Is a Bullish GBPUSD Reversal Underway?

Better UK Data

GBPUSD is trading at its highest level in over two months today against a backdrop of better-than-forecast UK data and a weaker US Dollar. On the data front, UK GDP was seen rising 0.1% in Q4 last year. While still clearly weak, the data was above the -0.1% level the market was looking for and the monthly figure was seen rising to 0.4% from 0.1% prior and expected. With some firmer readings elsewhere too, including stronger industrial production and a smaller-than-forecast trade deficit, GBP sentiment has improved enough to help lift the pound into the end of the week.

Trade War Update

News of a change in strategy on trade tariffs from Trump has also bolstered sentiment today. With reciprocal tariffs from the US now being adjusted on a country-by-country basis and not due to be applied until April, the UK has time to negotiate with the hopes of a achieving a better deal or avoiding tariffs altogether.

Improved GBP Sentiment

With the view that trade war risks are now greatly reduced on the back of this change in strategy from Trump, USD has weakened amidst diluted safe-haven demand. Traders will now be monitoring incoming news flow for any headlines regarding trade negotiations. If traders get a sense that the UK will be able to secure lower tariff amounts or, better yet, avoid them altogether through a trade deal, GBPUSD is likely to rally higher near-term as USD continues to weaken.

Technical Views

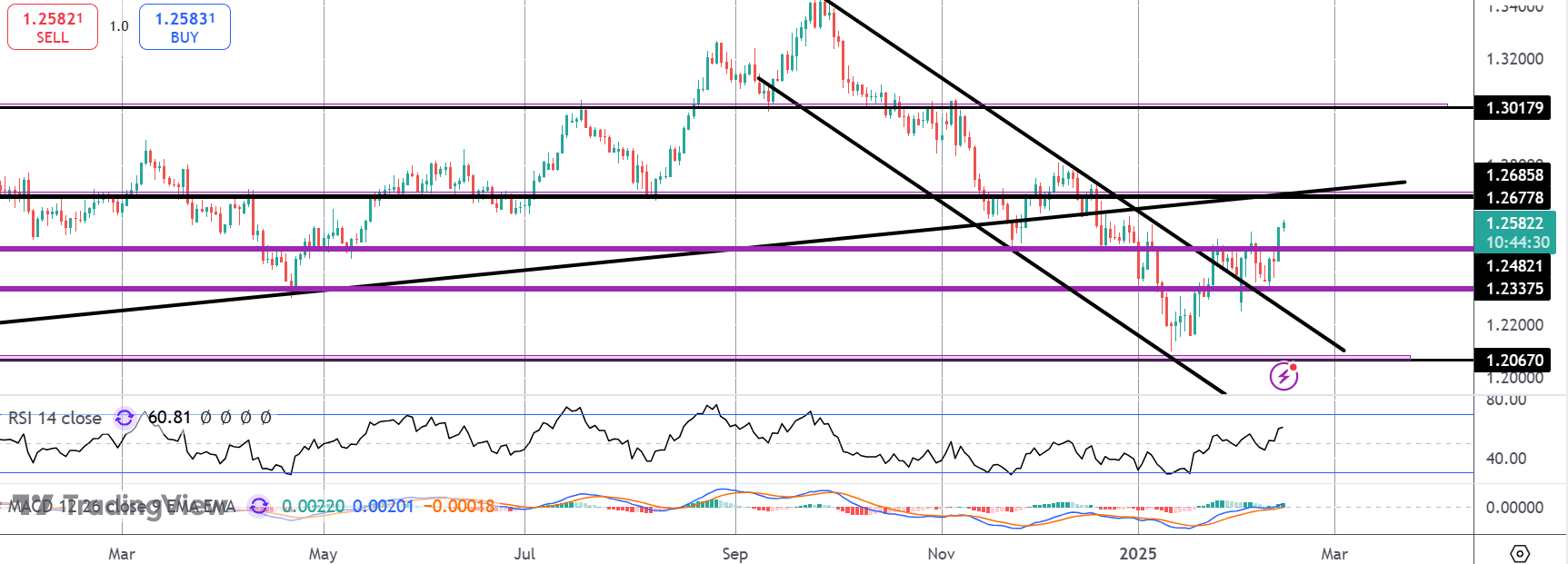

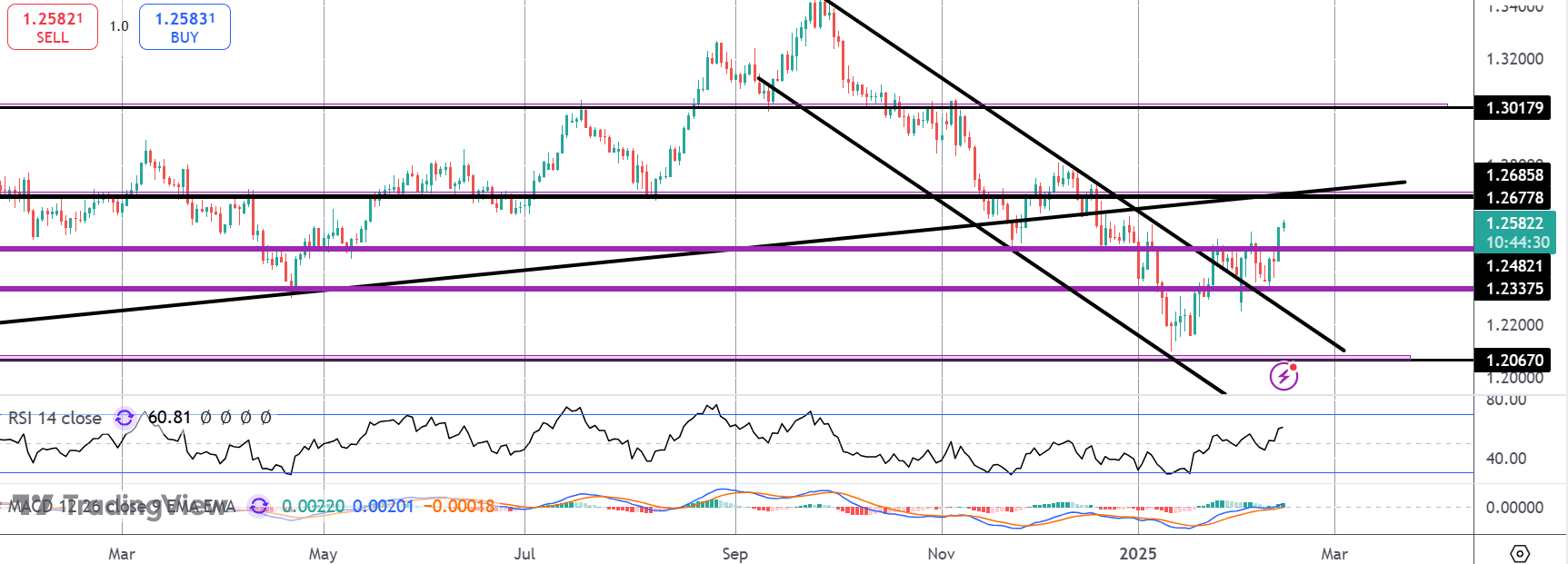

GBPUSD

The rally in GBPUSD has seen the market breaking out above the 1.2482 level with the prior period of price action now looking like a base following the channel break. While above here, focus is on a fresh test of the 1.2685 level and a retest of the broken bull trend line.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.