Institutional Insights: Nomura Cross-Asset: CLOSER TO "HEDGE WHEN YOU CAN"

Nomura Cross-Asset: CLOSER TO "HEDGE WHEN YOU CAN"

Equities have experienced a significant rally, driven by a combination of key catalysts previously highlighted:

- The "Trump Collar" Effect: The President's strategic use of tariff rhetoric at market highs ("selling the call") and his implicit safety net ("long put") for potential downturns has contributed to substantial compression in realized volatility. Over recent months, the market has adapted to his predictable reaction patterns, moving away from his earlier role as a disruptive force during the post-"Liberation Day" period.

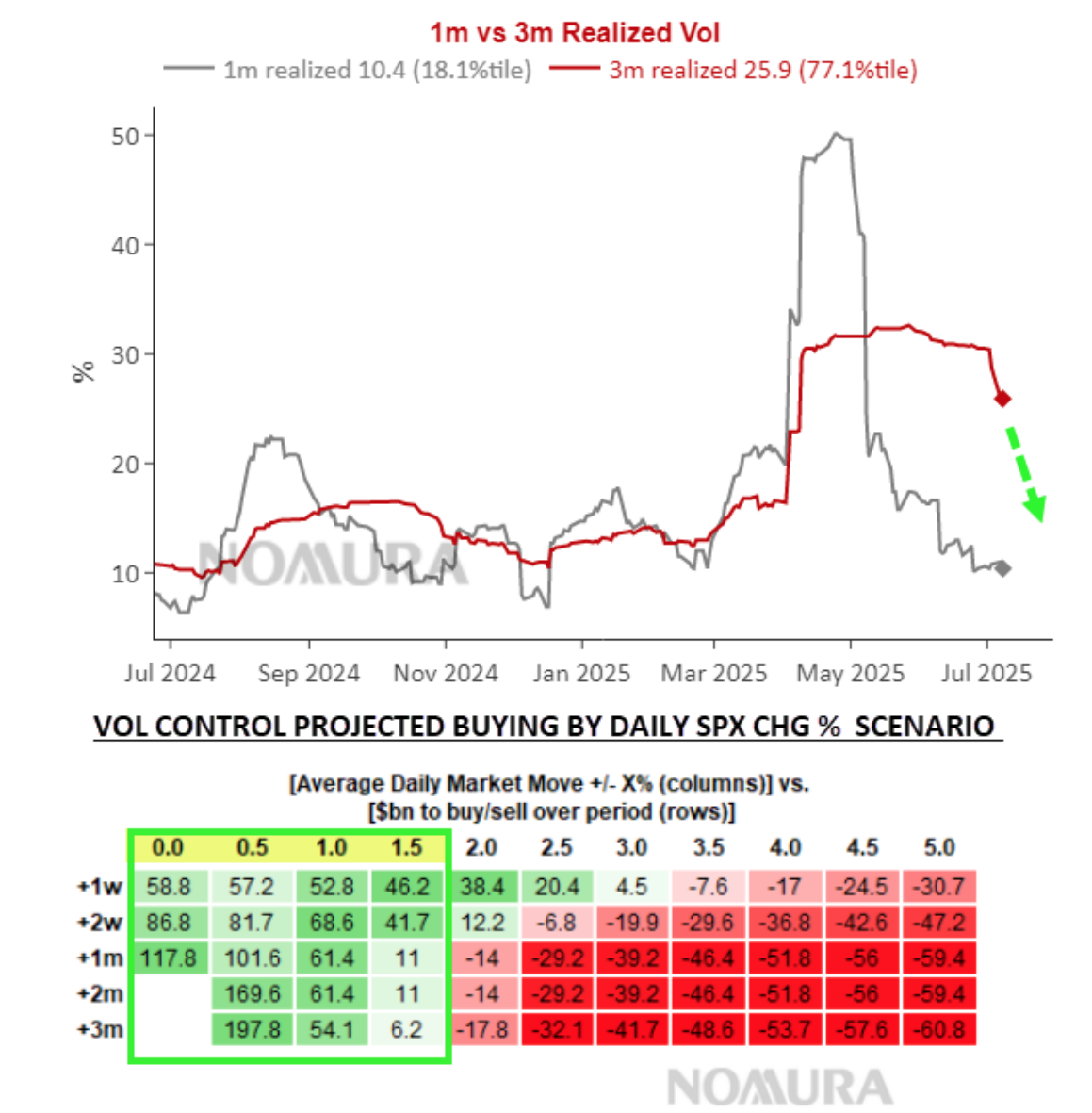

- Realized Volatility Decline: Several factors have contributed to the decline in realized volatility:

1. The stabilizing impact of the Trump Collar.

2. Significant supply of volatility in single-name stocks and indices, which has suppressed local volatility levels (e.g., 10-day realized vol at 8).

3. The fading impact of late March/early April outlier equity moves, as those dates shift out of sample.

4. Increased stock dispersion and reduced correlation, further mitigating index volatility.

This environment has enabled a notable reallocation into equities, particularly from Target Volatility and Vol Control strategies, where exposure is adjusted based on volatility levels. The upcoming 1-2 week window is expected to see heightened demand for equities, a trend that appears to have been widely anticipated and front-run by discretionary traders and retail investors, as evidenced by sentiment on platforms like X and Fintwit.

