Institutional Insights: Goldman Sachs NFP Preview 1/8/25

Goldman Sachs: NFP PREVIEW

FICC and Equities | 31 July 2025 |

From

GS Research:

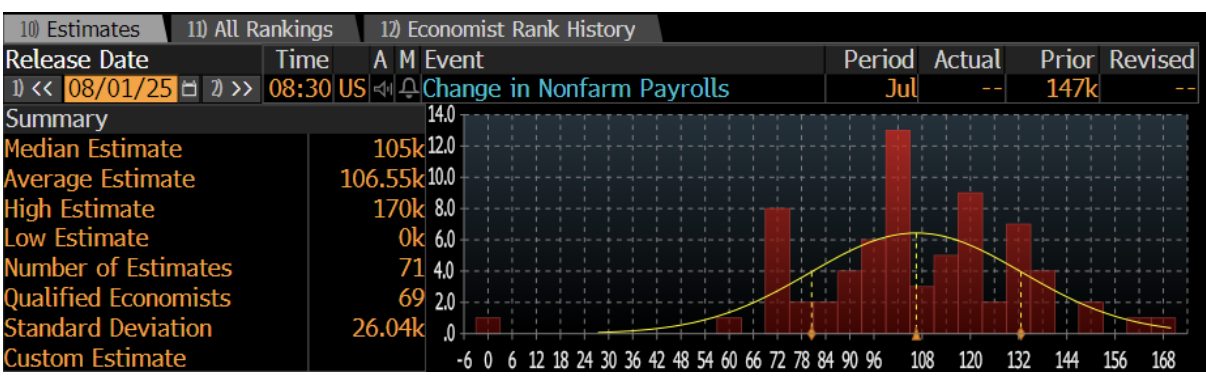

We project that nonfarm payrolls increased by 100k in July, which is slightly lower than the consensus estimate of +105k.

• We anticipate that the unemployment rate bounced back to 4.2% on a rounded basis, indicating the trends observed in other indicators of labor market slack.

• We expect average hourly earnings to have risen by 0.25% (month-over-month, seasonally adjusted), which reflects some negative calendar influence.

