Institutional Insights: UBS Market Internals Update

UBS Market Internal Weekly Report

Key Themes:

- SPX faces limited upside potential versus significant downside risks.

- Continued outperformance of IWM over QQQ.

- New risk factor to monitor: SPX Dealer Intraday Peak Gamma nearing critical levels.

---

Quick Takeaways:

1. SPX Capped Upside:

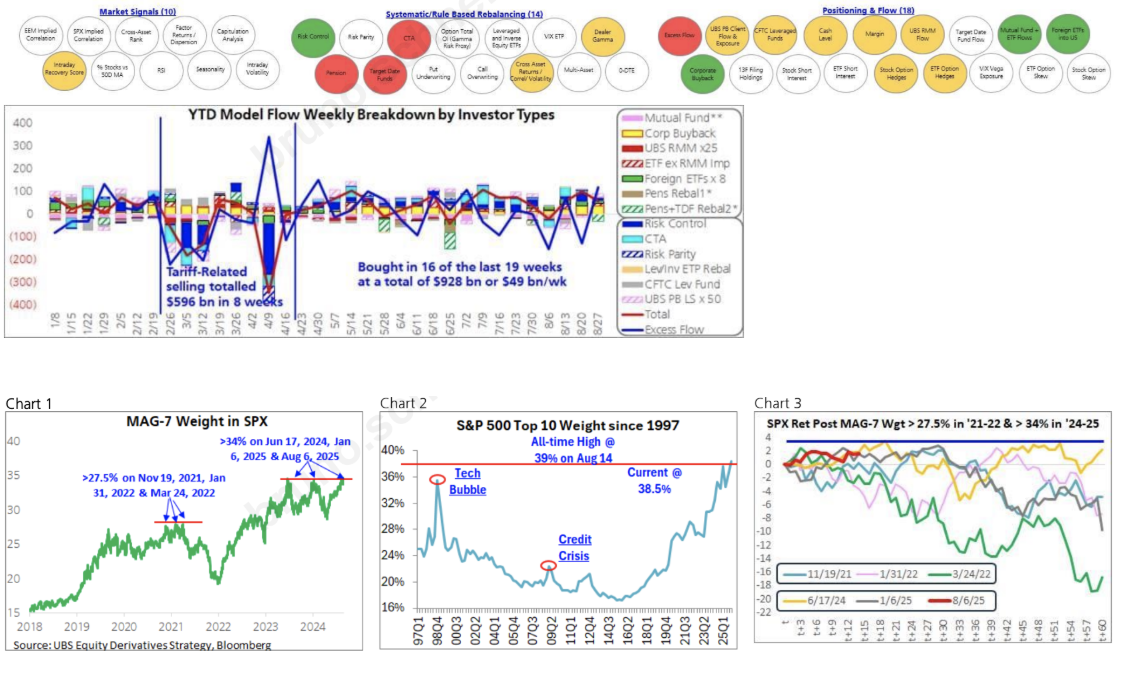

As anticipated, SPX's upside was constrained (< +2%), primarily due to top-heaviness, while extreme small-cap over-hedged and tech under-hedged conditions drove IWM to outperform QQQ by +4%. Though these conditions have moderated slightly, they remain extreme and could sustain the current performance trends

2. Historical Context:

- MAG-7 top-heaviness (as of Aug 6) limited SPX gains to +2.0%, aligning with the historical 1-month average upside of +2.5% (range: +1.6% to +3.5%).

- Historically, such capped upside was followed by significant drawdowns in all five comparable cases, averaging -12.9% (range: -8.5% to -18.9%) over the subsequent 1-2 months.