The equities consolidation triggered by Trump’s tariff remarks earlier this week can be viewed as marginally constructive. During the equities rally from one to two weeks ago, the market exhibited a concerning pattern of “Spot Up, Vol Up, vVol Up” in an unstable manner, which frequently leads to a collapse under the strain of excessive long Delta positioning. However, the recent willingness to sell off the residual Vol mini-bid, prompted by the initial tariff threats this week, has brought the market back to a more traditional Spot/Vol correlation. This shift has allowed Market Makers and Dealers to regain some Gamma from Vol sellers, which over time serves as a stabilizing force and shock absorber.

This presents an opportune moment to consider downside hedges “when you can, not when you have to,” especially with underlying exposure and net leverage increasing, skew flattening, Gamma having been exhausted, UX1 back in the teens, and VVIX poised to dip below 90. As we approach July Op-Ex, overlapping with the earnings season “Buyback Blackout” window, the fresh systematic positioning rebuild could become the primary driver of de-risking flows during a potential Spot selloff or Vol squeeze.

My best guess is that we’re heading toward a classic “Data Surprise,” characterized by downside risks in labor/employment or upside inflation pressures. This could serve as the shock catalyst at this stage of the cycle, particularly given the magnitude of the recent risk rally. Such a scenario might crystallize the market’s worst fears of lagged, tariff-induced “stagflation” by late summer.

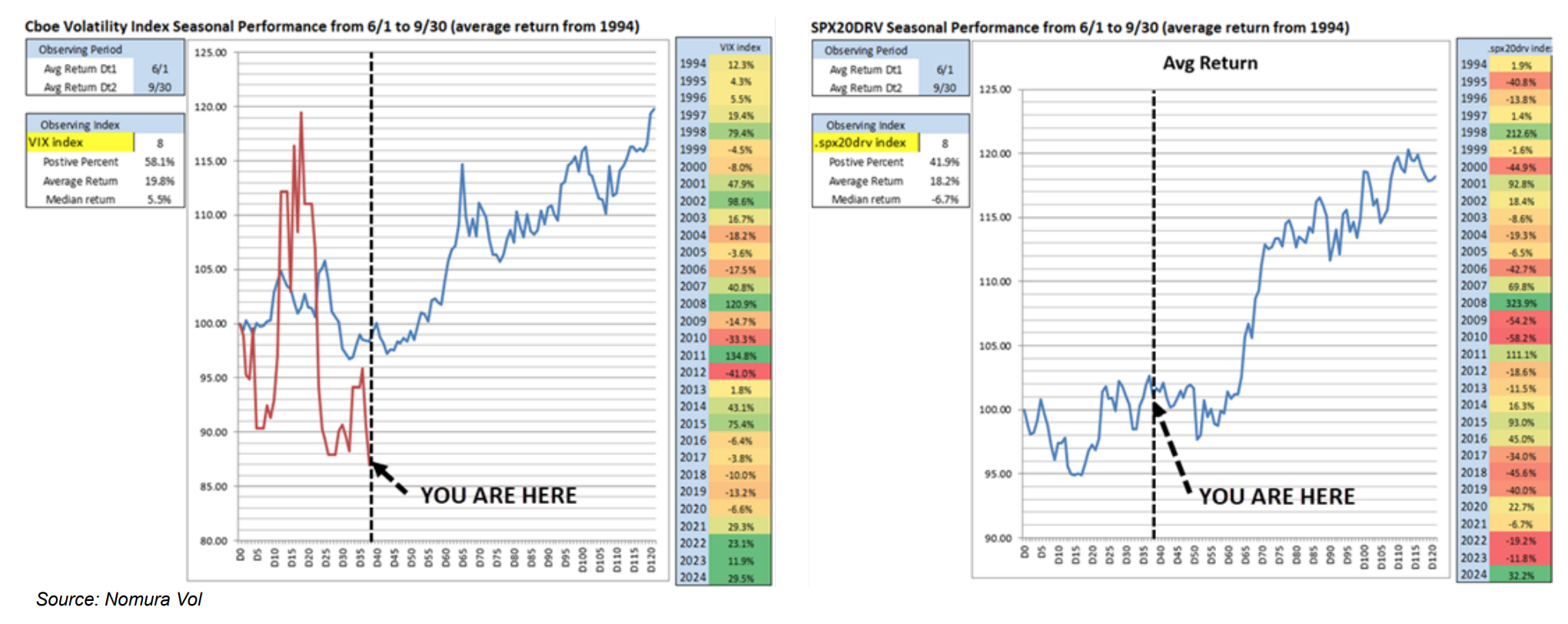

Additionally, seasonality for both implied and realized volatility is nearing its bottom and set to turn higher. While the current VIX options positioning appears subdued—lacking significant customer VIX call longs or dealer shorts—the leveraged VIX ETNs are showing multi-year highs in net and gross Vega positions. This suggests substantial “volatility to buy” in the event of a VIX shock, creating ample fuel for a potential volatility squeeze.

In essence, we’re inching closer to a situation where outright VIX upside calls could be effective for hedging a convex move. For more risk-savvy investors, VIX call spreads present an attractive setup, as call skew remains historically steep, with the 3-month skew sitting at the 94th percentile.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!