Institutional Insights:BofA FX Quant Insight USD bears revisit September NFP

BofA FX Quant Insight: USD bears revisit September NFP

Key Takeaways

- Bearish USD Sentiment:

- Increased bearish pressure on the USD as the US government shutdown ended, with the DXY index remaining below the 200-day Simple Moving Average (SMA).

- Option Skew Dynamics:

- Shift towards USD puts as the USD traded weaker, particularly in conjunction with declining US equities ahead of the September Non-Farm Payroll (NFP) report.

- GBP Momentum:

- Quantitative models indicate sustained bearish momentum for GBP, with no significant contrarian signals suggesting a potential rally.

- FX Signal of the Week:

- Bullish EUR/GBP at a level of 0.8800.

## Technical Insights

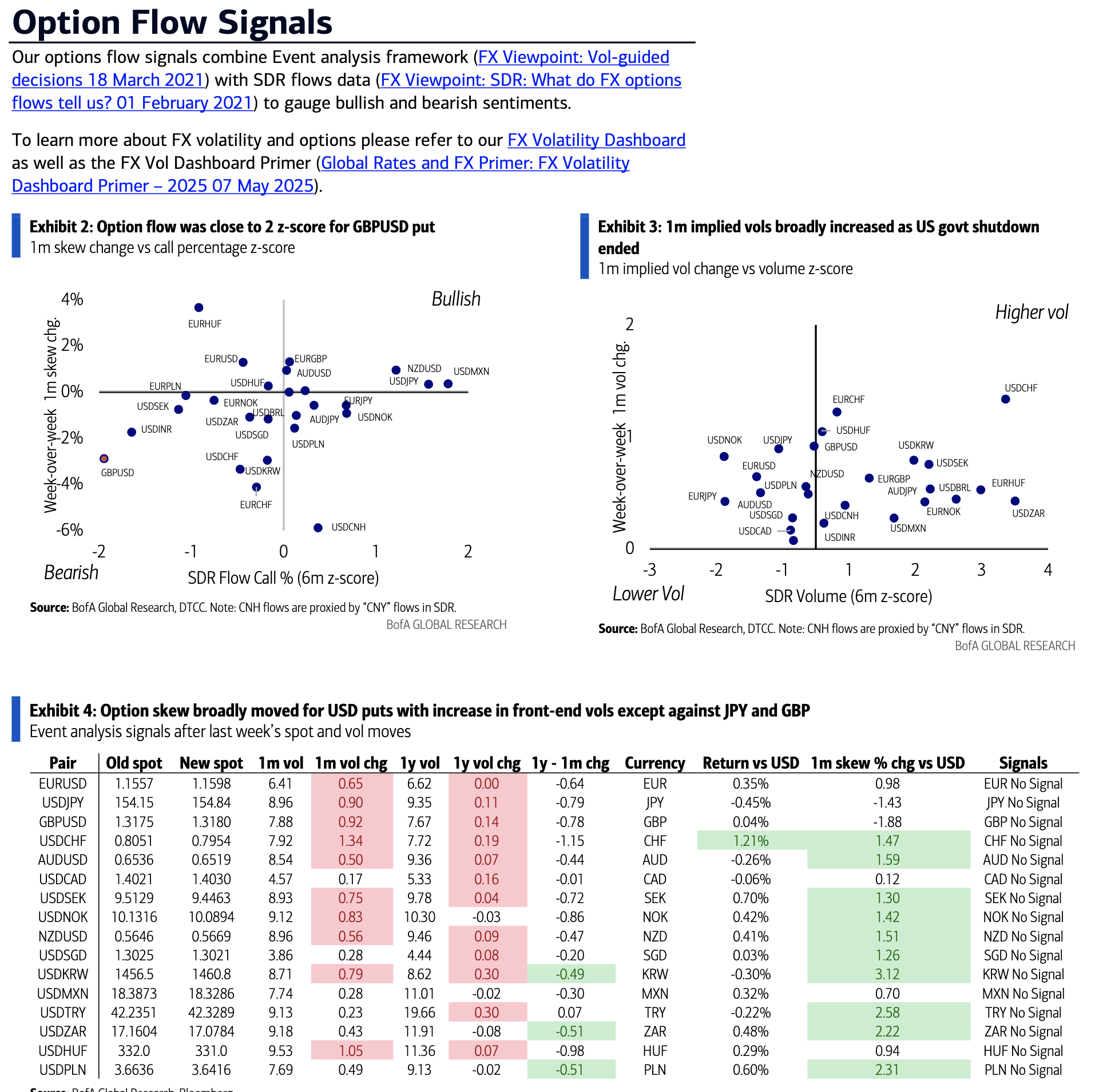

### Option Flow

- Bearish GBP:

- Last week saw a significant demand for GBP/USD puts, reflected in a 2 z-score move.

### Technical Matrix

- Bullish EUR/GBP:

- The EUR/GBP spot price indicates a bullish uptrend continuation signal.

### CARS Model

- Equity Regime:

- The model suggests bullish positions in CHF and NOK against bearish outlooks for GBP and AUD based on equity factors.

### Time Zone Impact

- Asia Hour GBP Supply:

- The rally in EUR/GBP since October has been predominantly driven during Asian trading hours.

### Emerging Market FX

- Bearish USD:

- Option skews have shifted towards USD puts relative to Emerging Market (EM) currencies.

## Market Context

- The end of the US government shutdown and the DXY's failure to break above the 200-day SMA have contributed to the increased demand for USD puts.

- Recent trends in US equities show a downward drift since the October FOMC meeting, leading to a weaker USD.

- The FX market remains influenced by equity performance, with muted spot trends observed. The EUR/USD trend is flat, and the USD/G10 trend breadth remains neutral.

- A soft US labor report this week may be necessary for further movement towards a weaker USD.

## GBP Outlook

- Current quant signals reinforce a bearish stance on GBP, with significant put demand observed.

- Despite potential for a relief rally post-UK budget announcement, bearish momentum remains intact, and risks are associated with maintaining a bearish GBP outlook this week.

### Conclusion

The FX market is currently characterized by bearish sentiment towards the USD and GBP, with bullish signals for EUR/GBP. Market participants are advised to watch for labor report outcomes to validate the prevailing trends.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!