Institutional Insights: Goldman Sachs - Managing Risks and Preparing for Elephant Trades

.jpeg)

Managing Risks and Preparing for Elephant Trades

FICC and Equities

“This is only a problem of speed; the magnitude is not the issue. The S&P here doesn’t even take us back to the beginning of 2024.”

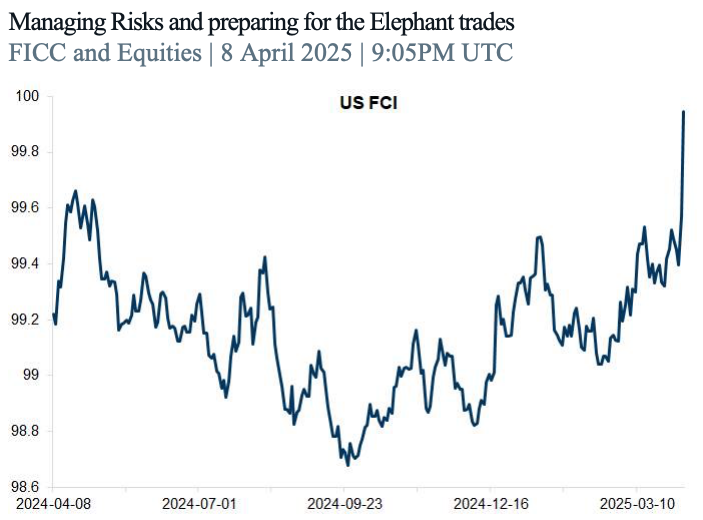

The real challenge lies in the speed—speed is what often causes significant damage. A VIX at 50 signals that there’s no speed limit in sight.

There’s a lack of stability and equilibrium across assets: oil down 4%, stocks down 3%, and 2s30s flattening to 100. This situation begins to feel non-linear.

Protecting financial and mental capital is critical. Poor trades can cause more harm than just monetary losses.

“It’s the psychological impact—it messes with your mindset. You lose your ammunition, and when the elephant trade comes by, your gun isn’t loaded.”

This is the biggest risk: missing the elephant trade.

For now, uncertainty is the only certainty, but 2025 could be the year of significant elephant trades. Moving forward, it’s about fundamental outcomes, the implications of new tariff rules, and assessing the damage already caused by financial conditions.

One conclusion is clear: risk assets are struggling—the patient is unwell. A significant unwinding is underway, and it’s uncertain how far along we are in this process.

Downside risks remain elevated, particularly with potential retaliation from China.

Selling fixed income when stocks drop 3% and oil falls 4% is a dangerous move, regardless of long-term inflation views. The reverse also holds true.

Starting Points:

For now, comparisons to 1929 are overly bearish—the Fed hiked rates back then, but they’re unlikely to do so now. If anything, they may support the long end of the curve.

Credit markets are dislocated, with 60% pricing in a mild recession. However, we likely shouldn’t price in more than 80%, as central banks are easing, and fiscal support remains strong.

Xover spreads would only reach 800bps in a scenario of rate hikes combined with austerity. During COVID, spreads reached 700-800bps, but this time, the peak may only be around 500bps. Policymakers would likely respond by supporting high-yield credit.

While central bank easing and fiscal support are mitigating some risks, there’s a tail risk that the bond market may react negatively, potentially leading to more steepening.

Key Insights:

This is an income-driven cycle rather than a credit-driven one. Apart from governments, consumer balance sheets will be the next critical area to monitor.

The nature and cause of the next potential recession are vital to understand. A modest recession scenario, combined with ongoing easing and fiscal support, could result in controlled market movements, particularly in credit and equities.

For now, XAU, 530s, and TIPS might perform relatively well.

Today marks the largest-ever point reversal in the S&P 500, surpassing the October 14, 2008, reversal during the Global Financial Crisis. Risks remain elevated, and a potential Black Swan event could involve Taiwan.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!