Institutional Insights: Goldman Sachs & JPMorgan Non Farm Payrolls Scenario's

.jpeg)

Institutional Insights: Goldman Sachs & JPMorgan: Non-Farm Payrolls Scenario's

Goldman Sachs View

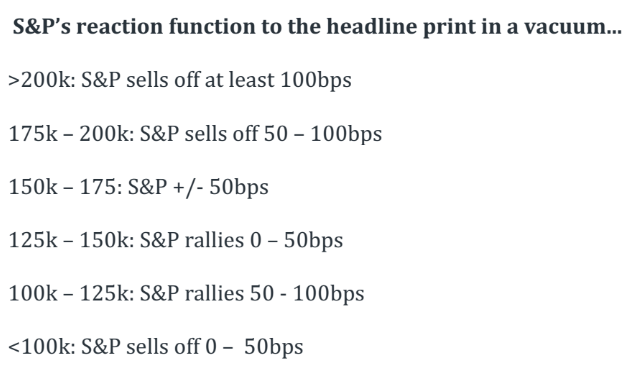

Specific to Friday’s print, Goldman Sachs Research is looking for a headline number of +125k (vs+160k consensus and +227k prior), AHE MoM +.3% (vs +.3% consensus and+.4% prior) and U/E Rate of 4.3% (vs 4.2% consensus and 4.2% prior). I believe that the ideal range for stocks is between 100k and 125k. Too hot and rates will climb higher (which the stock market clearly doesn’t want) and too cold will quickly shift worries from rates to growth. Vol market is pricing in a 107bp move for S&Pthrough Friday’s close.

Goldman Research official take: We estimate nonfarm payrolls rose 125k in December. BigData indicators indicated a sequentially softer pace of job creation, and we estimate that an unfavourable calendar configuration could weigh on job growth of 50k. On the positive side, we assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. We estimate that the unemployment rate edged up to 4.3% on a rounded basis—a low hurdle from an unrounded 4.246%—reflecting a rebound in the labour force participation rate and middling household employment growth amid more challenging job-finding prospects. That said, the annual seasonal factor revisions for the household survey will be released with this report, and we suspect will result in modest downward pressure on Q4 unemployment rate readings. We estimate average hourly earnings rose 0.3% (month-over-month, seasonally adjusted), which would leave the yearover-year rate unchanged at 4.0%, reflecting modestly positive calendar effects but waning wage pressures.

JPMorgan View

[5%]Above220k.This tail risk may bring renewed fears of inflation, especially if hourly earnings print above expectations. Currently, the Fedview is that the labour market is not a driver of inflation. The risk is that a hotter NFP print pushes the market back to dual-side risks, repricing the yield curve higher. Should this ignite a sell-off in bonds, the key level in the 10Y is 5%, the cycle high; stocks have reacted negatively on a multi-week or multi-month basis when the 10Y yield has made new highs during this cycle. SPX loses 50bps–1%.!

[25%]Between180k–220k.In the November NFIB report, the net percent of firms planning to increase employment spiked to the highest level in 12 months; these NFIBprints typically precede actual hiring by 3–5 months. If we see this print, it may be the first step in an inflation higher in hiring, which would have a positive impact on both GDP and earnings. SPXadds 25bps–75bps.!

[40%]Between140k–180k.This is the base case with payroll printing inline with 3mo(173k), 6mo (143k) and 12mo (190k) averages. This print supports the consensus view of above-trend growth in the US and continues to position the Fed to skip changes to policy at the January meeting. SPX adds25bps–50bps.!

[25%]Between100k–140k.A miss in NFP along with an uptick in Unemployment rate would lead to renewed growth fears; if combined with stronger hourly earnings, it could return the market to the stagflation narrative, though that will likely require CPI to print materially hotterthan consensus, which current shows Headline YoY printing 2.8% vs. 2.7% prior and CoreYoY printing 3.3%vs. 3.3% prior.SPX loses25bps–75bps.!

[5%]Below100k.The other tail riskis this scenario of NFPprinting below 100k jobs. While we have seen two of these prints recently, one was a revision to lower the print below 100k and the other was weather-related. In both cases, the market did not react strongly.On this occasion, a sub-100k print is likely to elicit a stronger, negative response as the market would take it this apart of a slowing that eventually leads to recession, though the more immediate risk is a stagflationary environment. SPX loses 75bps–1.5%.!

WHAT ARE OPTIONS PRICING? For options expiring on Jan 10, the market is pricing~1.2% move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!