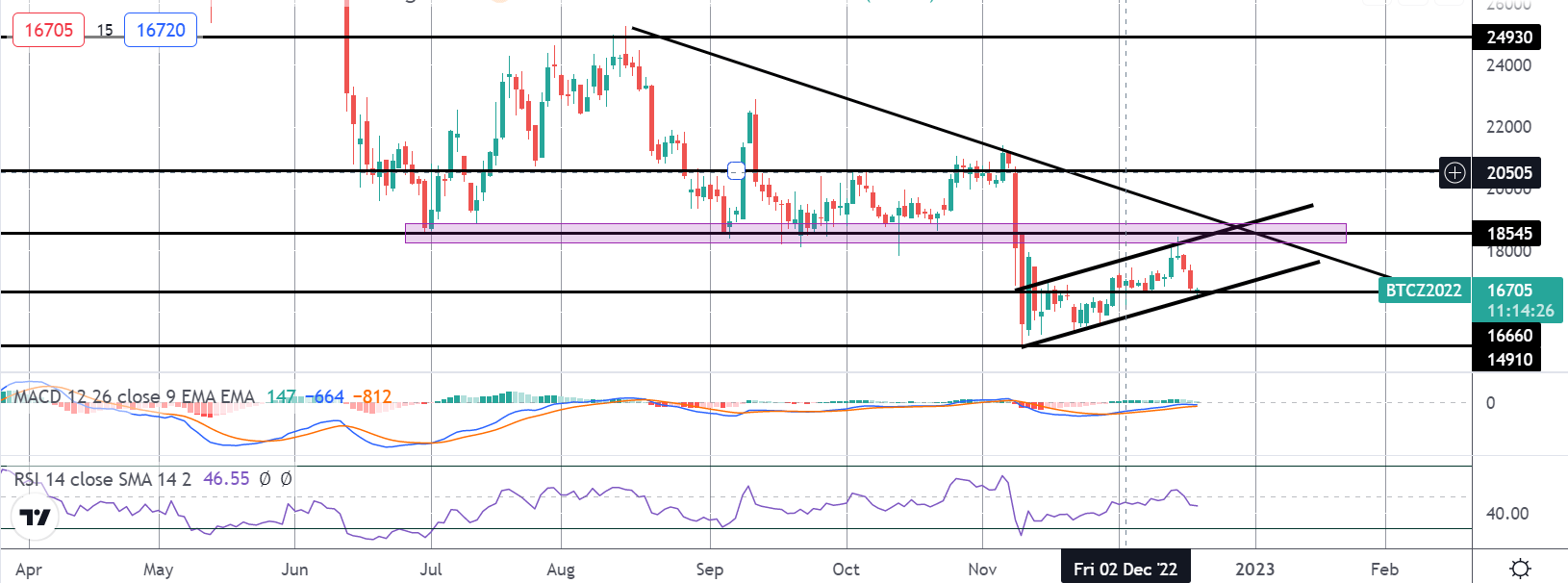

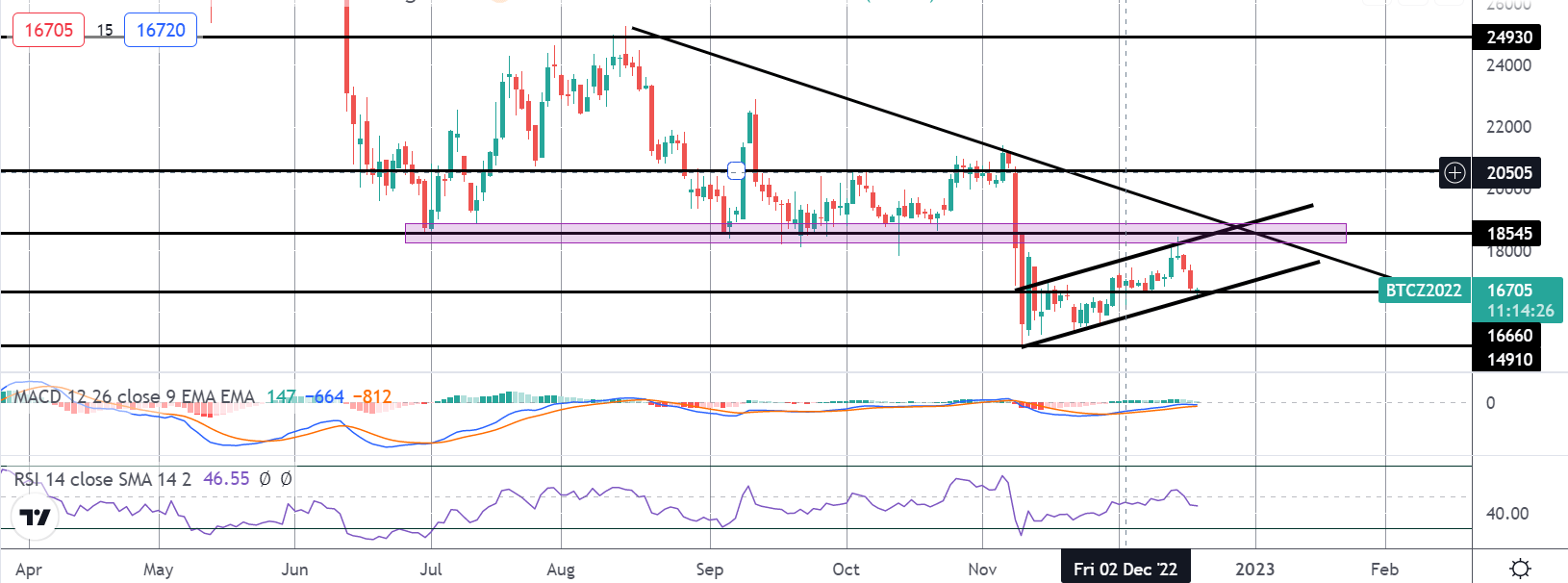

BTC

Following the latest leg lower in BTC, the market has been grinding higher since the November lows, moving with a narrow bull channel. However, the move stalled into a retest of the 18545 area. This is a key resistance level with the bear trend line from August highs sitting just above. Until we see a break of that region, the focus remains on further downside near term with a break of 16660 opening the way for a test of 14910 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.