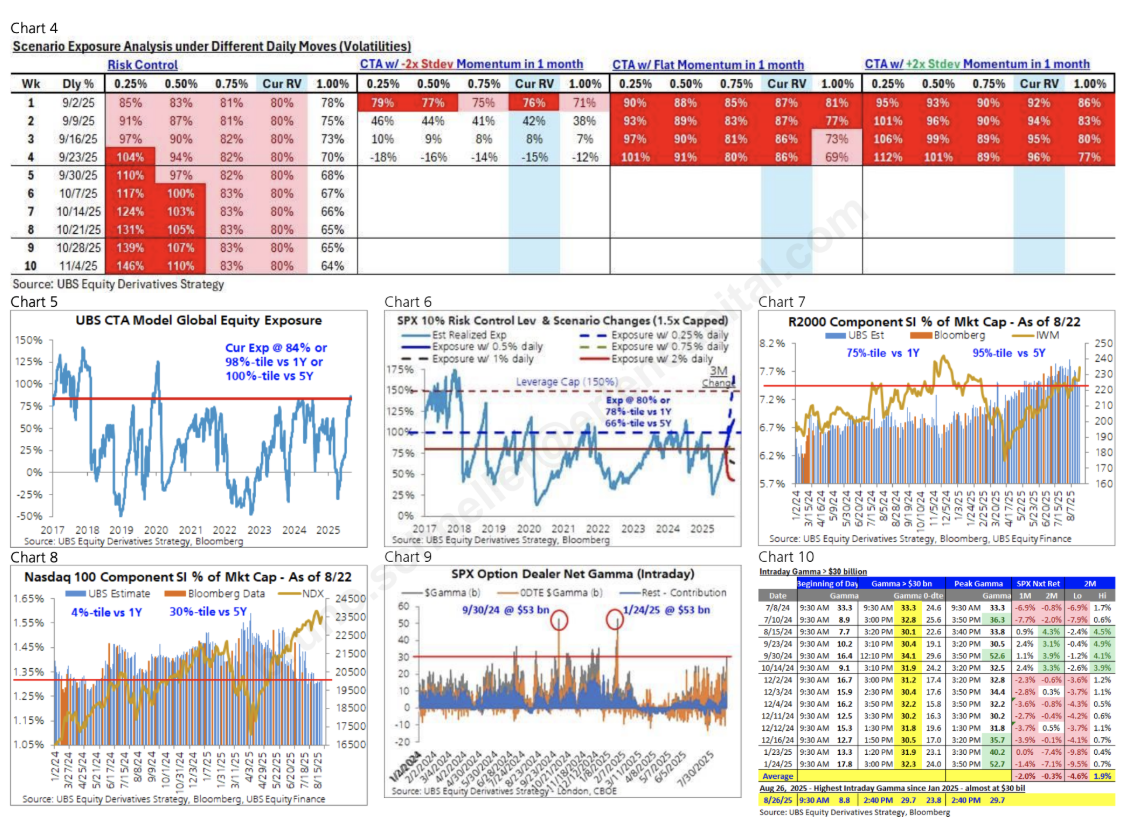

3. Systematic Unwind Risks:

- CTA bearish asymmetry has worsened, with the sell/buy ratio increasing from 7:1 to 12:1 on -/+2 standard deviation 1-month moves.

- Risk Control remains buy-biased for now but could approach vulnerable unwind levels around mid-September to early October, depending on SPX realized volatility.

4. Small Cap vs Tech Positioning:

- While the positioning gap between small caps and tech has narrowed, it remains extreme. This suggests continued IWM/QQQ outperformance.

- This setup is particularly relevant for the upcoming FOMC meeting:

- A dovish rate cut could trigger a small-cap short squeeze.

- A hawkish stance could lead to a tech unwind, as tech remains the most under-hedged segment.

5. Key Risk Factor – SPX Dealer Intraday Peak Gamma:

- SPX Dealer Intraday Peak Gamma reached $29.7 billion on Aug 26, nearing the $30 billion complacency threshold. Historically, this level has been a precursor to SPX downside risks, with subsequent 2-month average low/high returns of -4.6%/+1.9%.

- This development warrants close monitoring as a potential warning signal for SPX performance.

---

Conclusion:

While SPX's upside remains capped, downside risks are mounting, exacerbated by systematic unwind pressures and critical gamma levels. Small-cap outperformance versus tech could persist, particularly around FOMC outcomes. Investors should remain vigilant, especially as key risk thresholds approach.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!