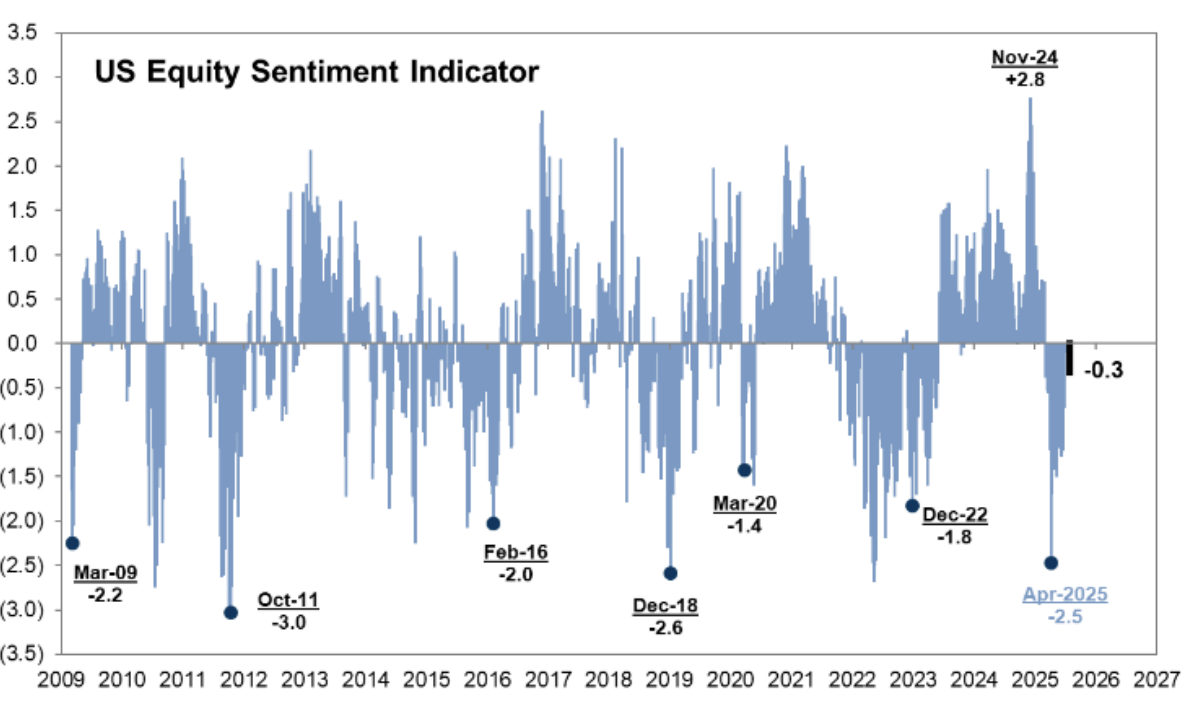

Thoughts from around GS => Vickie Chang (Global Macro Research) Our growth pricing estimates suggest that the market is pricing 1y-ahead growth at around 2%. That’s clearly above our near-term forecasts of 1.4% and a bit above our 2026 q4/q4 growth forecasts of 1.8%. So although growth pricing doesn’t look wildly optimistic versus the medium-term view, it is now more generously priced and is less likely to be the main source of macro tailwinds from here. We think our baseline forecast is still fairly friendly for risk assets and have generally been positive on the equity outlook in the last couple of months. But given the pricing and the rally, the market is more vulnerable to data that’s weak enough to catalyze a slowdown narrative. Arguably the quickest way to open up deeper downside tails is a sharp enough rise in the unemployment rate that makes the market worry that it's misjudged that growth weakness will be limited. Our baseline forecast for a tick higher in the unemployment rate to 4.2% and +100k on NFP is not that kind of print. But the jobs report is the kind of event that could in principle open up that debate if there is a big enough disappointment. We think that for investors with long risk positions it makes sense to look at adding protection for that reason, particularly if it helps them maintain long exposures that they would otherwise think about reducing. There is still a premium in implied vol to realized, but implied volatility has fallen enough that short dated protection, through some mix of front-end rate receivers or equity puts/VIX calls (or jointly positioning for lower rates and lower equities), looks reasonably priced. Ryan Hammond (US Portfolio Strategy) The jobs report on Friday represents an important test for the US equity market, which has continued its notch new all-time highs in the past few weeks. With Cyclicals having sharply outperformed Defensives and equity valuations near all-time highs, the equity market appears to be pricing a favorable combination of strong forward growth expectations and a dovish Fed. If the jobs report is broadly in line with consensus, we expect equities would continue to move higher as it would validate current market pricing that the worst growth outcomes will be avoided but the Fed will be able to resume its cutting cycle in September. Equity investor positioning remains in neutral territory (our Sentiment Indicator stands at -0.3), suggesting further room to add exposure to equities. However, if the jobs report is too strong, it could constrain the performance of equities as investors walk back expected Fed easing. On the other hand, if the jobs report is extremely weak, it would test investors’ ability to look through near-term growth weakness and reopen left tail risks to the equity market

