Institutional Insights: Goldman Sachs Raising SP500 12 Month Price Target

Institutional Insights: Goldman Sachs Raising SP500 12 Month Price Target

GOLDMAN SACHS - CHART OF THE DAY: RAISING OUR S&P 500 EPS GROWTH FORECAST

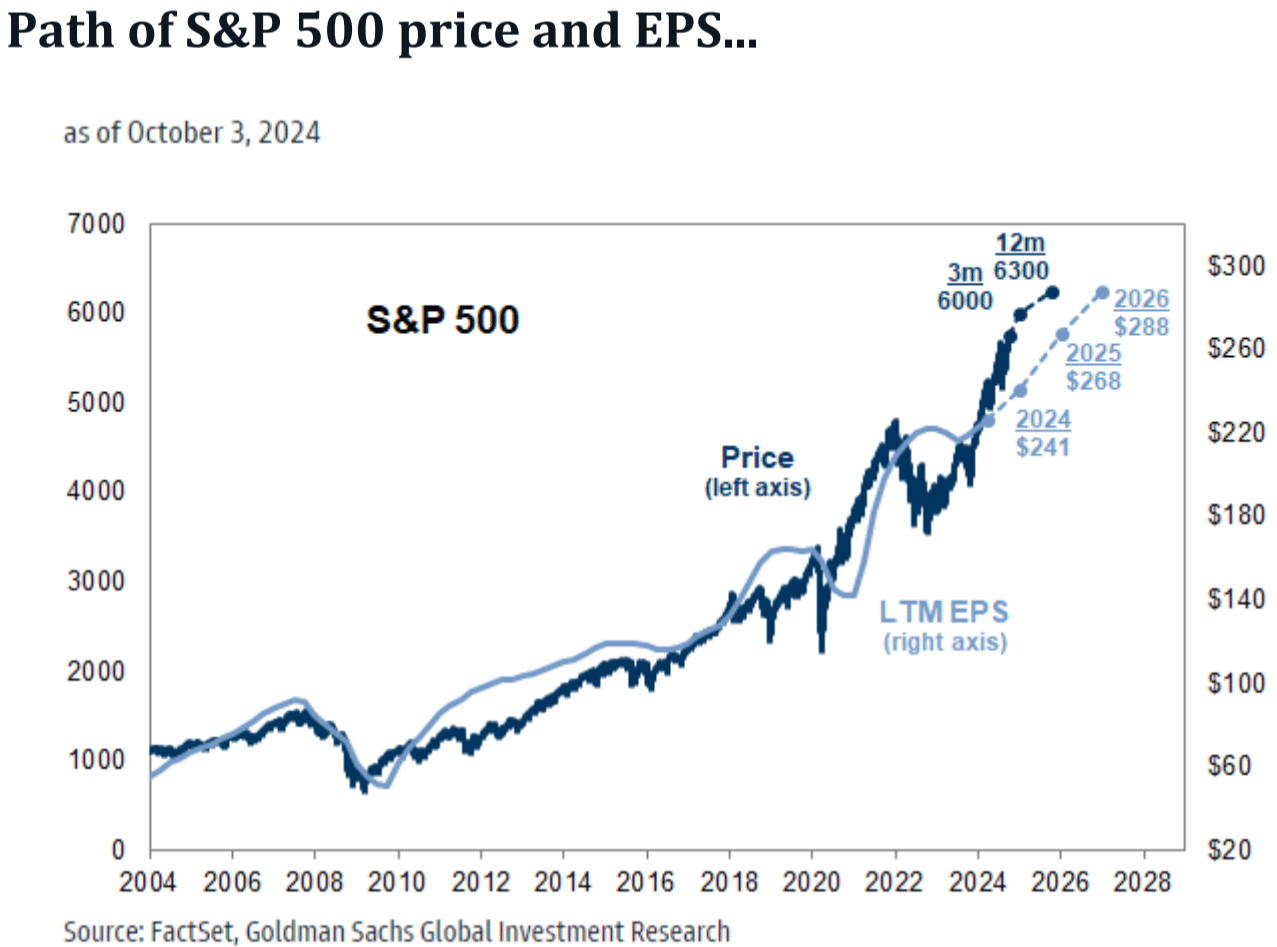

Analysts at Goldman Sachs have update their price objectivees for the SP500, "Ahead of the 3Q 2024 earnings season, GIR is raising our 2025 S&P 500 EPSforecast to $268 (+11% year/year) from $256 (+6%) and introducing a 2026 EPSestimate of $288 (+7%). We maintain our long-held full-year 2024 EPS forecastof $241 (+8%).We assume the market will capitalize earnings of $274 (2025)and $300 (2026), representing negative revisions to current bottom-upconsensus. Today’s P/E multiple of 22x is in line with our macro model of fairvalue.We forecast the P/E will be unchanged at year-end 2024, implying a4% gain in the S&P 500 to 6000 (vs. 5600 previously). Our new 12-monthprice target is 6300 (vs. 6000) and implies a 10% return.Path of S&P 500 price and EPS...

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!