Investment Bank Month End FX Flows

CITI: Month-End FX Hedge Rebalancing: October 2021 Preliminary Estimate

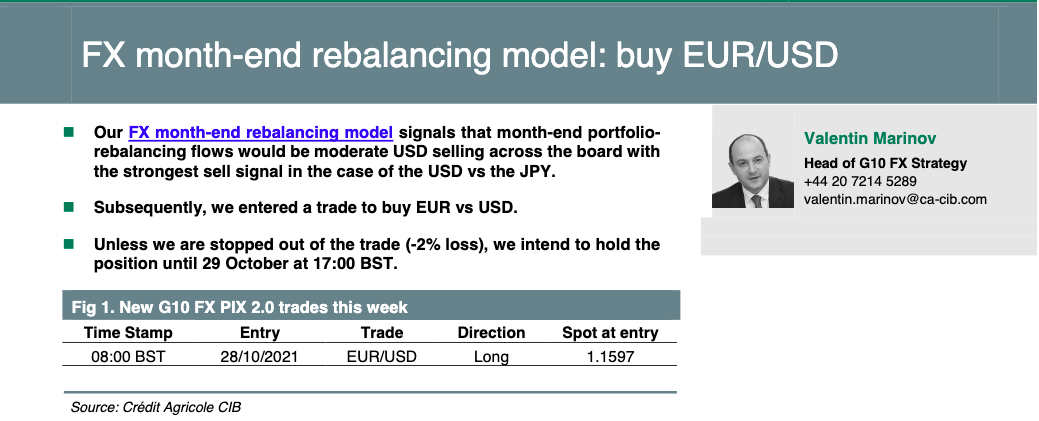

· The preliminary estimate of month-end FX hedge rebalancing needs points to slightly above average USD selling this week.

· Global equities bounced strongly in October after previous month’s losses with the US market leading the recovery. The MSCI US equity index reached a new record last Thursday, 21 October. Although US fixed income is down on the month, the gain in equities dominates and this has likely left foreign investors with US assets under-hedged.

· The signal is a USD sell even against currencies like CAD where local equities have done even better than the US ones, because we assume foreigners hold more US assets and tend to hedge them to a greater degree.

· Poor performance of Japanese assets means that foreigners may also buy JPY to reduce hedges, adding to domestic JPY buying needs. At +1.6 standard deviations, the signal to buy JPY and sell USD is strongest among major currencies this month.

· There are no major data releases or central bank speakers currently scheduled ahead of the 4pm London WMR fix this Friday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!