Institutional Insights: Nomura - Short USD/JPY: Targeting a Break Below 140

Short USD/JPY: Targeting a Break Below 140

Trade Idea

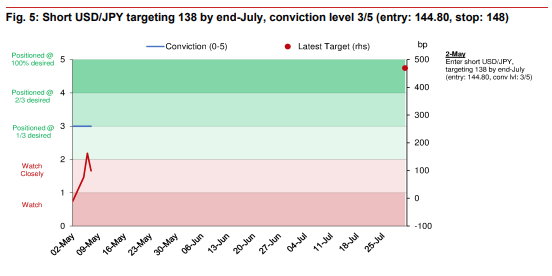

- Short USD/JPY, targeting 138 by the end of July (conviction level: 3/5).

- This trade was initiated on May 2, following a recent bounce that provided cleaner JPY positioning and a favorable entry level.

Key Themes Supporting the Trade

1. Ongoing De-dollarization: A global shift away from USD dominance continues to weigh on the dollar.

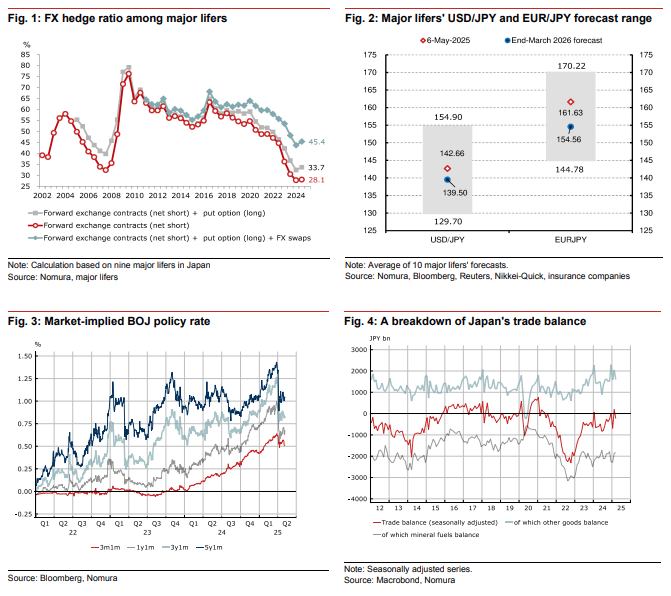

2. FX Hedging Flows: Market attention remains on potential FX hedging adjustments, particularly by Japanese institutional investors.

3. BOJ Rate Hike Continuity: Japan's central bank is maintaining its rate-hiking cycle, contrasting with other central banks.

4. Improved Terms of Trade for Japan: Falling crude oil prices are enhancing Japan’s trade balance and currency fundamentals.

5. Limited Hawkish Risks from the Fed: The Federal Reserve is unlikely to adopt a significantly more hawkish stance, reducing upside risks for USD.

Rationale

1. Softening USD Momentum

- The USD faces continued downward pressure due to diminishing US growth exceptionalism and a thematic reallocation of assets by global investors.

- While evidence of capital outflows from the US remains mixed, uncertainty surrounding US policies and economic outlook persists. This could lead to further reallocation of long-term real money investments away from US assets.

2. Potential FX Hedging Adjustments by Japanese Lifers

- Japanese life insurers hold historically low FX hedge ratios (33.7% as of September 2024), presenting scope for increased hedging activity.

- With USD/JPY potentially breaking below 139.50, lifers may accelerate FX hedging, adding further downward pressure on the pair.

3. BOJ’s Rate Hiking Cycle Remains Intact

- While recent BOJ statements appeared cautious, there is no indication of a shift away from its tightening stance.

- The BOJ's policy guidance continues to support rate hikes, setting it apart from other central banks that are leaning toward rate cuts.

4. Falling Crude Oil Prices and Japan’s Trade Balance

- Brent Crude prices have dropped 18% year-to-date, improving Japan’s terms of trade.

- Although Japan’s trade balance hasn’t fully recovered, lower oil prices strengthen the yen’s fundamentals and support the case for a stronger JPY.

5. Limited Upside Risks from the Federal Reserve

- The Fed is unlikely to shift toward a more hawkish stance, even with inflationary pressures from tariffs.

- Market expectations for rate cuts remain intact, and USD/JPY is sensitive to weaker US activity data, which could further limit upside risks for the pair.

Conclusion

The combination of a softening USD, potential FX hedging flows, the BOJ’s ongoing tightening cycle, improved Japanese trade fundamentals, and limited hawkish risks from the Fed creates a favorable environment for shorting USD/JPY. Targeting 138 by the end of July, this trade aligns with broader macroeconomic and policy trends.

Risks

1. Risks from US Trade Talks: The ongoing challenges in US-Japan trade negotiations could result in the Bank of Japan (BOJ) maintaining its cautious approach toward interest rate hikes. Additionally, if the US-China trade talks progress beyond market expectations, it may negatively impact Japan’s trade by improving global market risk sentiment, potentially reducing demand for safe-haven assets.

2. Risks from Domestic Politics: A significant loss of seats by the Liberal Democratic Party (LDP) in the upcoming Upper House election in late July could bring political uncertainty. Opposition parties, such as the CDPJ and DPP, are advocating for consumption tax cuts, and a major defeat for the LDP might lead to additional fiscal stimulus measures. While fiscal loosening could elevate inflation expectations, it also raises concerns about fiscal dominance over monetary policy, given the combination of Japan’s substantial government debt and rising interest rates.

3. Risks from an FX Deal: No discussions on foreign exchange (FX) levels or management frameworks occurred during the recent bilateral Finance Ministers meeting between Kato and Bessent, aligning with expectations. While no significant FX deal is anticipated in the near term, some market participants still expect a potential agreement, which has contributed to a “deal premium.” If this expectation unwinds, it could temporarily lead to selling pressure on the Japanese yen (JPY).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!