Institutional Insights: SocGen - A Dollar Mini - Bounce: How far can it reach?

A Dollar Mini - Bounce: How far can it reach?

The market is attempting to stabilize for the summer, but the conflicting factors are still too intense for a proper rest. The Dollar has managed a slight recovery this past week, primarily from today’s movements. As many are aware, I believe the insights we can gather from Monday morning shifts are minimal at best. Meanwhile, President Trump and Treasury Secretary Scott Bessen are still threatening retaliatory tariffs for those hesitant to agree on deals, as well as punitive tariffs for those siding with BRIC countries against the US. Additionally, the US economy is showing signs that a lack of available labor may heighten the inflationary effects of tariffs, alongside marginally weak data overall that supports the notion of a very gradual slowdown in growth. The interest rates market continues to forecast 50 basis points of Federal Reserve rate cuts this year, with the first likely in September. This will only occur if one of the two labor market reports released before then shows a noticeable softening compared to last week's data. The prevailing impression is one of disorder.

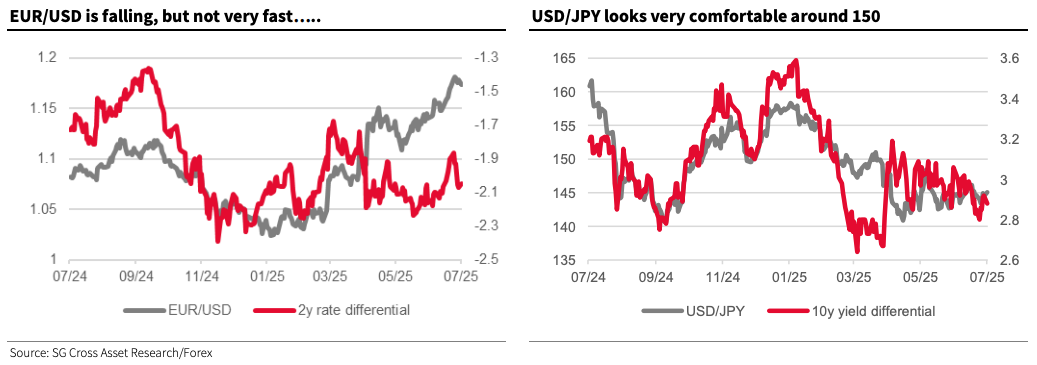

Currency rate differentials reveal that the FX market is currently operating independently. EUR/USD has significant room to decline without altering the overall situation, yet even today, the euro remains resilient compared to other G10 currencies. There is optimism regarding the medium to longer-term outlook in Europe, and while this is relative to a very low starting level, it is still bolstering the EUR, PLN, CZK, and SEK. Conversely, USD/JPY appears confined within a 139-149 range that hasn't changed for over three months.

In summary, we have erratic policymaking, a constant stream of puzzling headlines, and a sense that the FX market is attempting to establish a summertime range, if feasible. I suspect this is what some market players desire, but the underlying chaos makes it unlikely for markets to quiet for long. Let’s observe the actions and statements from the RBA and RBNZ, and then await the UK data on Friday. Perhaps that will serve as the trigger to push GBP/JPY back down towards the 193-194 range.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!