Kiwi Collapses on Shock RBNZ Rate Cut

Kiwi Under Pressure

The kiwi is under pressure today on the back of the latest RBNZ rate cut overnight. The bank slashed rates to 2.5% from 3% prior. The .5% cut was deeper than forecast and caught traders off guard with NZDUSD slumping accordingly. Along with the larger rate cut the bank struck a dovish tone in its statement, signalling that further easing is expected. On the back of the move, traders are now pricing in another .25% cut in November.

Dovish RBNZ Expectations

The rate cut, which comes ahead of Q3 inflation data, suggests the bank is more concerned with supporting the economy right now. The recent larger-than-forecast drop in GDP looks to have taken centre stage for the bank. As such, any fresh weakness in upcoming inflation data can only amplify dovish expectations, putting further pressure on NZD if seen.

USD On Watch

Given the rally we’re seeing in USD this week, fuelled by political developments in Japan and France, NZDUSD has room to move lower near-term. Looking ahead, focus will now turn to the FOMC minutes tonight. Given that other key US data is delayed currently due to the shutdown, the minutes will take on greater importance. USD could see some pullback in response to the minutes, however, if the Fed is seen to be more dovish than expected.

Technical Views

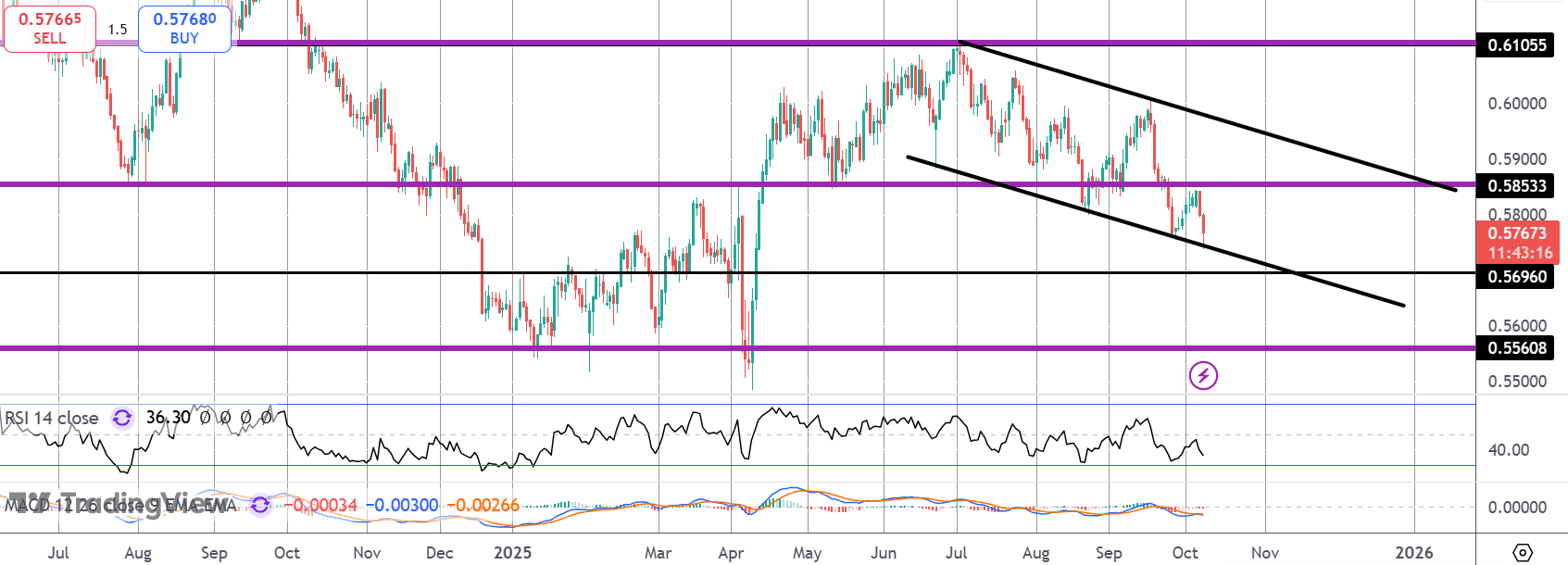

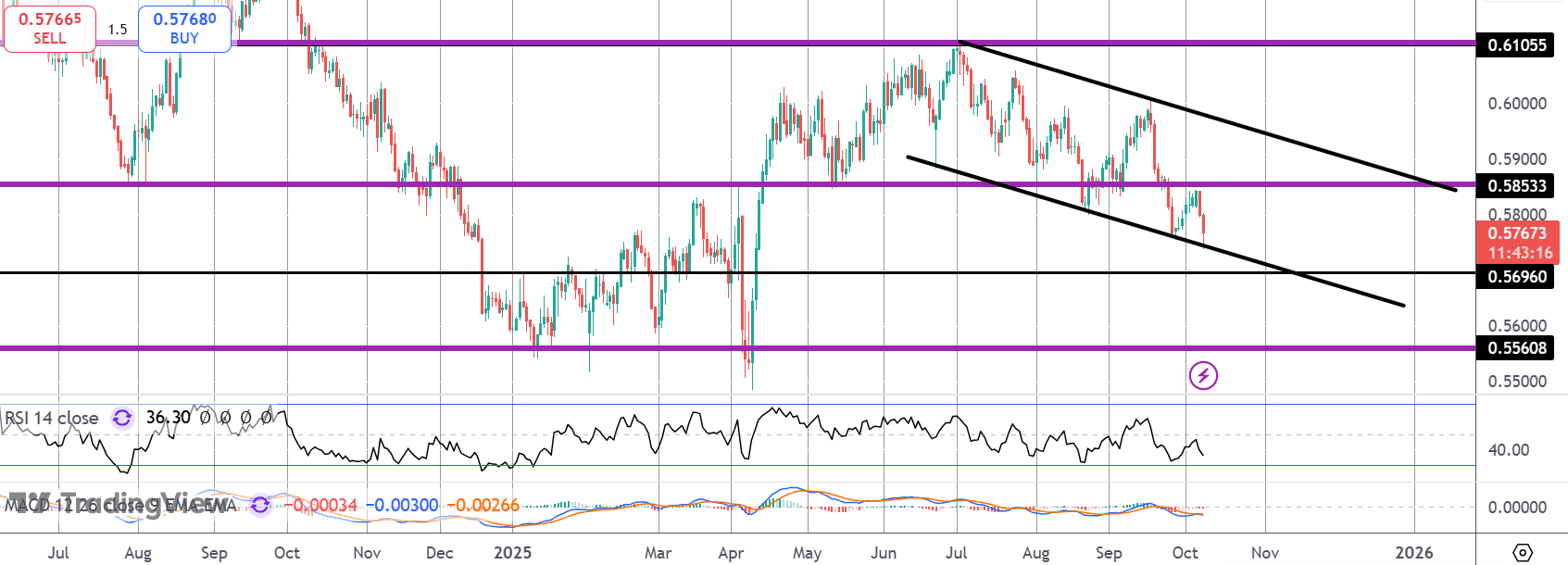

NZDUSD

The sell off in the kiwi has seen price breaking down below the .5855 level with price now testing the bear channel lows once again. With momentum studies bearish, focus is on a test of the .5696 level next with .5560 the deeper bear target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.