Institutional Insights:Goldman Sachs CPI PREVIEW 12/8/25

Goldman Sachs CPI PREVIEW

FICC and Equities

11 August 2025 | 2:43 PM UTC

From GS Research:

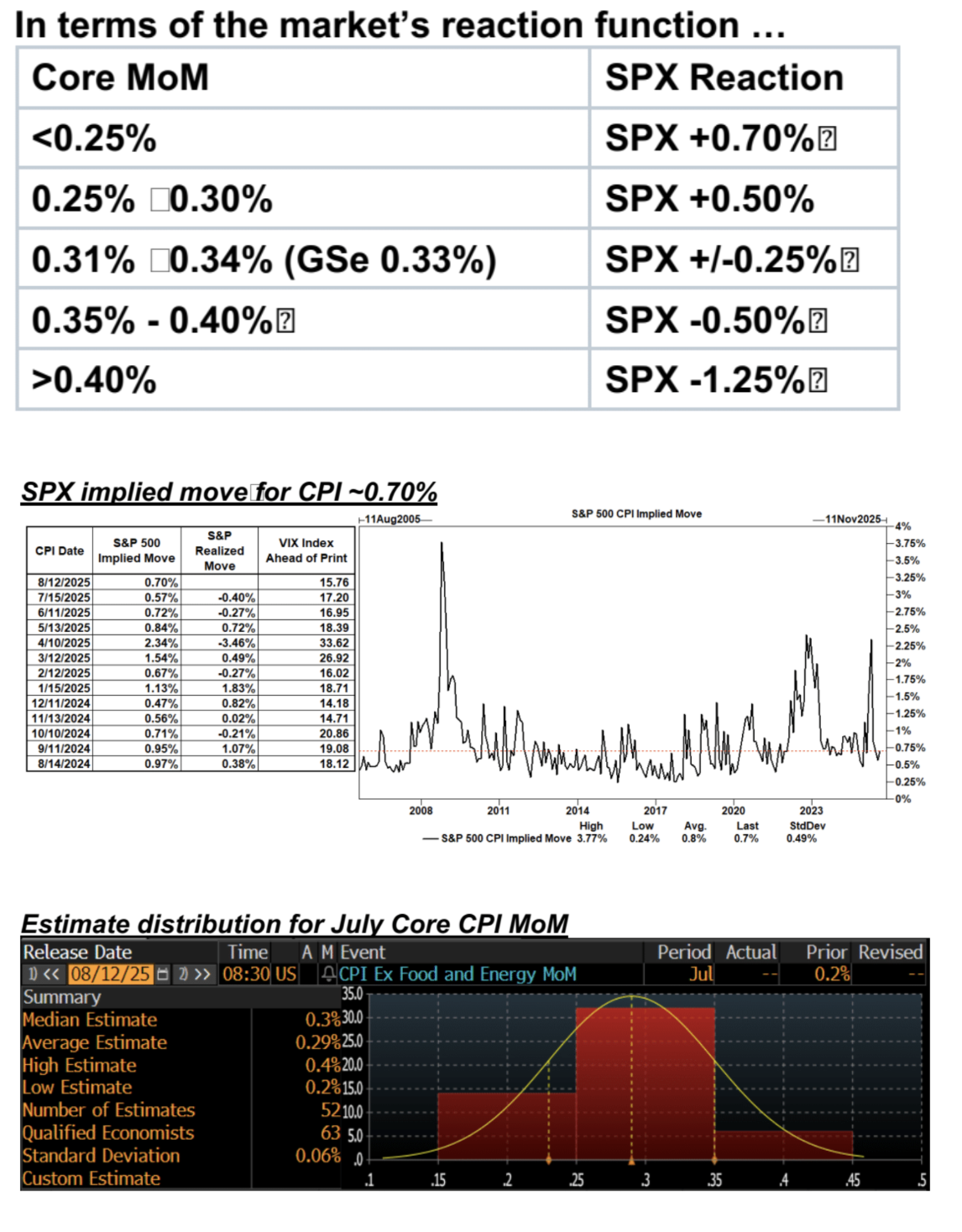

We anticipate a 0.33% increase in July core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 3.08% (vs. +3.0% consensus).

- Headline CPI: Expected to rise 0.27% (vs. +0.2% consensus), driven by higher food prices (+0.3%) but offset by lower energy prices (-0.6%). This equates to a year-over-year rate of 2.80% (vs. +2.8% consensus).

Key Component-Level Trends:

1. Used Car Prices: Forecasted to rebound by 0.75%, reflecting higher auction prices, while new car prices are expected to decline by 0.2% due to increased dealer incentives.

2. Car Insurance: Anticipated to drop by 0.1%, based on premiums tracked in our online dataset.

3. Airfares: Projected to rise by 2%, though risks remain two-sided due to seasonal distortions and stronger underlying airfare increases from online price data tracked by equity analysts.

4. Tariffs Impact: Categories like household furnishings and recreation/communication goods are expected to face upward pressure, contributing +0.12pp to core inflation, alongside a +0.02pp boost from auto inflation.

Outlook:

- Over the next few months, tariffs are likely to continue driving monthly inflation upward, with monthly core CPI inflation forecasted between 0.3%-0.4%.

- Excluding tariff effects, underlying trend inflation is expected to decline this year due to reduced contributions from housing rental and labor markets.

- By December 2025, we forecast year-over-year core CPI inflation at +3.3% and core PCE inflation at +3.3% (or +2.5% for both measures excluding tariff impacts).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!