Institutional Insights: SocGen FX View USD 65trn nervous dollars

.jpeg)

FX View USD65trn nervous dollars

No clarity ahead of ‘Freedom Day,’ but USD remains capped.

The sheer volume of foreign holdings in US assets (approximately $65 trillion at last count) and concerns about the dollar’s stability if global growth is impacted by Freedom Day tariffs are testing the relationship between risk sentiment and the dollar once again.

This morning, the standout currency is the Japanese yen (JPY), as markets nervously anticipate Wednesday. The connection between USD/JPY and 10-year Treasury yields remains strong, even as risk aversion seems to offer limited support to the USD. If USD/JPY declines too sharply or quickly, Japanese authorities may grow uneasy. The large speculative long positions in the futures market suggest that intervention could have an impact. However, these factors are likely to come into focus only if USD/JPY falls below 145 and approaches the 140 level.

The outlook for European currencies is less clear. The threat to growth from tariffs is evident, and skepticism persists regarding the economic impact of Germany’s fiscal shift. Positive factors for the euro and other European currencies—such as a better fiscal and monetary policy mix and the potential drag on US growth from policy activism—are likely to unfold slowly. Meanwhile, the tariff drama is expected to dominate headlines in the coming days, contributing to choppy and frustrating trading in EUR/USD and other European currency pairs. While President Trump’s threat of oil sanctions on Russia has bolstered the Swiss franc (CHF), and Swedish krona (SEK) longs remain a favored trade due to increased European defense spending, EUR/USD and GBP/USD may stay range-bound for now, even though a breakout higher is anticipated eventually.

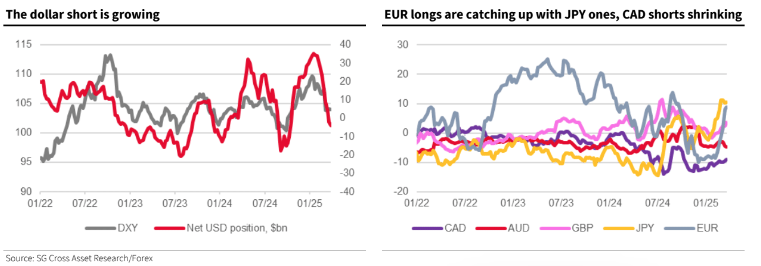

CFTC data as of last Tuesday reveals a buildup of USD shorts in the futures market, now totaling nearly $4 billion. This includes a $19 billion short against the euro (EUR) and yen (JPY), offset by a $16 billion long position against the Australian dollar (AUD), New Zealand dollar (NZD), and Canadian dollar (CAD). There are also USD shorts against the Mexican peso (MXN), South African rand (ZAR), and Brazilian real (BRL). Notably, the largest short remains in CAD, though it may have slightly decreased. We conclude that MXN might be more vulnerable to ‘Freedom Day’ developments than CAD.

AUD/USD rebounded from 0.62 to 0.64 in March before drifting back down. However, with the Reserve Bank of Australia (RBA) unlikely to adjust rates overnight and supported by stronger Chinese PMI data, we believe another test of 0.64 is more probable this month than a decline back below 0.62.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!