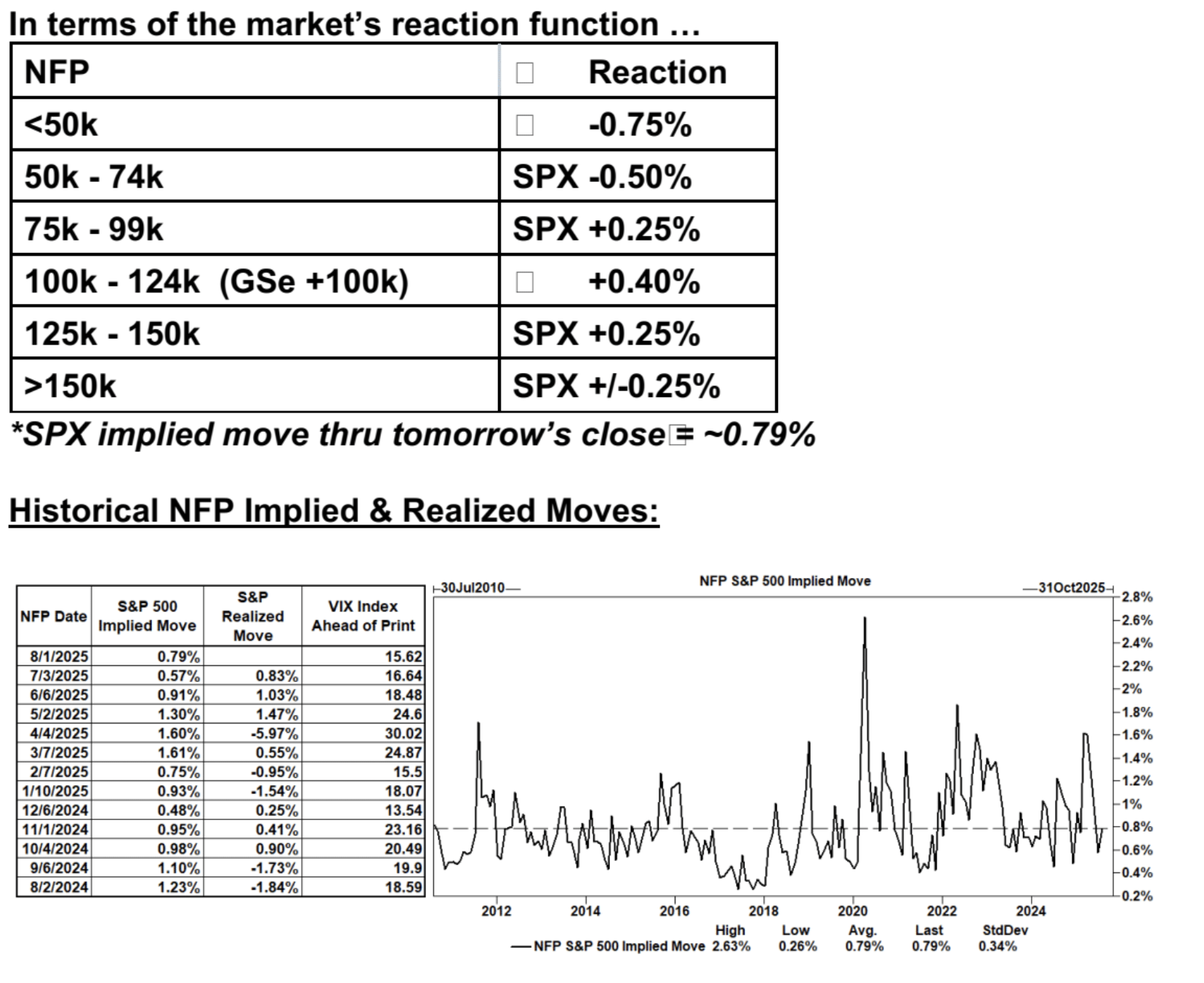

Shawn Tuteja (ETF/Basket Vol Trading) Heading into the FOMC yesterday, it felt the equity market was hopeful the Fed would explicitly set up a September cut as base case. Now that the interpretation of the meeting was slightly more hawkish than market expectations (even though Powell did talk about the slowing economy many times), I think we’re entering a unique set up tomorrow. If the data is really bad (sub 50k, URate 4.4-4.5%), the market will likely trade the same theme it did last year post the July meeting – a policy mistake into a growth slowdown. If the data is extremely strong or mixed (weak NFP number but 4.1% URate), I don’t believe the market can interpret that number too bullishly either. The most bullish outcome seems to be a slightly soft number with a 4.2% URate, as a gradual slowing to lead to a Fed easing cycle is what the market wants. Into this week, we’ve seen a renewed boldness from our client base to fade the non-profitable tech names / lower quality parts of the market, as the view is the quant community has de-grossed and the pain is over on the short side of this trade. Colleague Lee Coppersmith put out a good note on SMH – it’s trading over 60 days without touching its 20d MA to the downside, something it’s only done once since its 2012 inception. With all vols having re-rated lower, any positioningdriven sell offs are likely driven by the semis complex trading weaker, and we think downside makes sense as portfolio hedges. Joe Clyne (Index Vol Trading) Heading into Friday's NFP, we've been trading in quite consistent SPX range with low realized for about a month now. As realized has fallen, we've seen front end vols compress as well and after NFP, we are mostly catalyst free through August expiry. While the straddle for Friday's close still costs 50 dollars, the desk thinks that includes premia for both month-end rebalance flows as well as AMZN/AAPL earnings. In other words, there shouldn't be a large vol premium for the jobs report itself. We think the traded range should be somewhat tight coming out of the jobs report as weaker numbers could lead to more dovish interpretations of the path of rates and a stronger jobs number could be faded as cuts get priced out. We think that 3 month SPX upside looks cheap as it trades close to the botto

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!