Institutional Insights: Morgan Stanley - WIll Gold Hold?

.jpeg)

Will Gold Hold?

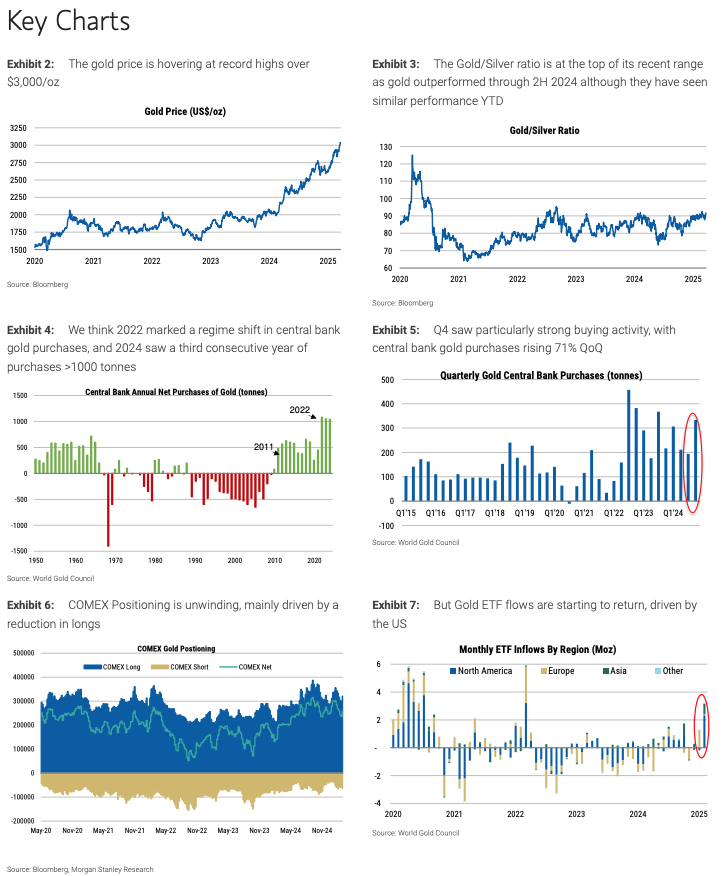

Morgan Stanley note Gold prices are at record highs, driven by robust physical demand from central banks and ETFs, alongside tariff uncertainty bolstering its safe-haven appeal. While prices may not have peaked yet, the pace of further gains could slow.

Key Takeaways:

- Strong Physical Demand: Central banks purchased over 1,000 tonnes of gold for the third consecutive year in 2024. ETFs are also seeing renewed inflows after a period of stagnation.

- Supportive Macro Factors: Falling interest rates and a weakening dollar continue to underpin gold's appeal.

- Risks to Upside: Slowing jewellery demand and reduced imports from India pose risks to further price increases.

Gold at $3,000/oz

As of now, gold trades just above $3,000/oz, marking a 15% year-to-date increase after a 27% rise in 2024. Physical demand was a key driver last year, with central banks buying over 1,000 tonnes for the third year running, and investment demand (bars and coins) surging by 25%. In early 2025, China’s PBOC continued its gold purchases, while global gold ETFs recorded their largest two-month inflow since Q2 2022, with Chinese ETFs hitting record volumes in February. Additionally, concerns over U.S. tariffs have driven up COMEX prices relative to LBMA, prompting increased physical metal purchases in the U.S.

Supportive Factors Remain

Uncertainty surrounding global growth, tariffs, and geopolitics continues to support gold’s safe-haven status. Central bank buying appears to be a structural trend, with expectations for another strong year of purchases. ETF inflows also show room for growth—130 tonnes have been added so far in 2025, but total holdings remain about 750 tonnes below their 2020 peak.

Challenges for the Next Phase

Despite strong investment demand, rising prices are beginning to weigh on other areas. India’s gold imports more than halved in January and February compared to Q4 2024, despite the wedding season, though bar and coin demand remains resilient. In China, February withdrawals from the Shanghai Gold Exchange dropped 29% year-on-year, as weaker jewellery demand offset robust investment buying. Investor positioning on COMEX has also declined to 257,000 long contracts from over 300,000 in mid-February, becoming a significant factor influencing price movements.

Outlook

While gold prices may not have peaked, the next leg higher is likely to take longer. The World Gold Council noted that the move from $2,500 to $3,000/oz was the fastest-ever climb to a major milestone. Jewellery demand shows signs of slowing and may require price stabilization to recover. However, central bank purchases and investment demand remain strong, suggesting continued support for gold prices in the near term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!