THOUGHTS ON JOBS PRINT FICC and Equities

"Doubt whom you will, but never yourself." -Christian Nestell Bovee

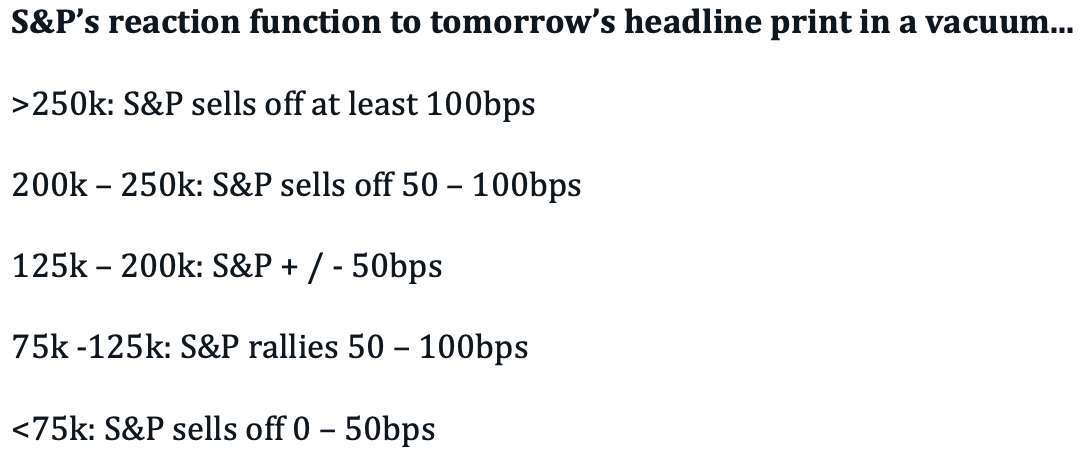

Yesterday’s ADP jobs report was strong: +233K (vs. the Street +111K and vs. Sept’s +159K number). This was much better than most traders were braced for given the recent disruptions caused by hurricanes & BA strike. Coming into this week traders were prepping for a very soft NFP print, but now whispers are creeping higher (125k ish) after the strong ADP # and the decline in weekly claims. For tomorrow’s print GIR is looking for a headline number of +95k (vs +110k consensus and +254k prior), AHE MoM +.3% (vs +.3% consensus and +.4% prior) and U/E Rate of 4.1% (vs 4.2% consensus and 4.1% prior). Sweet spot for stocks tomorrow is 75k – 125k as mkt will dismiss the headline weakness due to storms/strikes and rate cut probabilities for 11/7 and 12/18 will creep higher. Market doesn’t want a number north of 200k as it will add to worries about a slower pace of Fed cuts (1 cut this year not 2). Vol market is pricing in a 94bp move for S&P through tomorrow's close

GIR’s official take: We estimate nonfarm payrolls rose 95k in October. Big Data indicators indicated a sequentially softer pace of job creation, and we estimate the recent hurricanes weighed on October job growth by 40-50k. The Bureau of Labor Statistics indicated that newly striking workers, including those at Boeing, will exert a 41k drag on October payroll growth. We assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. We estimate that the unemployment rate was unchanged at 4.1%, reflecting a flat labor force participation rate and solid household employment growth. We estimate average hourly earnings rose 0.3% (month-over-month, seasonally adjusted), which would leave the year-over-year rate unchanged at 4.0%, reflecting a boost from the impact of the hurricanes but payback for unusually strong supervisory earnings in recent months

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!