Institutional Insights: HSBC FX Focus EURUSD

Institutional Insights: HSBC FX Focus EURUSD

The trade agreement between the EU and the US does not indicate the end of the EUR's upward trend. Bond flows can influence the EUR-USD exchange rate and highlight the risks associated with US policy, which have affected interest rate differentials since April. Although these rate differentials might temper the rise of the EUR-USD, ongoing concerns about the Federal Reserve's independence keep policy risks in play, decreasing the USD's strength. When President Trump and President von der Leyen revealed their trade agreement on July 28, the markets reacted positively. However, uncertainty surrounding US policy remains, particularly regarding the Federal Reserve. We believe that a resurgence of policy uncertainty would again favor the EUR. Since April, the EUR has gained value primarily by not being the USD. Recent balance of payments data indicates that this rally was fueled by capital inflows into Eurozone bonds, disregarding the higher yields from US Treasuries. With the Federal Reserve likely to implement easing measures in the coming months and ongoing uncertainty from the White House, we anticipate that the recent correction in the EUR-USD could establish a foundation for a move toward our target of 1.20 by the end of the year.

Bonds transactions influenced the EUR-USD exchange rate. Understanding the Euro area's Balance of Payments can help anticipate how financial flows between the Eurozone and the US might change and explains our expectation for a stronger EUR-USD.

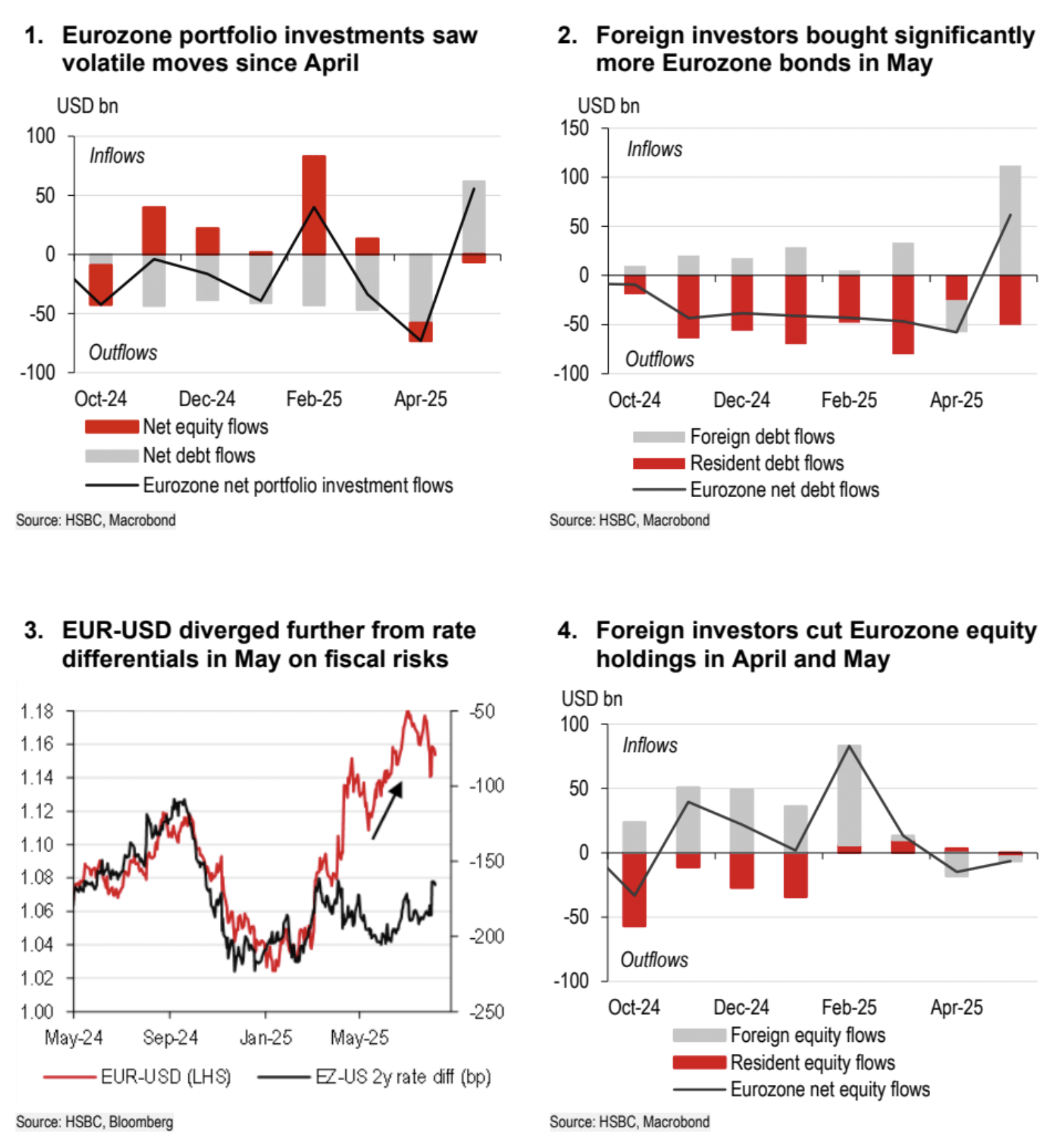

It is important to examine the evolution of these flows, particularly in the second quarter of this year when the EUR experienced a rapid increase. In April and May, Eurozone portfolio flows were notably erratic, primarily driven by foreign investor activity. In April, foreign investors were net sellers of Eurozone bonds, but this trend shifted in May with significant net purchases.

The robust demand for Eurozone bonds in May was likely a response to emerging fiscal risks in the US. The surge in May suggests a stronger shift towards European safe haven investments. While part of this might have involved capital returning after being withdrawn in April, it is noteworthy that May's foreign investment in Eurozone bonds reached its peak since June 2024.

By May, the impact of the initial tariff shock from Liberation Day had lessened. The tensions between the US and China had eased, and President Trump had limited tariffs on most nations to 10% for 90 days. Instead, concerns around fiscal policy unsettled markets, particularly due to the proposed Big Beautiful Bill. The Congressional Budget Office forecasted continued fiscal deficits for years, and Moody’s downgraded the US sovereign credit rating from AAA to Aa.

Diminishing faith in US policy has weakened the USD. Investment trends indicate that investors have turned to other currencies for safety, particularly the EUR. Uncertainty regarding US policy continues, and we believe that concerns about the independence of the Fed may intensify the skepticism, further diminishing confidence in the USD. Once more, the EUR could gain from simply not being the USD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!